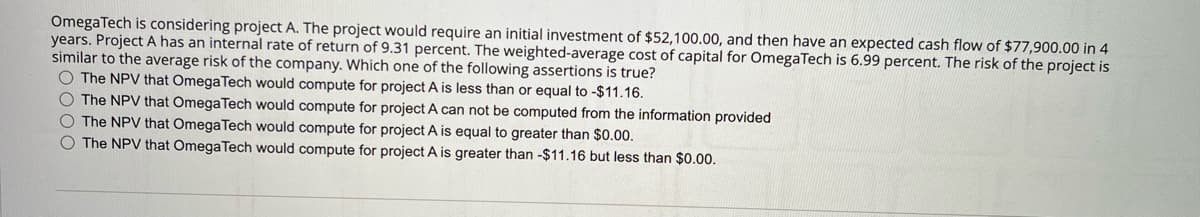

OmegaTech is considering project A. The project would require an initial investment of $52,100.00, and then have an expected cash flow of $77,900.00 in 4 years. Project A has an internal rate of return of 9.31 percent. The weighted-average cost of capital for OmegaTech is 6.99 percent. The risk of the project is similar to the average risk of the company. Which one of the following assertions is true? The NPV that Omega Tech would compute for project A is less than or equal to -$11.16. The NPV that Omega Tech would compute for project A can not be computed from the information provided The NPV that Omega Tech would compute for project A is equal to greater than $0.00. The NPV that OmegaTech would compute for project A is greater than -$11.16 but less than $0.00.

OmegaTech is considering project A. The project would require an initial investment of $52,100.00, and then have an expected cash flow of $77,900.00 in 4 years. Project A has an internal rate of return of 9.31 percent. The weighted-average cost of capital for OmegaTech is 6.99 percent. The risk of the project is similar to the average risk of the company. Which one of the following assertions is true? The NPV that Omega Tech would compute for project A is less than or equal to -$11.16. The NPV that Omega Tech would compute for project A can not be computed from the information provided The NPV that Omega Tech would compute for project A is equal to greater than $0.00. The NPV that OmegaTech would compute for project A is greater than -$11.16 but less than $0.00.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter14: Real Options

Section: Chapter Questions

Problem 3MC: Tropical Sweets is considering a project that will cost $70 million and will generate expected cash...

Related questions

Question

Transcribed Image Text:OmegaTech is considering project A. The project would require an initial investment of $52,100.00, and then have an expected cash flow of $77,900.00 in 4

years. Project A has an internal rate of return of 9.31 percent. The weighted-average cost of capital for OmegaTech is 6.99 percent. The risk of the project is

similar to the average risk of the company. Which one of the following assertions is true?

The NPV that Omega Tech would compute for project A is less than or equal to -$11.16.

The NPV that Omega Tech would compute for project A can not be computed from the information provided

The NPV that Omega Tech would compute for project A is equal to greater than $0.00.

The NPV that OmegaTech would compute for project A is greater than -$11.16 but less than $0.00.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College