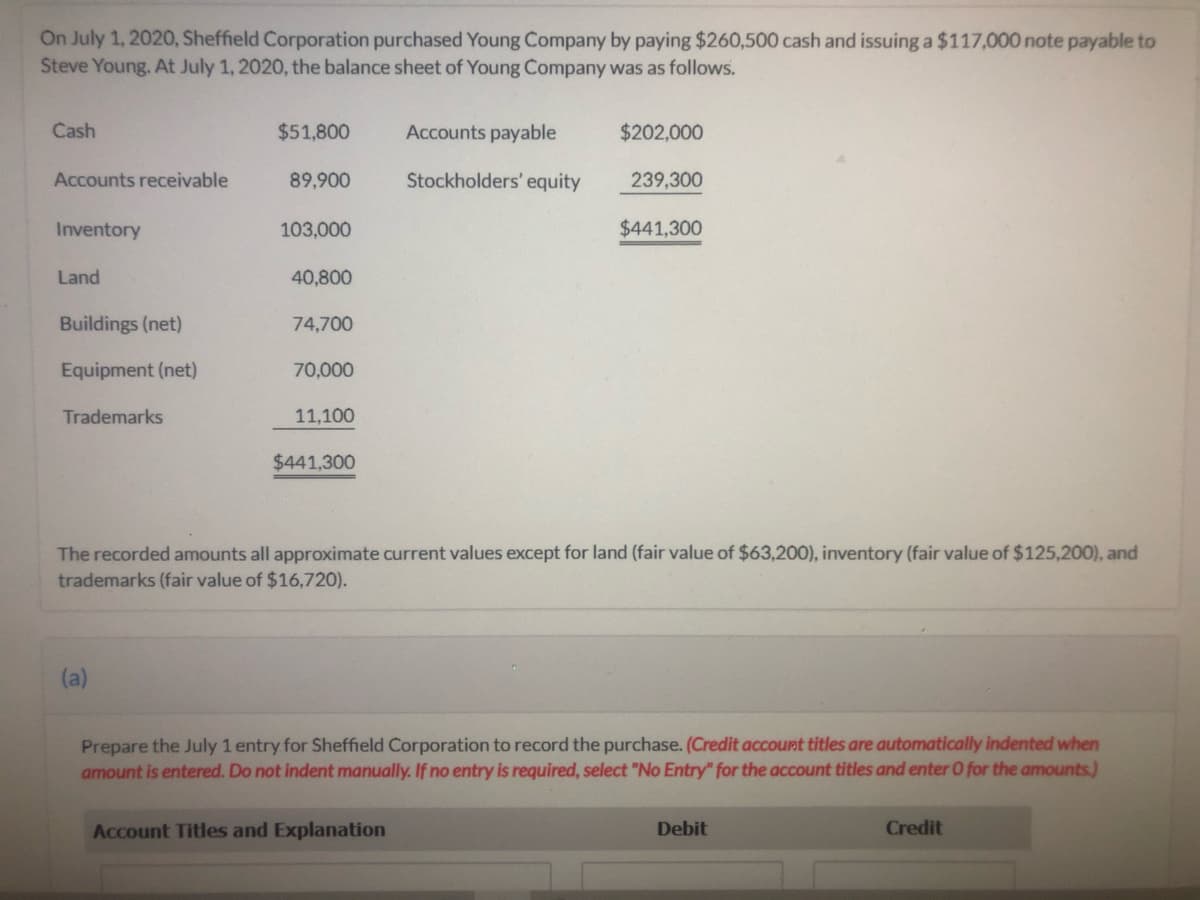

On July 1, 2020, Sheffield Corporation purchased Young Company by paying $260,500 cash and issuing a $117,000 note payable to Steve Young. At July 1, 2020, the balance sheet of Young Company was as follows. Cash $51,800 Accounts payable $202,000 Accounts receivable 89,900 Stockholders' equity 239,300 Inventory 103,000 $441,300 Land 40,800 Buildings (net) 74,700 Equipment (net) 70,000 Trademarks 11,100 $441,300 The recorded amounts all approximate current values except for land (fair value of $63,200), inventory (fair value of $125,200), and trademarks (fair value of $16,720). (a) Prepare the July 1 entry for Sheffield Corporation to record the purchase. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit

On July 1, 2020, Sheffield Corporation purchased Young Company by paying $260,500 cash and issuing a $117,000 note payable to Steve Young. At July 1, 2020, the balance sheet of Young Company was as follows. Cash $51,800 Accounts payable $202,000 Accounts receivable 89,900 Stockholders' equity 239,300 Inventory 103,000 $441,300 Land 40,800 Buildings (net) 74,700 Equipment (net) 70,000 Trademarks 11,100 $441,300 The recorded amounts all approximate current values except for land (fair value of $63,200), inventory (fair value of $125,200), and trademarks (fair value of $16,720). (a) Prepare the July 1 entry for Sheffield Corporation to record the purchase. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

100%

Transcribed Image Text:On July 1, 2020, Sheffield Corporation purchased Young Company by paying $260,500 cash and issuing a $117,000 note payable to

Steve Young. At July 1, 2020, the balance sheet of Young Company was as follows.

Cash

$51,800

Accounts payable

$202,000

Accounts receivable

89,900

Stockholders' equity

239,300

Inventory

103,000

$441,300

Land

40,800

Buildings (net)

74,700

Equipment (net)

70,000

Trademarks

11,100

$441,300

The recorded amounts all approximate current values except for land (fair value of $63,200), inventory (fair value of $125,200), and

trademarks (fair value of $16,720).

(a)

Prepare the July 1 entry for Sheffield Corporation to record the purchase. (Credit account titles are automatically indented when

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Account Titles and Explanation

Debit

Credit

Transcribed Image Text:Prepare the July 1 entry for Sheffield Corporation to record the purchase. (Credit account titles are automatically indented when

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning