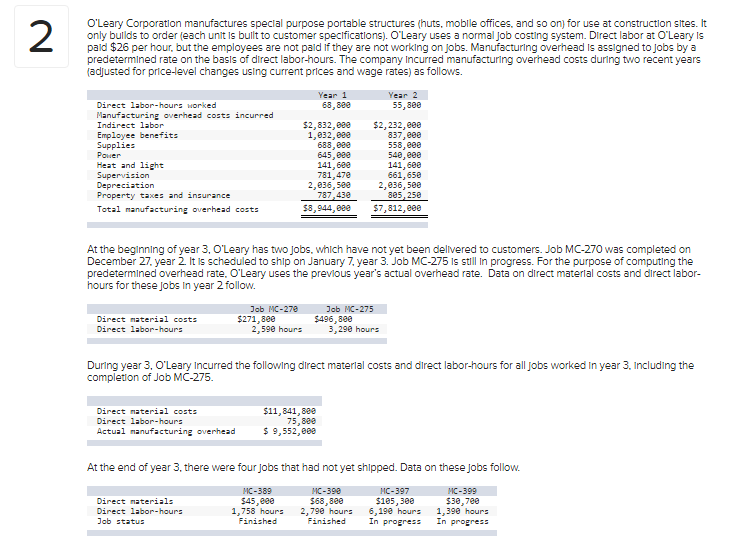

O'Leary Corporation manufactures special purpose portable structures (huts, mobile offices, and so on) for use at construction sites. It only bulds to order (each unit is bult to customer specifications). O'Leary uses a normal job costing system. Direct labor at O'Leary is paid $26 per hour. but the employees are not paid if they are not working on jobs. Manufacturing overhead is assigned to jobs by a predetermined rate on the basis of direct labor-hours. The company Incurred manufacturing overhead costs during two recent years (adjusted for price-level changes using current prices and wage rates) as follows. Year 1 Year 2 Direct labor-hours worked 68, 8ee 55,30e Manufacturing overhead costs incurred Indirect labor $2,832, 800 1,832, 00e 688,00e 645, e0e 141,6ee 781,470 2,836, 500 787,430 $2, 232, e00 837,e8e 558, eee 548, e0e 141, 6ee 661,650 2,e36, 500 385, 250 $7,812, e0e Employee benefits Supplies Power Heat and light Supervision Depreciation Property taxes and insurance Total manufacturing overhead costs $3,944, 000 At the beginning of year 3. O'Leary has two jobs, which have not yet been delivered to customers. Job MC-270 was completed on December 27. year 2 It is scheduled to ship on January 7. year 3. Job MC-275 Is still in progress. For the purpose of computing the predetermined overhead rate. O'Leary uses the previous year's actual overhead rate. Data on direct material costs and direct labor- hours for these Jobs In year 2 follow. Job MC-270 $271,8ee 2,590 hours Job MC-275 $496, 8ee 3,290 hours Direct material costs Direct labor-hours During year 3. O'Leary Incurred the following direct material costs and direct labor-hours for all jobs worked in year 3, Including the completion of Job MC-275. Direct naterial costs $11,841, 800 75,800 $ 9,552,880 Direct labor-hours Actual manufacturing overhead At the end of year 3, there were four Jobs that had not yet shipped. Data on these jobs follow. MC-390 S68,800 2,790 hours Finished MC-389 MC-397 MC-399 Direct materials $45,e0e 1,758 hours Finished $185, 380 6,190 hours In progress $30,700 1,390 hours In progress Direct labor-hours Job status

O'Leary Corporation manufactures special purpose portable structures (huts, mobile offices, and so on) for use at construction sites. It only bulds to order (each unit is bult to customer specifications). O'Leary uses a normal job costing system. Direct labor at O'Leary is paid $26 per hour. but the employees are not paid if they are not working on jobs. Manufacturing overhead is assigned to jobs by a predetermined rate on the basis of direct labor-hours. The company Incurred manufacturing overhead costs during two recent years (adjusted for price-level changes using current prices and wage rates) as follows. Year 1 Year 2 Direct labor-hours worked 68, 8ee 55,30e Manufacturing overhead costs incurred Indirect labor $2,832, 800 1,832, 00e 688,00e 645, e0e 141,6ee 781,470 2,836, 500 787,430 $2, 232, e00 837,e8e 558, eee 548, e0e 141, 6ee 661,650 2,e36, 500 385, 250 $7,812, e0e Employee benefits Supplies Power Heat and light Supervision Depreciation Property taxes and insurance Total manufacturing overhead costs $3,944, 000 At the beginning of year 3. O'Leary has two jobs, which have not yet been delivered to customers. Job MC-270 was completed on December 27. year 2 It is scheduled to ship on January 7. year 3. Job MC-275 Is still in progress. For the purpose of computing the predetermined overhead rate. O'Leary uses the previous year's actual overhead rate. Data on direct material costs and direct labor- hours for these Jobs In year 2 follow. Job MC-270 $271,8ee 2,590 hours Job MC-275 $496, 8ee 3,290 hours Direct material costs Direct labor-hours During year 3. O'Leary Incurred the following direct material costs and direct labor-hours for all jobs worked in year 3, Including the completion of Job MC-275. Direct naterial costs $11,841, 800 75,800 $ 9,552,880 Direct labor-hours Actual manufacturing overhead At the end of year 3, there were four Jobs that had not yet shipped. Data on these jobs follow. MC-390 S68,800 2,790 hours Finished MC-389 MC-397 MC-399 Direct materials $45,e0e 1,758 hours Finished $185, 380 6,190 hours In progress $30,700 1,390 hours In progress Direct labor-hours Job status

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter5: Product And Service Costing: Job-order System

Section: Chapter Questions

Problem 22E: CleanCom Company specializes in cleaning commercial buildings and construction sites. Each building...

Related questions

Question

Please answer D

Transcribed Image Text:O'Leary Corporation manufactures special purpose portable structures (huts, mobile offices, and so on) for use at construction sites. It

only bullds to order (each unit is bullt to customer specifications). O'Leary uses a normal Job costing system. Direct labor at O'Leary Is

pald $26 per hour, but the employees are not pald if they are not working on Jobs. Manufacturing overhead Is assigned to Jobs by a

predetermined rate on the basis of direct labor-hours. The company Incurred manufacturing overhead costs during two recent years

(adjusted for price-level changes usling current prices and wage rates) as follows.

Year 1

Year 2

Direct labor-hours worked

68, 800

55,800

Manufacturing overhead costs incurred

Indirect labor

$2,832, 000

1,832, 880

688, 000

645, 000

141, 600

781,478

2,036, 5ee

787,430

$2, 232, 800

837,800

558, 000

548, 800

141,600

661,650

2,836, 500

805, 250

$7,812, 800

Employee benefits

Supplies

Power

Heat and light

Supervision

Depreciation

Property taxes and insurance

Total manufacturing overhead costs

$8,944, 000

At the beginning of year 3, O'Leary has two Jobs, which have not yet been delivered to customers. Job MC-270 was completed on

December 27. year 2. It is scheduled to ship on January 7, year 3. Job MC-275 Is still n progress. For the purpose of computing the

predetermined overhead rate. O'Leary uses the prevlous year's actual overhead rate. Data on direct materlal costs and direct labor-

hours for these Jobs In year 2 follow.

Job MC-270

$271,880

2,590 hours

Job MC-275

Direct naterial costs

Direct labor-hours

$496,800

3,290 hours

During year 3, O'Leary Incurred the following direct materlal costs and direct labor-hours for all jobs worked in year 3. Including the

completion of Job MC-275.

Direct naterial costs

$11,841,800

75,800

$ 9,552, 808

Direct labor-hours

Actual manufacturing overhead

At the end of year 3, there were four Jobs that had not yet shipped. Data on these Jobs follow.

MC-389

MC-390

MC-397

MC-399

$68,8e0

2,790 hours

Finished

Direct materials

$45,000

1,758 hours

Finished

$165, 300

6,190 hours

In progress

$30,780

1,390 hours

In progress

Direct labor-hours

Job statu

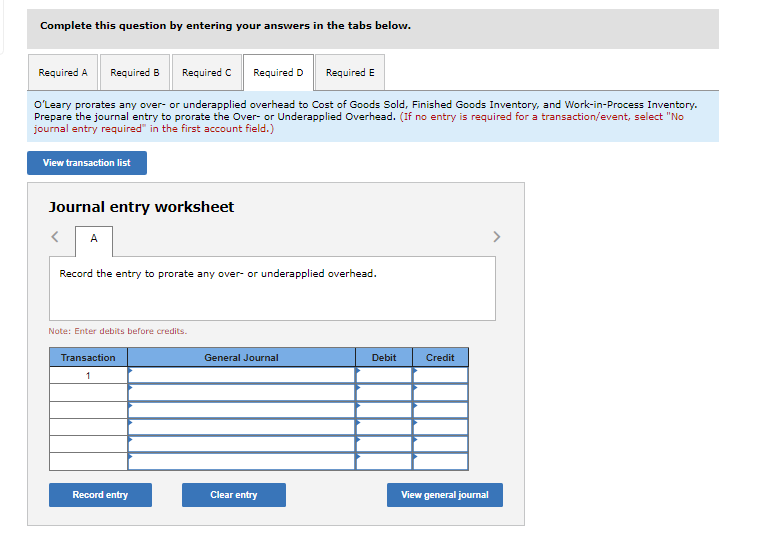

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Required D

Required E

O'Leary prorates any over- or underapplied overhead to Cost of Goods Sold, Finished Goods Inventory, and Work-in-Process Inventory.

Prepare the journal entry to prorate the Over- or Underapplied Overhead. (If no entry is required for a transaction/event, select "No

journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

A

Record the entry to prorate any over- or underapplied overhead.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

1

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning