On 30 June 2019, TIE Ltd acquired a machire for $180 000 cash, with an expected useful life of 9 years and a zero residual value. The company has adopted fair value for the valuation of non-current assets. On 30 June 202o, the company hired an independent valuer who assessed the value of the machine to be $175 000 with a remaining useful life cf 8 years and residual value of S5 000. On 30 June 2021, the fair value of the machine is $122 000 with a remaining useful life of 6 years and zero residual value. The company uses straight-line depreciation method for depreciating all its property, plant and equipment. Income tax rate is 30%. The financial year ends on 30 June.

On 30 June 2019, TIE Ltd acquired a machire for $180 000 cash, with an expected useful life of 9 years and a zero residual value. The company has adopted fair value for the valuation of non-current assets. On 30 June 202o, the company hired an independent valuer who assessed the value of the machine to be $175 000 with a remaining useful life cf 8 years and residual value of S5 000. On 30 June 2021, the fair value of the machine is $122 000 with a remaining useful life of 6 years and zero residual value. The company uses straight-line depreciation method for depreciating all its property, plant and equipment. Income tax rate is 30%. The financial year ends on 30 June.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 11P

Related questions

Question

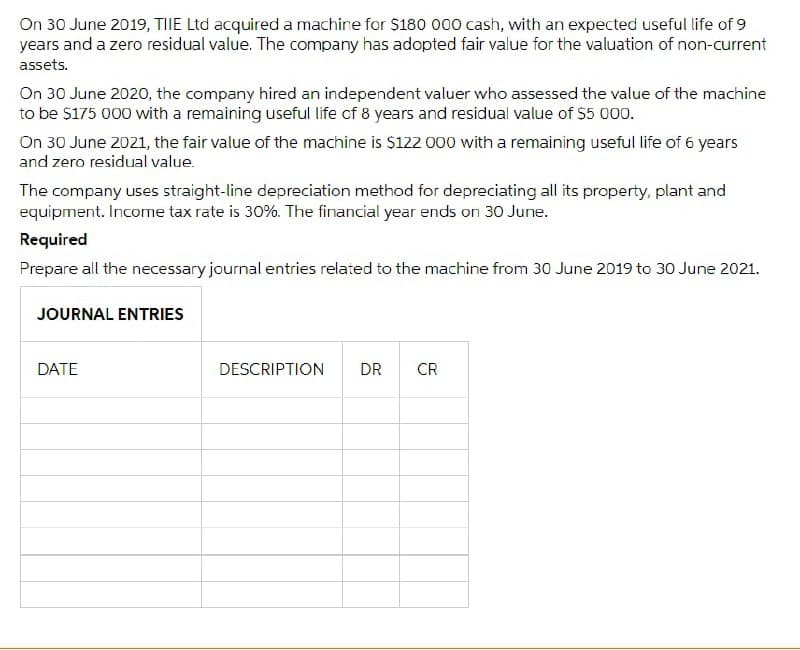

Transcribed Image Text:On 30 June 2019, TIE Ltd acquired a machine for $180 0o00 cash, with an expected useful life of 9

years and a zero residual value. The company has adopted fair value for the valuation of non-current

assets.

On 30 June 2020, the company hired an independent valuer who assessed the value of the machine

to be S175 000 with a remaining useful life cf 8 years and residual value of 55 000.

On 30 June 2021, the fair value of the machine is $122 O00 with a remaining useful life of 6 years

and zero residual value.

The company uses straight-line depreciation method for depreciating all its property, plant and

equipment. Income tax rate is 30%. The financial year ends on 30 June.

Required

Prepare all the necessary journal entries related to the machine from 30 June 2019 to 30 June 2021.

JOURNAL ENTRIES

DATE

DESCRIPTION

DR

CR

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning