Problem 1-24 Different Cost Classifications for Different Purposes [LO1-1, LO1-2, LO1-3, LO1-4, LO1-5] Dozier Company produced and sold 1,000 units during its first month of operations. It reported the following costs and expenses for the month: $ 87,000 $ 44,000 Direct materials Direct labor $ 22,200 33,400 Variable manufacturing overhead Fixed manufacturing overhead Total manufacturing overhead Variab Fixed selling expense Total selling expense Variable administrative expense Fixed administrative expense Total administrative expense $ 55,600 $ 15,600 25,200 selling expense $ 40,800 5,800 28,600 $ 34,400 Required: 1. With respect to cost classifications for preparing financial statements: a. What is the total product cost? b. What is the total period cost? 2. With respect to cost classifications for assigning costs to cost objects: a. What is total direct manufacturing cost? b. What is the total indirect manufacturing cost? 3. With respect to cost classifications for manufacturers: a. What is the total manufacturing cost? b. What is the total nonmanufacturing cost? c. What is the total conversion cost and prime cost? 4. With respect to cost classifications for predicting cost behavior: a. What is the total variable manufacturing cost? b. What is the total fixed cost for the company as a whole? c. What is the variable cost per unit produced and sold? 5. With respect to cost classifications for decision making: a. If Dozier had produced 1,001 units instead of 1,000 units, how much incremental manufacturing cost would it have incurred to make the additional unit? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 3. With respect to cost classifications for manufacturers: a. What is the total manufacturing cost? b. What is the total nonmanufacturing cost? c. What is the total conversion cost and prime cost? Show lessA 3a. Total manufacturing cost 3b. Total nonmanufacturing cost 3c. Total conversion cost Total prime cost < Required 2 Required 4

Problem 1-24 Different Cost Classifications for Different Purposes [LO1-1, LO1-2, LO1-3, LO1-4, LO1-5] Dozier Company produced and sold 1,000 units during its first month of operations. It reported the following costs and expenses for the month: $ 87,000 $ 44,000 Direct materials Direct labor $ 22,200 33,400 Variable manufacturing overhead Fixed manufacturing overhead Total manufacturing overhead Variab Fixed selling expense Total selling expense Variable administrative expense Fixed administrative expense Total administrative expense $ 55,600 $ 15,600 25,200 selling expense $ 40,800 5,800 28,600 $ 34,400 Required: 1. With respect to cost classifications for preparing financial statements: a. What is the total product cost? b. What is the total period cost? 2. With respect to cost classifications for assigning costs to cost objects: a. What is total direct manufacturing cost? b. What is the total indirect manufacturing cost? 3. With respect to cost classifications for manufacturers: a. What is the total manufacturing cost? b. What is the total nonmanufacturing cost? c. What is the total conversion cost and prime cost? 4. With respect to cost classifications for predicting cost behavior: a. What is the total variable manufacturing cost? b. What is the total fixed cost for the company as a whole? c. What is the variable cost per unit produced and sold? 5. With respect to cost classifications for decision making: a. If Dozier had produced 1,001 units instead of 1,000 units, how much incremental manufacturing cost would it have incurred to make the additional unit? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 3. With respect to cost classifications for manufacturers: a. What is the total manufacturing cost? b. What is the total nonmanufacturing cost? c. What is the total conversion cost and prime cost? Show lessA 3a. Total manufacturing cost 3b. Total nonmanufacturing cost 3c. Total conversion cost Total prime cost < Required 2 Required 4

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter15: Introduction To Managerial Accounting

Section: Chapter Questions

Problem 15.9EX: Classifying costs The following is a manufacturing cost report of Marching Ants Inc. Evaluate and...

Related questions

Question

Please do the required parts 3-5

![Problem 1-24 Different Cost Classifications for Different Purposes [LO1-1, LO1-2, LO1-3, LO1-4, LO1-5]

Dozier Company produced and sold 1,000 units during its first month of operations. It reported the following costs and expenses for

the month:

$ 87,000

$ 44,000

Direct materials

Direct labor

$ 22,200

33,400

Variable manufacturing overhead

Fixed manufacturing overhead

Total manufacturing overhead

Variab

Fixed selling expense

Total selling expense

Variable administrative expense

Fixed administrative expense

Total administrative expense

$ 55,600

$ 15,600

25,200

selling expense

$ 40,800

5,800

28,600

$ 34,400

Required:

1. With respect to cost classifications for preparing financial statements:

a. What is the total product cost?

b. What is the total period cost?

2. With respect to cost classifications for assigning costs to cost objects:

a. What is total direct manufacturing cost?

b. What is the total indirect manufacturing cost?

3. With respect to cost classifications for manufacturers:

a. What is the total manufacturing cost?

b. What is the total nonmanufacturing cost?

c. What is the total conversion cost and prime cost?

4. With respect to cost classifications for predicting cost behavior:

a. What is the total variable manufacturing cost?

b. What is the total fixed cost for the company as a whole?

c. What is the variable cost per unit produced and sold?

5. With respect to cost classifications for decision making:

a. If Dozier had produced 1,001 units instead of 1,000 units, how much incremental manufacturing cost would it have incurred to

make the additional unit?](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F8aeb4c9c-8d33-4b47-954d-a4d3ce02aa40%2F2c3732d0-634d-4811-925d-14eb43dcf826%2Fdarjuc.png&w=3840&q=75)

Transcribed Image Text:Problem 1-24 Different Cost Classifications for Different Purposes [LO1-1, LO1-2, LO1-3, LO1-4, LO1-5]

Dozier Company produced and sold 1,000 units during its first month of operations. It reported the following costs and expenses for

the month:

$ 87,000

$ 44,000

Direct materials

Direct labor

$ 22,200

33,400

Variable manufacturing overhead

Fixed manufacturing overhead

Total manufacturing overhead

Variab

Fixed selling expense

Total selling expense

Variable administrative expense

Fixed administrative expense

Total administrative expense

$ 55,600

$ 15,600

25,200

selling expense

$ 40,800

5,800

28,600

$ 34,400

Required:

1. With respect to cost classifications for preparing financial statements:

a. What is the total product cost?

b. What is the total period cost?

2. With respect to cost classifications for assigning costs to cost objects:

a. What is total direct manufacturing cost?

b. What is the total indirect manufacturing cost?

3. With respect to cost classifications for manufacturers:

a. What is the total manufacturing cost?

b. What is the total nonmanufacturing cost?

c. What is the total conversion cost and prime cost?

4. With respect to cost classifications for predicting cost behavior:

a. What is the total variable manufacturing cost?

b. What is the total fixed cost for the company as a whole?

c. What is the variable cost per unit produced and sold?

5. With respect to cost classifications for decision making:

a. If Dozier had produced 1,001 units instead of 1,000 units, how much incremental manufacturing cost would it have incurred to

make the additional unit?

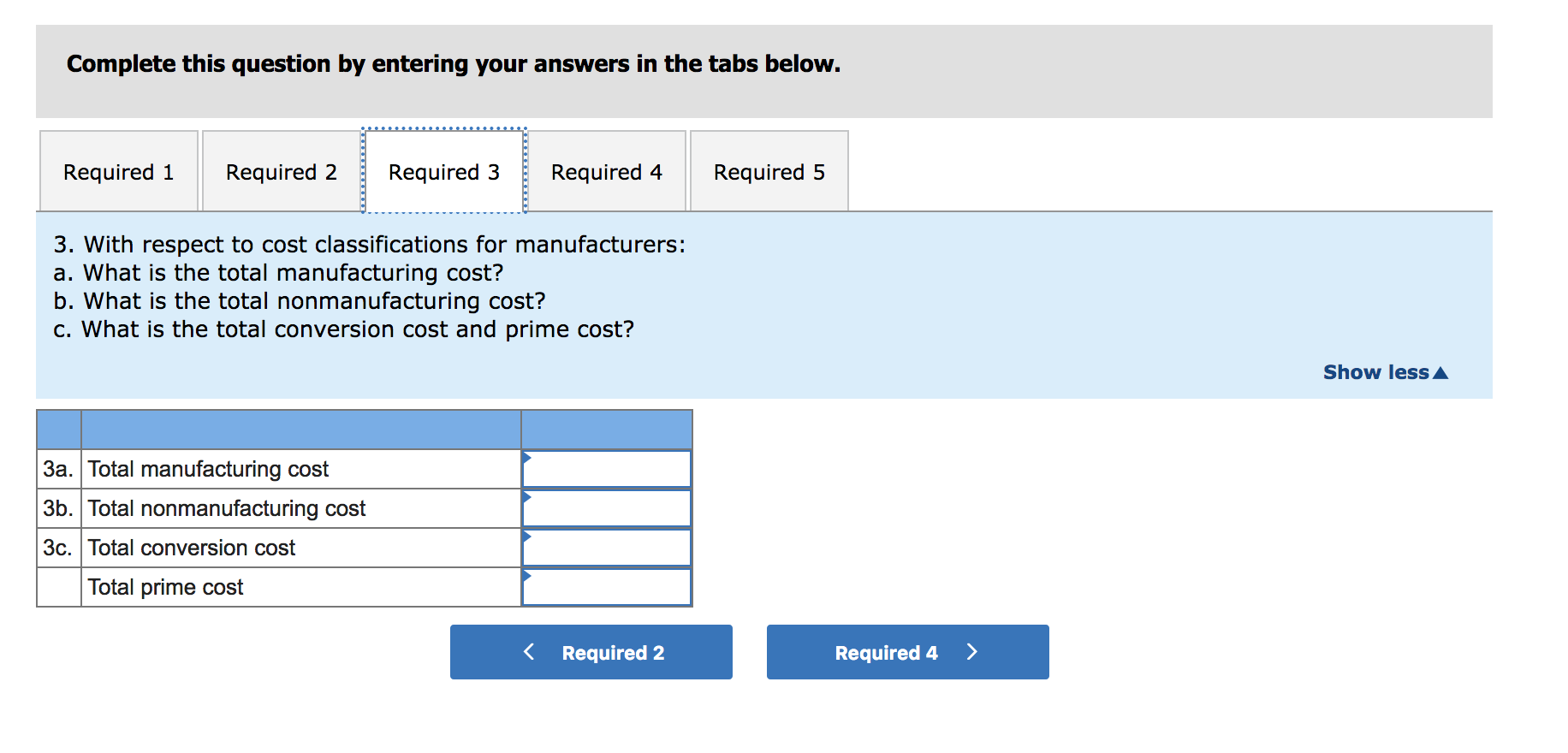

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Required 4

Required 5

3. With respect to cost classifications for manufacturers:

a. What is the total manufacturing cost?

b. What is the total nonmanufacturing cost?

c. What is the total conversion cost and prime cost?

Show lessA

3a. Total manufacturing cost

3b. Total nonmanufacturing cost

3c. Total conversion cost

Total prime cost

< Required 2

Required 4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning