October 1 Materials purchased on account, $663,320. Materials requisitioned, $618,780, of which $71,310 was for general factory use. Factory labor used, $640,350, of which $88,200 was indirect. Other costs incurred on account for factory overhead, $140,430; selling expenses, $245,050; and administrative expenses, $145,440. Prepaid expenses expired for factory overhead were $30,100; for selling expenses, $27,880; and for administrative expenses, $18,590. Depreciation of office building was $86,490; of office equipment, $45,350; and of factory equipment, $30,880. Factory overhead costs applied to jobs, $365,760. Jobs completed, $1,017,410. Cost of goods sold, $911,220. 2 31 31 31 31 31 31 31

October 1 Materials purchased on account, $663,320. Materials requisitioned, $618,780, of which $71,310 was for general factory use. Factory labor used, $640,350, of which $88,200 was indirect. Other costs incurred on account for factory overhead, $140,430; selling expenses, $245,050; and administrative expenses, $145,440. Prepaid expenses expired for factory overhead were $30,100; for selling expenses, $27,880; and for administrative expenses, $18,590. Depreciation of office building was $86,490; of office equipment, $45,350; and of factory equipment, $30,880. Factory overhead costs applied to jobs, $365,760. Jobs completed, $1,017,410. Cost of goods sold, $911,220. 2 31 31 31 31 31 31 31

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter2: Job Order Costing

Section: Chapter Questions

Problem 1PA: Barnes Company uses a job order cost system. The following data summarize the operations related to...

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

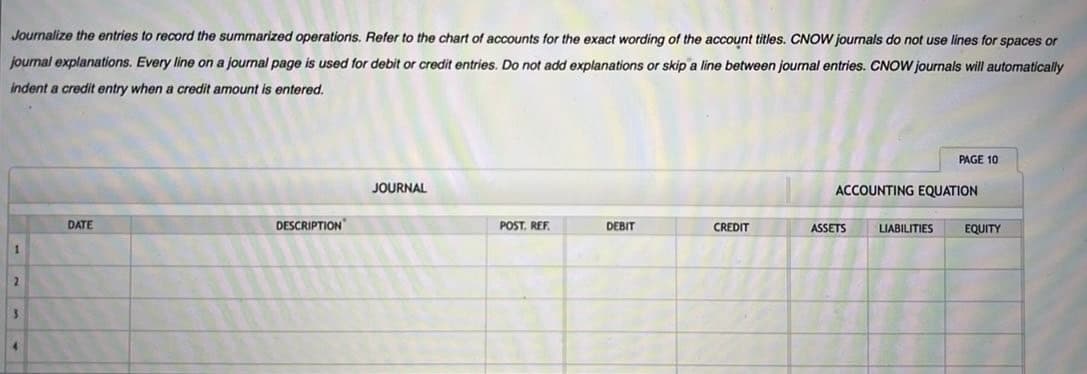

Transcribed Image Text:Journalize the entries to record the summarized operations. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for spaces or

journal explanations. Every line on a journal page is used for debit or credit entries. Do not add explanations or skip a line between journal entries. CNOW journals will automatically

indent a credit entry when a credit amount is entered.

DATE

DESCRIPTION

JOURNAL

POST. REF.

DEBIT

CREDIT

ACCOUNTING EQUATION

ASSETS

PAGE 10

LIABILITIES

EQUITY

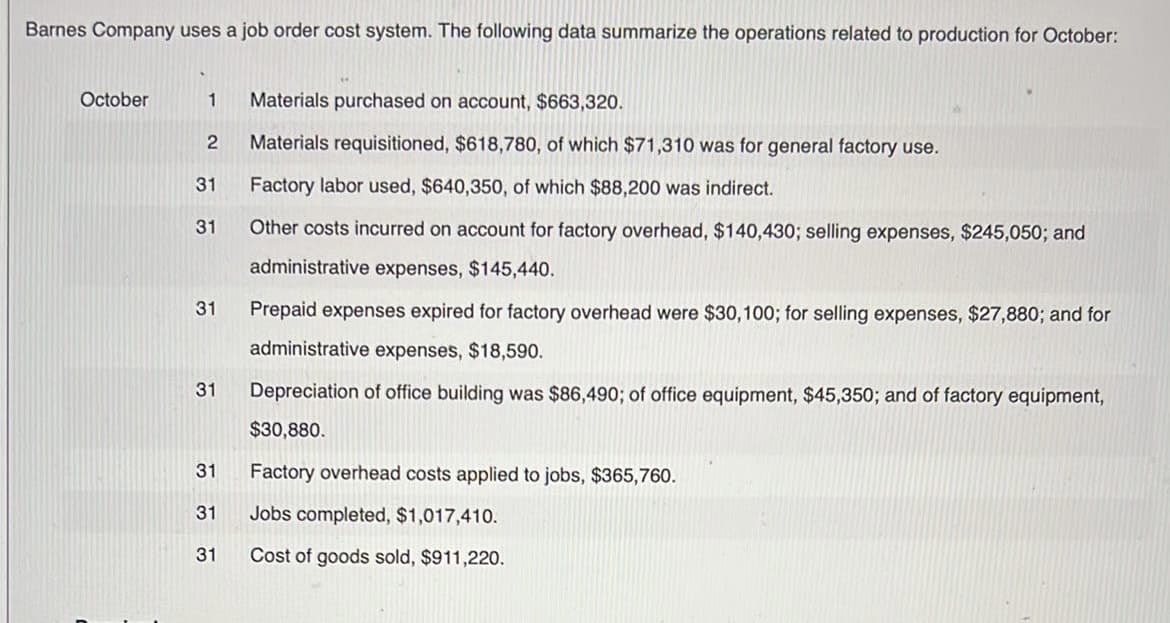

Transcribed Image Text:Barnes Company uses a job order cost system. The following data summarize the operations related to production for October:

October

1 Materials purchased on account, $663,320.

Materials requisitioned, $618,780, of which $71,310 was for general factory use.

Factory labor used, $640,350, of which $88,200 was indirect.

Other costs incurred on account for factory overhead, $140,430; selling expenses, $245,050; and

administrative expenses, $145,440.

2

31

31

31

31

31

31

31

Prepaid expenses expired for factory overhead were $30,100; for selling expenses, $27,880; and for

administrative expenses, $18,590.

Depreciation of office building was $86,490; of office equipment, $45,350; and of factory equipment,

$30,880.

Factory overhead costs applied to jobs, $365,760.

Jobs completed, $1,017,410.

Cost of goods sold, $911,220.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,