Accounts payable Accounts receivable Account Accumulated depreciation, building Accumulated depreciation, equipment Accumulated depreciation, furniture Allowance for doubtful accounts Building Cash Balance $ 11,820 20,400 79,800 38,000 21,500 940 137,000 11,600

Accounts payable Accounts receivable Account Accumulated depreciation, building Accumulated depreciation, equipment Accumulated depreciation, furniture Allowance for doubtful accounts Building Cash Balance $ 11,820 20,400 79,800 38,000 21,500 940 137,000 11,600

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 15PB: Prepare an adjusted trial balance from the following account information, considering the adjustment...

Related questions

Question

Please help me with correct answer thanku

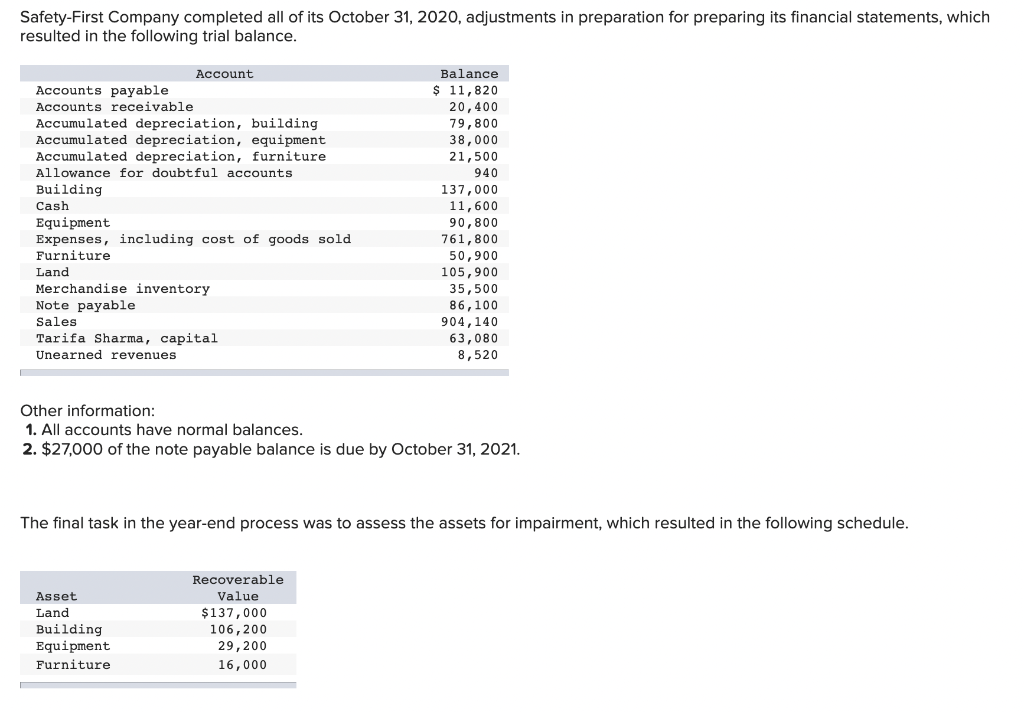

Transcribed Image Text:Safety-First Company completed all of its October 31, 2020, adjustments in preparation for preparing its financial statements, which

resulted in the following trial balance.

Accounts payable

Accounts receivable.

Accumulated depreciation, building.

Accumulated depreciation, equipment

Accumulated depreciation, furniture

Allowance for doubtful accounts

Building

***

Cash

Account

Equipment

Expenses, including cost of goods sold

Furniture

Land

Merchandise inventory

Note payable

Sales

Tarifa Sharma, capital

Unearned revenues

Asset

Land

Building

Equipment

Furniture

Other information:

1. All accounts have normal balances.

2. $27,000 of the note payable balance is due by October 31, 2021.

Balance

$ 11,820

20,400

79,800

38,000

7000

21,500

1040

940

The final task in the year-end process was to assess the assets for impairment, which resulted in the following schedule.

Recoverable

Value

$137,000

106, 200

137,000

11,600

90,800

761,800

50,900

105,900

35,500

86,100

904,140

29,200

16,000

63,080

8,520

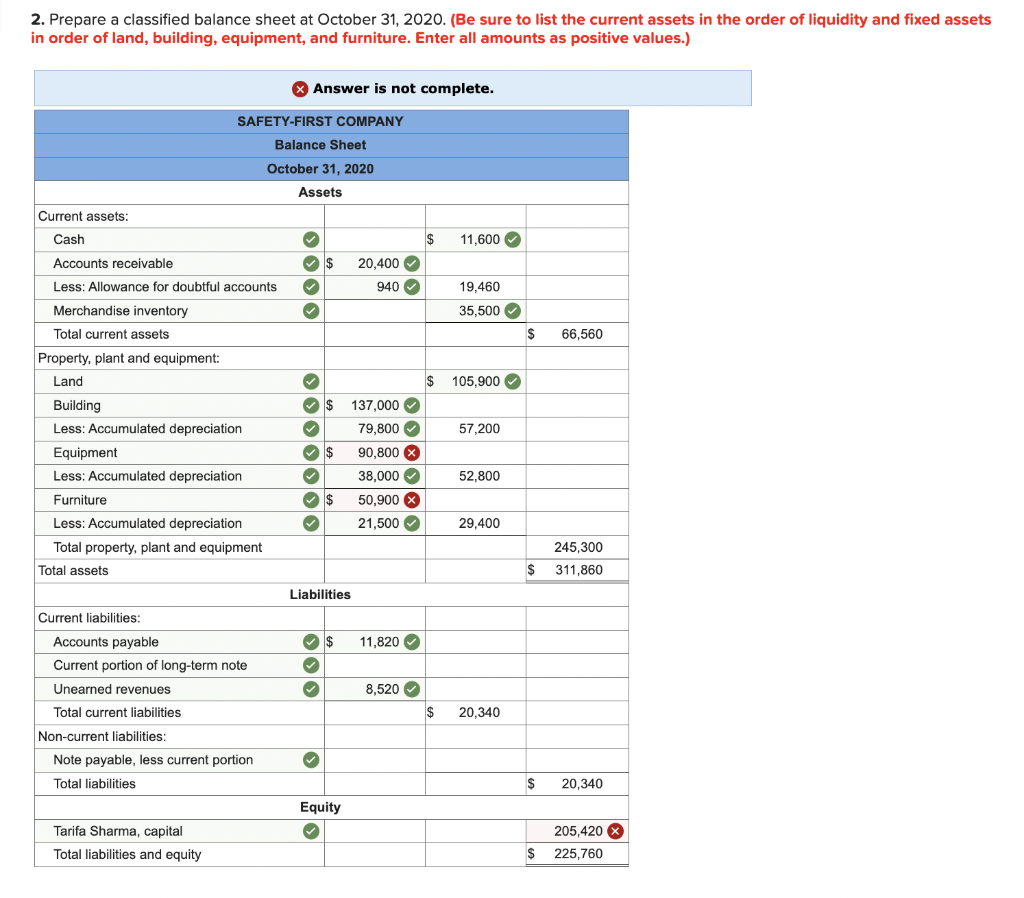

Transcribed Image Text:2. Prepare a classified balance sheet at October 31, 2020. (Be sure to list the current assets in the order of liquidity and fixed assets

in order of land, building, equipment, and furniture. Enter all amounts as positive values.)

Current assets:

Cash

Accounts receivable

Less: Allowance for doubtful accounts

Merchandise inventory

Total current assets

Property, plant and equipment:

Land

Building

Less: Accumulated depreciation

Equipment

Less: Accumulated depreciation

Furniture

Less: Accumulated depreciation

Total property, plant and equipment

Total assets

Current liabilities:

SAFETY-FIRST COMPANY

Balance Sheet

October 31, 2020

Assets

Accounts payable

Current portion of long-term note

Unearned revenues

Total current liabilities

Non-current liabilities:

Note payable, less current portion

Total liabilities

Tarifa Sharma, capital

Total liabilities and equity

> Answer is not complete.

✓

✓$

✓

›› › › › › ›

✓

✓$ $ 137,000 ✓

79,800✔

90,800 x

38,000✔

50,900 X

21,500✔

✓ $

✓ $

$

Liabilities

333

✓ $

›>

20,400✔

940✔

Equity

✓

11,820✔

8,520✔

$ 11,600✔

19,460

35,500✔

$ 105,900

57,200

52,800

29,400

$ 20,340

$ 66,560

245,300

$ 311,860

$

20,340

205,420 x

$ 225,760

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub