NPV

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 9E: Each of the following scenarios is independent. All cash flows are after-tax cash flows. Required:...

Related questions

Question

Urgent it is

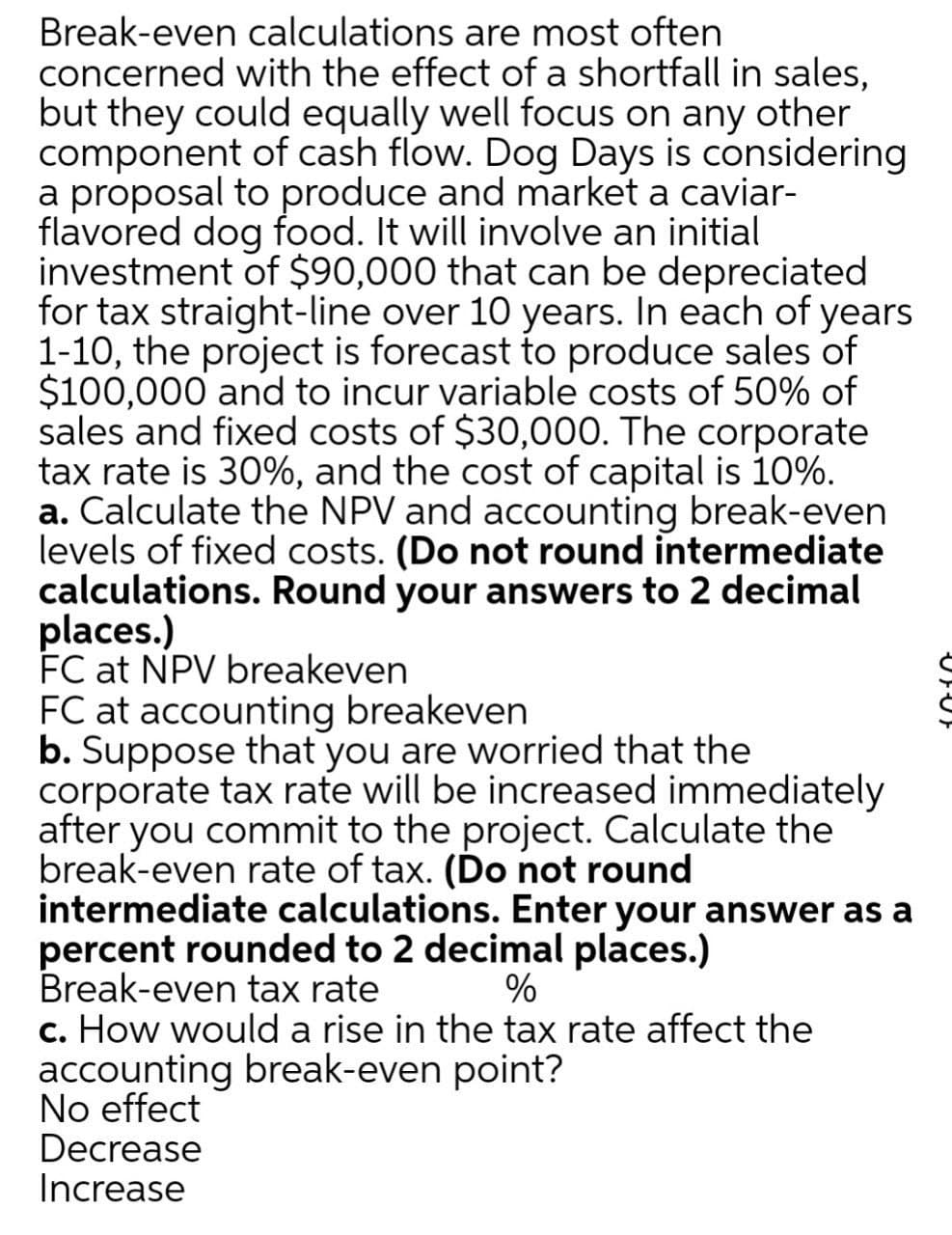

Transcribed Image Text:Break-even calculations are most often

concerned with the effect of a shortfall in sales,

but they could equally well focus on any other

component of cash flow. Dog Days is considering

a proposal to produce and market a caviar-

flavored dog food. It will involve an initial

investment of $90,000 that can be depreciated

for tax straight-line over 10 years. In each of years

1-10, the project is forecast to produce sales of

$100,000 and to incur variable costs of 50% of

sales and fixed costs of $30,000. The corporate

tax rate is 30%, and the cost of capital is 10%.

a. Calculate the NPV and accounting break-even

levels of fixed costs. (Do not round intermediate

calculations. Round your answers to 2 decimal

places.)

FC at NPV breakeven

FC at accounting breakeven

b. Suppose that you are worried that the

corporate tax rate will be increased immediately

after you commit to the project. Calculate the

break-even rate of tax. (Do not round

intermediate calculations. Enter your answer as a

percent rounded to 2 decimal places.)

Break-even tax rate

c. How would a rise in the tax rate affect the

accounting break-even point?

No effect

Decrease

Increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College