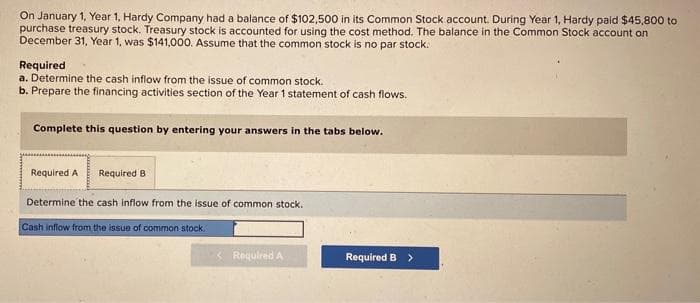

On January 1, Year 1, Hardy Company had a balance of $102,500 in its Common Stock account. During Year 1, Hardy paid $45,800 to purchase treasury stock. Treasury stock is accounted for using the cost method. The balance in the Common Stock account on December 31, Year 1, was $141,000. Assume that the common stock is no par stock. Required a. Determine the cash inflow from the issue of common stock. b. Prepare the financing activities section of the Year 1 statement of cash flows. Complete this question by entering your answers in the tabs below. Required A Required B Determine the cash inflow from the issue of common stock. Cash inflow from the issue of common stock.. Required A Required B >

On January 1, Year 1, Hardy Company had a balance of $102,500 in its Common Stock account. During Year 1, Hardy paid $45,800 to purchase treasury stock. Treasury stock is accounted for using the cost method. The balance in the Common Stock account on December 31, Year 1, was $141,000. Assume that the common stock is no par stock. Required a. Determine the cash inflow from the issue of common stock. b. Prepare the financing activities section of the Year 1 statement of cash flows. Complete this question by entering your answers in the tabs below. Required A Required B Determine the cash inflow from the issue of common stock. Cash inflow from the issue of common stock.. Required A Required B >

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter18: Acquiring Capital For Growth And Development

Section: Chapter Questions

Problem 3AP

Related questions

Question

Subject : Accounting

Transcribed Image Text:On January 1, Year 1, Hardy Company had a balance of $102,500 in its Common Stock account. During Year 1, Hardy paid $45,800 to

purchase treasury stock. Treasury stock is accounted for using the cost method. The balance in the Common Stock account on

December 31, Year 1, was $141,000. Assume that the common stock is no par stock.

Required

a. Determine the cash inflow from the issue of common stock.

b. Prepare the financing activities section of the Year 1 statement of cash flows.

Complete this question by entering your answers in the tabs below.

Required A Required B

Determine the cash inflow from the issue of common stock.

Cash inflow from the issue of common stock.

< Required A

Required B >

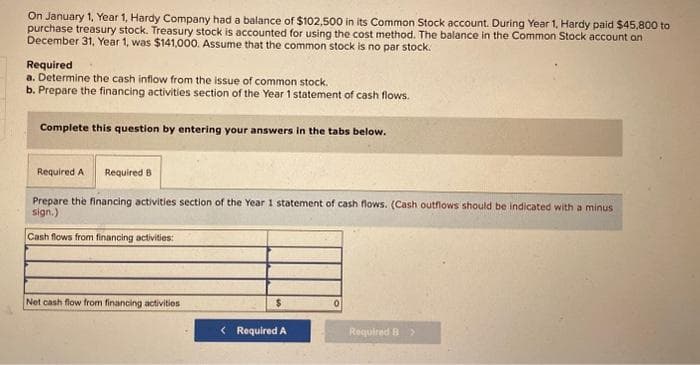

Transcribed Image Text:On January 1, Year 1, Hardy Company had a balance of $102,500 in its Common Stock account. During Year 1, Hardy paid $45,800 to

purchase treasury stock. Treasury stock is accounted for using the cost method. The balance in the Common Stock account on

December 31, Year 1, was $141,000. Assume that the common stock is no par stock.

Required

a. Determine the cash inflow from the issue of common stock.

b. Prepare the financing activities section of the Year 1 statement of cash flows.

Complete this question by entering your answers in the tabs below.

Required A Required B

Prepare the financing activities section of the Year 1 statement of cash flows. (Cash outflows should be indicated with a minus

sign.)

Cash flows from financing activities:

Net cash flow from financing activities

$

< Required A

0

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning