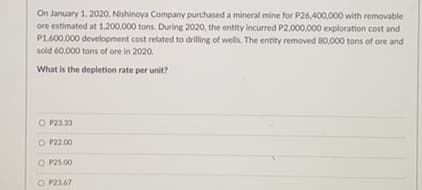

On January 1, 2020, Nishinoya Company purchased a mineral mine for P26,400,000 with removable ore estimated at 1,200,000 tons. During 2020, the entity incurred P2,000.000 exploration cost and P1600,000 development cost related to drilling of wells. The entity removed 80,000 tons of ore and sold 60.000 tons of ore in 2020. What is the depletion rate per unit? O P23.33 O P22.00 O P25.00 O P23.67

Q: On January 1, 2018, Nickel Co. purchased a land for P12,000,000. The company expected to extract…

A: Year 2018 Purchase price of land = P12,000,000 Expected minerals to be extracted = 2,000,000…

Q: On January 1, 2021, Canyon Company decided to decrease the estimated useful life of the patent from…

A: Depreciation refers to a decline in the value of a fixed asset over its useful life. A patent is an…

Q: In 2020, Tableta Company paid P4,000,000 to purchase a land containing a total estimated 160,000…

A: Annual depreciation= (cost of the assets - residual value) / life of the assets = (P1,500,000-0) /…

Q: On April 17, 2018, the Loadstone Mining Company purchased the rights to a coal mine. The purchase…

A: 1) Compute depletion expense for the year 2018:

Q: During 2020, Prospect Company incurred P4,000,000 in exploration cost for each of the 15 oil wells…

A: The amount of exploration cost would be apportioned for only successfully drilled oil wells. Out of…

Q: At the beginning of the current year, Bert Company purchased a mineral mine for P26,400,000 with…

A: GIVEN At the beginning of the current year, Bert Company purchased a mineral mine for P26,400,000…

Q: On January 1, 2019, Minas Company purchased a mining site in the mountains for the extraction of…

A: Decommission liability means the amount of money that needs to spent on return of a developed site…

Q: In March, 2020, Sunland Company purchased a coal mine for $8110000. Removable coal is estimated at…

A: Depreciation , amortization , depletion all means the fall in value of assets due to one reason or…

Q: EL Corporation, an entity under the mining industry, incurred a total of ₱20,000,000 on March 31,…

A: Depletion expense is the expense charged on the use of the natural resources during the accounting…

Q: n 2018, IRIS Company paid ₱4,000,000 to purchase land containing a total estimated 160,000 tons of…

A: Given information: Purchase price = ₱4,000,000 Total estimated tons = 160,000 Salvage value =…

Q: The Clarke Co. acquired a machine on May 1, 2021, at a cost of $60,000. The machine is expected to…

A: Date of acquiring: May 1, 2021 Cost: $ 60,000 Life: 10 years Residual Value: $5,000 Life (in units):…

Q: On April 17, 2021, the Loadstone Mining Company purchased the rights to a coal mine. The purchase…

A: DepletionDepletion is an accrual accounting technique used to allocate the cost of extracting…

Q: On July 1, 2017, Jungkook Mining Company purchased the rights to a mine. The total purchase price…

A: Value of mine = Total purchase price - Amount allocated to land = P7,920,000 - P240,000 =…

Q: EL Corporation, an entity under the mining industry, incurred a total of ₱20,000,000 on March 31,…

A: The systemic redistribution of costs related to extracting or obtaining natural resources from a…

Q: On January 1, 2021, Brandy Company owned a group of machines with the following aggregate cost and…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: At the beginning of the current year, Bert Company purchased a mineral mine for P26,400,000 with…

A: Lets understand the basics. Depletion needs to calculate when there is extraction of mineral…

Q: Radical Company acquired a mineral right for P30,000,000 January 2020. The mine has a recoverable…

A: In mining there is depletion based depreciation accounting is done and based on the minerals are…

Q: Tamarisk Corporation acquires a coal mine at a cost of $464,000. Intangible development costs total…

A: Depletion expense = (Cost - Salvage value) * coal extracted / Total coal estimated to be available =…

Q: Novak Corporation acquires a coal mine at a cost of $ 831,000. Intangible development costs total $…

A: Total Cost of mine = Total purchase price + Development costs + restoration costs =…

Q: Pina Colada Corporation acquires a coal mine at a cost of $ 863,800. Intangible development costs…

A: Solution:- Calculation of Depletion note per ton as follows;- =($863,800+$221,000+$93,000-$120,000)…

Q: In January 2018, HUKAY Mining Corporation purchased a mineral mine for P7,200,000 with removable ore…

A: Depletion can be defined as the method that is used to determine and allocate the cost of extracting…

Q: On July 1, 2021, Lambda Company, a calendar year entity purchased the rights to a mine. The total…

A: Cost of right = P14,000,000 - P2,000,000 = P12,000,000 Reserves used during the year = 25,000 tons x…

Q: On June 1, 2021, ABC Company purchased rights to a mine for P30,000,000, of which, P3,000,000 was…

A: Cost of mine = Total purchase value - Amount allocable to land = 30000000 - 3000000 = 27,000,000

Q: On July 1,2021, Phantom Corporation purchased the rights to a mine for a total purchase price of…

A: The depreciation expense is charged on fixed assets as reduction in the value of fixed assets with…

Q: f 18,000 tons were extracted during the first year, which of the following would be included in the…

A: Journal refers to the process of recording all the monetary transactions which shows all the credit…

Q: On January 1, 2021, Stanford Company purchased a mining site that will have to be restored to…

A: The answer is stated below:

Q: At the beginning of current year, Nilli Company purchased a coal mine for P30,000,000. Removable…

A: Depletion expense is a charge against profits for the use of natural resources.it is most commonly…

Q: On July 1, 2022, ABC Company, (using a calendar year), purchased the rights to a mine. The total…

A: Depletion: It is the cost a company spends in the process of mining natural resources from the…

Q: In 20x1, Newman Company paid P1,000,000 to purchase land containing a total estimated 160,000 tons…

A: Solution: Total cost of land= P1,000,000. Estimated value after mineral have been removed= P200,000…

Q: Pronghorn Corporation acquires a coal mine at a cost of $484,000. Intangible development costs total…

A:

Q: On May, 1, 2020, Star Mines Inc. purchased an ore mine for $2,400,000 to access an estimated…

A: Solution: The ore mine should be recorded at = Purchase cost of mine + Development cost + Present…

Q: On April 1, 2022, Deland Manufacturing Company purchased a new equipment for P800,000. The equipment…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: On July 1,2021, Phantom Corporation purchased the rights to a mine for a total purchase price of…

A: Depreciation , amortization , depletion all means the fall in value of assets due to one reason or…

Q: In 2017, Bodino Company paid P 4,000,000 to purchase land containing a total estimated 160,000 of…

A: The depletion rate indicates the allocation of cost extractions of deposits minerals.

Q: On January, 2023, Big Company purchased a mineral mine for P2,640,000 with removable ore estimated…

A: Depletion expenses: Depletion expenses is the reduction in the profit due to the use of natural…

Q: n July 1, 2019, Lam Company, a calendar year entity, purchased the rights to a mine. The total…

A: Depreciation means the loss in value of assets because of usage of assets , passage of time or…

Q: On January 1, 2018, Spring Co. purchased a land for $12,000,000. The company expected to extract…

A:

Q: On July 1, 2017, Jungkook Mining Company purchased the rights to a mine. The total purchase price…

A: Value of mine = Total purchase price - Amount allocated to land = P7,920,000 - P240,000 =…

Q: EL Corporation, an entity under the mining industry, incurred a total of ₱20,000,000 on March 31,…

A: Depreciation is the amortization of the asset's cost over its useful life which will be debited to…

Q: In 2020, Tableta Company paid P4,000,000 to purchase a land containing a total estimated 160,000…

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage…

Q: On January 2, 2019, Whistler Company purchased land for $450,000, from which it is estimated that…

A: The process by which financial transactions of the business are recorded and communicated with the…

Q: Crane Corporation acquires a coal mine at a cost of $404,000. Intangible development costs total…

A: The question is based on the concept of Journal Entry.

Q: On January 1, 2020, Hilary Company purchased a mineral mine for P26,400,000 with removable ore…

A: Depreciation , amortization , depletion all means the fall in value of assets due to one reason or…

Q: ABC Company has an equipment acquired on January 1, 2018 at a cost of P2,200,000 with estimated…

A: Given, 1/1/18 - purchased equipment worth P2200000. residual value = P200000. estimated useful life…

Q: Mustang Company changed from straight line depreciation to double declinir method at the beginning…

A: Step 1 Depreciation is the written don in the value of the assets.

Q: On April 1, 2019, CanAm Company purchased a copper mine at a cost of $14,000,000. The mine was…

A: Depletion expense per ton = (Cost - Residual value)/Total estimated tons

Q: 5. In 2018. RIS Company paid P4.000.000 to purchase land containing a total estimated 160.000 tons…

A: In 2018, IRIS Company paid for purchase of land containing a extractable minerals = P4000000 Total…

Q: On July 1, 2017, Jungkook Mining Company purchased the rights to a mine. The total purchase price…

A: Value of mine = Total purchase price - Amount allocated to land = P7,920,000 - P240,000 =…

Q: During 2021, Bondoc Corporation acquired a mineral mine for P900,000 of which P150,000 was ascribed…

A: Depletion of mine will be on the basis of amount of mineral extracted during the period. Accumulated…

Q: During 2020, ABC Company acquired a mineral mine for P1,500,000 of which P200,000 was ascribed to…

A: Formula: Total Depletion amount = Depletion per unit x Total extracted units.

Step by step

Solved in 2 steps

- On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.

- Comprehensive: Acquisition, Subsequent Expenditures, and Depreciation On January 2, 2019, Lapar Corporation purchased a machine for 50,000. Lapar paid shipping expenses of 500, as well as installation costs of 1,200. The company estimated that the machine would have a useful life of 10 years and a residual value of 3,000. On January 1, 2020, Lapar made additions costing 3,600 to the machine in order to comply with pollution-control ordinances. These additions neither prolonged the life of the machine nor increased the residual value. Required: 1. If Lapar records depreciation expense under the straight-line method, how much is the depreciation expense for 2020? 2. Assume Lapar determines the machine has three significant components as shown below. If Lapar uses IFRS, what is the amount of depreciation expense that would be recorded?On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.

- The following intangible assets were purchased by Hanna Unlimited: A. A patent with a remaining legal life of twelve years is bought, and Hanna expects to be able to use it for six years. It is purchased at a cost of $48,000. B. A copyright with a remaining life of thirty years is purchased, and Hanna expects to be able to use it for ten years. It is purchased for $70,000. Determine the annual amortization amount for each intangible asset.Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.Susquehanna Company purchased an asset at the beginning of the current year for 250,000. The estimated residual value is 25,000. Susquehanna estimates that the asset will be used for 10 years and uses straight-line depreciation. Calculate the depreciation expense per year.