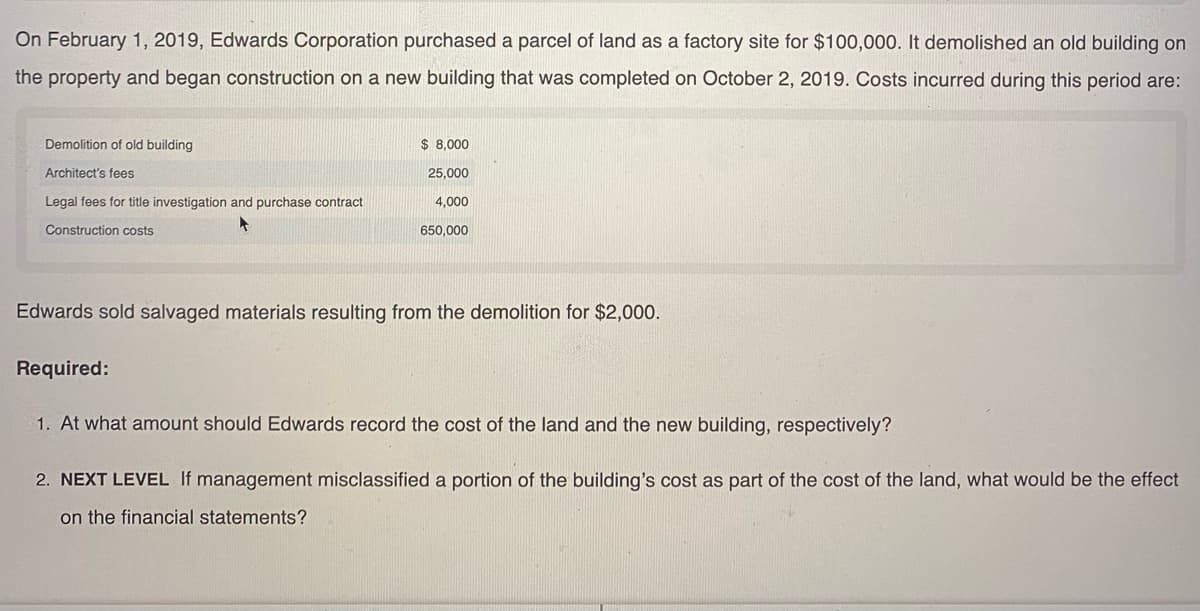

On February 1, 2019, Edwards Corporation purchased a parcel of land as a factory site for $100,000. It demolished an old building or he property and began construction on a new building that was completed on October 2, 2019. Costs incurred during this period are: Demolition of old building $ 8,000 Architect's fees 25,000 Legal fees for title investigation and purchase contract 4.000 Construction costs 650,000 Edwards sold salvaged materials resulting from the demolition for $2,000. Required: 1. At what amount should Edwards record the cost of the land and the new building, respectively? 2. NEXT LEVEL If management misclassified a portion of the building's cost as part of the cost of the land, what would be the effect

On February 1, 2019, Edwards Corporation purchased a parcel of land as a factory site for $100,000. It demolished an old building or he property and began construction on a new building that was completed on October 2, 2019. Costs incurred during this period are: Demolition of old building $ 8,000 Architect's fees 25,000 Legal fees for title investigation and purchase contract 4.000 Construction costs 650,000 Edwards sold salvaged materials resulting from the demolition for $2,000. Required: 1. At what amount should Edwards record the cost of the land and the new building, respectively? 2. NEXT LEVEL If management misclassified a portion of the building's cost as part of the cost of the land, what would be the effect

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 38P

Related questions

Question

100%

Transcribed Image Text:On February 1, 2019, Edwards Corporation purchased a parcel of land as a factory site for $100,000. It demolished an old building on

the property and began construction on a new building that was completed on October 2, 2019. Costs incurred during this period are:

Demolition of old building

$ 8,000

Architect's fees

25.000

Legal fees for title investigation and purchase contract

4,000

Construction costs

650,000

Edwards sold salvaged materials resulting from the demolition for $2,000.

Required:

1. At what amount should Edwards record the cost of the land and the new building, respectively?

2. NEXT LEVEL If management misclassified a portion of the building's cost as part of the cost of the land, what would be the effect

on the financial statements?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning