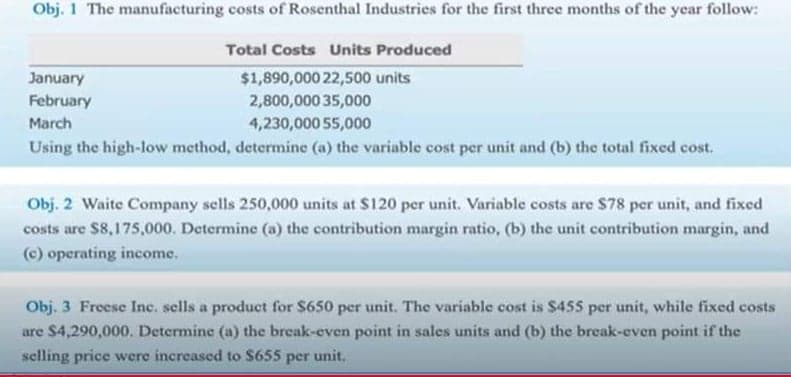

Obj. 1 The manufacturing costs of Rosenthal Industries for the first three months of the year follow: Total Costs Units Produced January $1,890,000 22,500 units February 2,800,000 35,000 March 4,230,000 55,000 Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost.

Obj. 1 The manufacturing costs of Rosenthal Industries for the first three months of the year follow: Total Costs Units Produced January $1,890,000 22,500 units February 2,800,000 35,000 March 4,230,000 55,000 Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost.

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter21: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 21.28EX: Appendix Absorption costing income statement On June 30, the end of the first month of operations,...

Related questions

Question

Transcribed Image Text:Obj. 1 The manufacturing costs of Rosenthal Industries for the first three months of the year follow:

Total Costs Units Produced

January

$1,890,000 22,500 units

February

2,800,000 35,000

March

4,230,000 55,000

Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost.

Obj. 2 Waite Company sells 250,000 units at $120 per unit. Variable costs are $78 per unit, and fixed

costs are $8,175,000. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and

(c) operating income.

Obj. 3 Freese Inc. sells a product for $650 per unit. The variable cost is $455 per unit, while fixed costs

are $4,290,000. Determine (a) the break-even point in sales units and (b) the break-even point if the

selling price were increased to $655 per unit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning