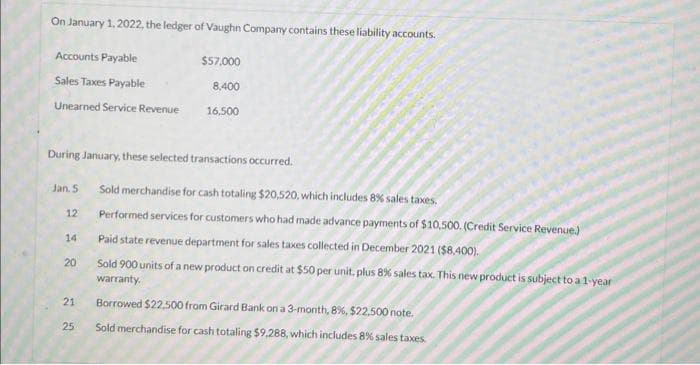

On January 1, 2022, the ledger of Vaughn Company contains these liability accounts. Accounts Payable Sales Taxes Payable Unearned Service Revenue Jan. 5 12 During January, these selected transactions occurred. 14 20 21 $57,000 25 8,400 16,500 Sold merchandise for cash totaling $20,520, which includes 8% sales taxes. Performed services for customers who had made advance payments of $10,500. (Credit Service Revenue) Paid state revenue department for sales taxes collected in December 2021 ($8,400). Sold 900 units of a new product on credit at $50 per unit, plus 8% sales tax. This new product is subject to a 1-year warranty. Borrowed $22,500 from Girard Bank on a 3-month, 8 %, $22.500 note. Sold merchandise for cash totaling $9,288, which includes 8% sales taxes.

On January 1, 2022, the ledger of Vaughn Company contains these liability accounts. Accounts Payable Sales Taxes Payable Unearned Service Revenue Jan. 5 12 During January, these selected transactions occurred. 14 20 21 $57,000 25 8,400 16,500 Sold merchandise for cash totaling $20,520, which includes 8% sales taxes. Performed services for customers who had made advance payments of $10,500. (Credit Service Revenue) Paid state revenue department for sales taxes collected in December 2021 ($8,400). Sold 900 units of a new product on credit at $50 per unit, plus 8% sales tax. This new product is subject to a 1-year warranty. Borrowed $22,500 from Girard Bank on a 3-month, 8 %, $22.500 note. Sold merchandise for cash totaling $9,288, which includes 8% sales taxes.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 2EA: Consider the following accounts and determine if the account is a current liability, a noncurrent...

Related questions

Question

Transcribed Image Text:On January 1, 2022, the ledger of Vaughn Company contains these liability accounts.

Accounts Payable

Sales Taxes Payable

Unearned Service Revenue

Jan. 5

12

During January, these selected transactions occurred.

14

20

21

$57,000

25

8,400

16,500

Sold merchandise for cash totaling $20,520, which includes 8% sales taxes.

Performed services for customers who had made advance payments of $10,500. (Credit Service Revenue)

Paid state revenue department for sales taxes collected in December 2021 ($8,400).

Sold 900 units of a new product on credit at $50 per unit, plus 8% sales tax. This new product is subject to a 1-year

warranty.

Borrowed $22,500 from Girard Bank on a 3-month, 8 %, $22.500 note.

Sold merchandise for cash totaling $9,288, which includes 8% sales taxes.

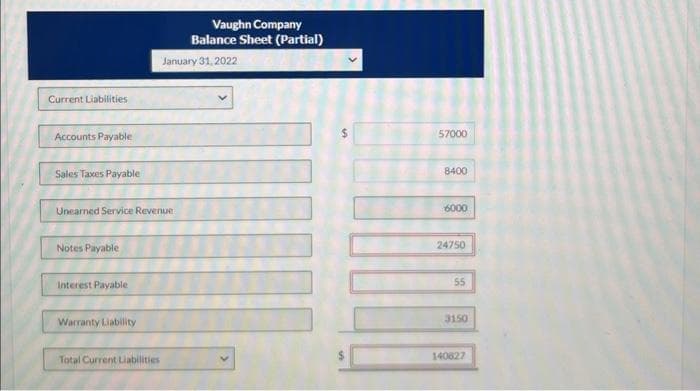

Transcribed Image Text:Current Liabilities

Accounts Payable

Sales Taxes Payable

Unearned Service Revenue

Notes Payable

Interest Payable

Warranty Liability

Total Current Liabilities

Vaughn Company

Balance Sheet (Partial)

January 31, 2022

57000

8400

6000

24750

55

3150

140827

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning