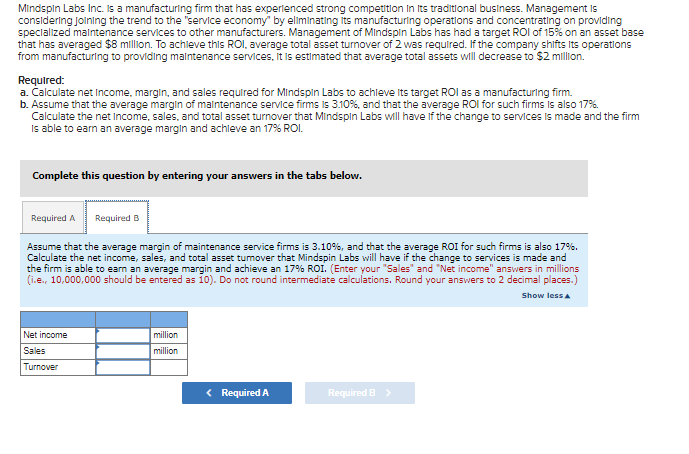

Complete this question by entering your answers in the tabs below. Required A Required B Assume that the average margin of maintenance service firms is 3.10%, and that the average ROI for such firms is also 17%. Calculate the net income, sales, and total asset tumover that Mindspin Labs will have if the change to services is made and the firm is able to earn an average margin and achieve an 17% ROI. (Enter your "Sales" and "Net income" answers in millions (i.e., 10,000,000 should be entered as 10). Do not round intermediate calculations. Round your answers to 2 decimal places.) Show less A Net income Sales Turnover million million < Required A Required B >

Complete this question by entering your answers in the tabs below. Required A Required B Assume that the average margin of maintenance service firms is 3.10%, and that the average ROI for such firms is also 17%. Calculate the net income, sales, and total asset tumover that Mindspin Labs will have if the change to services is made and the firm is able to earn an average margin and achieve an 17% ROI. (Enter your "Sales" and "Net income" answers in millions (i.e., 10,000,000 should be entered as 10). Do not round intermediate calculations. Round your answers to 2 decimal places.) Show less A Net income Sales Turnover million million < Required A Required B >

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter11: Strategic Cost Management

Section: Chapter Questions

Problem 9E

Related questions

Question

Transcribed Image Text:Mindspin Labs Inc. is a manufacturing firm that has experienced strong competition in its traditional business. Management is

considering Joining the trend to the "service economy" by eliminating its manufacturing operations and concentrating on providing

specialized maintenance services to other manufacturers. Management of Mindspin Labs has had a target ROI of 15% on an asset base

that has averaged $8 million. To achieve this ROI, average total asset turnover of 2 was required. If the company shifts its operations

from manufacturing to providing maintenance services, it is estimated that average total assets will decrease to $2 million.

Required:

a. Calculate net Income, margin, and sales required for Mindspin Labs to achieve its target ROI as a manufacturing firm.

b. Assume that the average margin of maintenance service firms is 3.10%, and that the average ROI for such firms is also 17%.

Calculate the net income, sales, and total asset turnover that Mindspin Labs will have if the change to services is made and the firm

is able to earn an average margin and achieve an 17% ROI.

Complete this question by entering your answers in the tabs below.

Required A Required B

Assume that the average margin of maintenance service firms is 3.10%, and that the average ROI for such firms is also 17%.

Calculate the net income, sales, and total asset tumover that Mindspin Labs will have if the change to services is made and

the firm is able to earn an average margin and achieve an 17% ROI. (Enter your "Sales" and "Net income" answers in millions

(i.e., 10,000,000 should be entered as 10). Do not round intermediate calculations. Round your answers to 2 decimal places.)

Show less A

Net income

Sales

Turnover

million

million

< Required A

Required B >

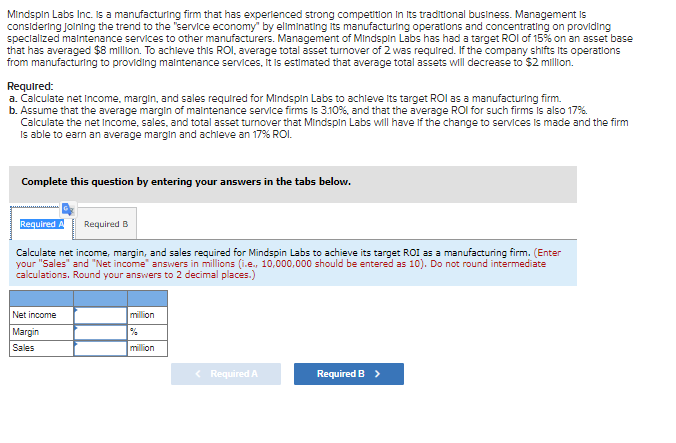

Transcribed Image Text:Mindspin Labs Inc. is a manufacturing firm that has experienced strong competition in its traditional business. Management is

considering Joining the trend to the "service economy" by eliminating its manufacturing operations and concentrating on providing

specialized maintenance services to other manufacturers. Management of Mindspin Labs has had a target ROI of 15% on an asset base

that has averaged $8 million. To achieve this ROI, average total asset turnover of 2 was required. If the company shifts its operations

from manufacturing to providing maintenance services, it is estimated that average total assets will decrease to $2 million.

Required:

a. Calculate net Income, margin, and sales required for Mindspin Labs to achieve its target ROI as a manufacturing firm.

b. Assume that the average margin of maintenance service firms is 3.10%, and that the average ROI for such firms is also 17%

Calculate the net Income, sales, and total asset turnover that Mindspin Labs will have if the change to services is made and the firm

is able to earn an average margin and achieve an 17% ROI.

Complete this question by entering your answers in the tabs below.

Required

Calculate net income, margin, and sales required for Mindspin Labs to achieve its target ROI as a manufacturing firm. (Enter

your "Sales" and "Net income" answers in millions (i.e., 10,000,000 should be entered as 10). Do not round intermediate

calculations. Round your answers to 2 decimal places.)

Net income

Margin

Sales

Required B

million

%

million

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT