On December 31, 2022, the equity accounts of Book Creations, Inc., contained the following balances: Common stock ($10 par, 100,000 shares authorized) 30,000 shares issued and outstanding $300,000 Retained earnings $476,600 For the year 2022, the corporation had net income before income taxes of $176,300, income taxes of $35,260, and net income after taxes of $141,040. The corporation’s tax rate is 20 percent. An expansion of the existing plant at a cost of $564,300 is planned. The corporation’s president, who owns 60 percent of the corporation’s common stock, estimates that the expansion would result in an increased net income of approximately $176,300 before interest and taxes. The financial vice president forecasts that the increase would be only $88,150. Management is considering two possibilities for financing: Issuance of 20,000 additional shares of common stock for $29 per share. Issuance of $564,300 face amount, 10-year, 6 percent bonds payable, secured by a mortgage lien on the plant.

On December 31, 2022, the equity accounts of Book Creations, Inc., contained the following balances: Common stock ($10 par, 100,000 shares authorized) 30,000 shares issued and outstanding $300,000 Retained earnings $476,600 For the year 2022, the corporation had net income before income taxes of $176,300, income taxes of $35,260, and net income after taxes of $141,040. The corporation’s tax rate is 20 percent. An expansion of the existing plant at a cost of $564,300 is planned. The corporation’s president, who owns 60 percent of the corporation’s common stock, estimates that the expansion would result in an increased net income of approximately $176,300 before interest and taxes. The financial vice president forecasts that the increase would be only $88,150. Management is considering two possibilities for financing: Issuance of 20,000 additional shares of common stock for $29 per share. Issuance of $564,300 face amount, 10-year, 6 percent bonds payable, secured by a mortgage lien on the plant.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter14: Long-term Liabilities: Bonds And Notes

Section: Chapter Questions

Problem 1PEA

Related questions

Question

On December 31, 2022, the equity accounts of Book Creations, Inc., contained the following balances:

| Common stock ($10 par, 100,000 shares authorized) 30,000 shares issued and outstanding | $300,000 |

| $476,600 | |

For the year 2022, the corporation had net income before income taxes of $176,300, income taxes of $35,260, and net income after taxes of $141,040. The corporation’s tax rate is 20 percent.

An expansion of the existing plant at a cost of $564,300 is planned. The corporation’s president, who owns 60 percent of the corporation’s common stock, estimates that the expansion would result in an increased net income of approximately $176,300 before interest and taxes. The financial vice president

Management is considering two possibilities for financing:

- Issuance of 20,000 additional shares of common stock for $29 per share.

- Issuance of $564,300 face amount, 10-year, 6 percent bonds payable, secured by a mortgage lien on the plant.

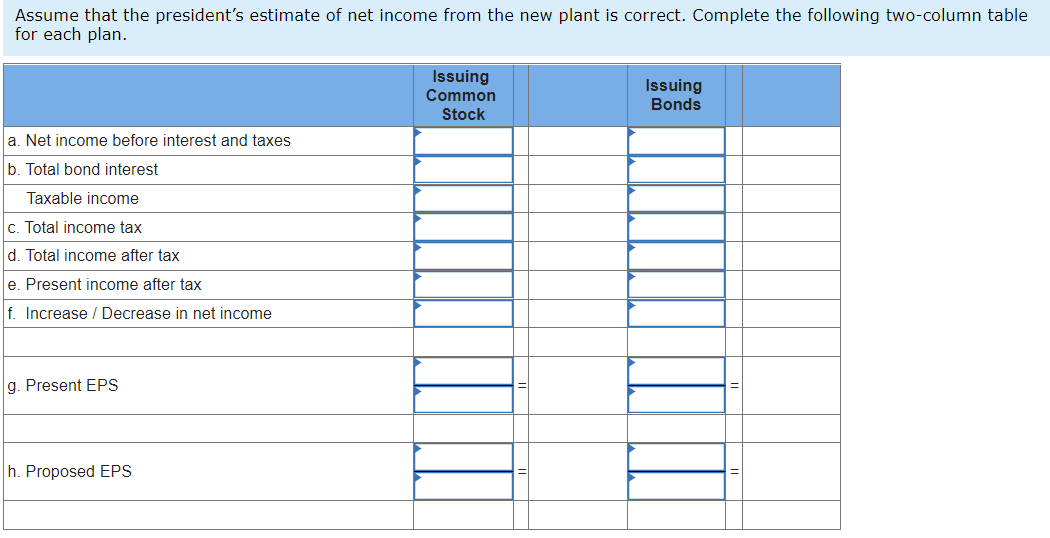

Transcribed Image Text:Assume that the president's estimate of net income from the new plant is correct. Complete the following two-column table

for each plan.

Issuing

Common

Stock

Issuing

Bonds

a. Net income before interest and taxes

b. Total bond interest

Taxable income

c. Total income tax

d. Total income after tax

e. Present income after tax

f. Increase / Decrease in net income

g. Present EPS

h. Proposed EPS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning