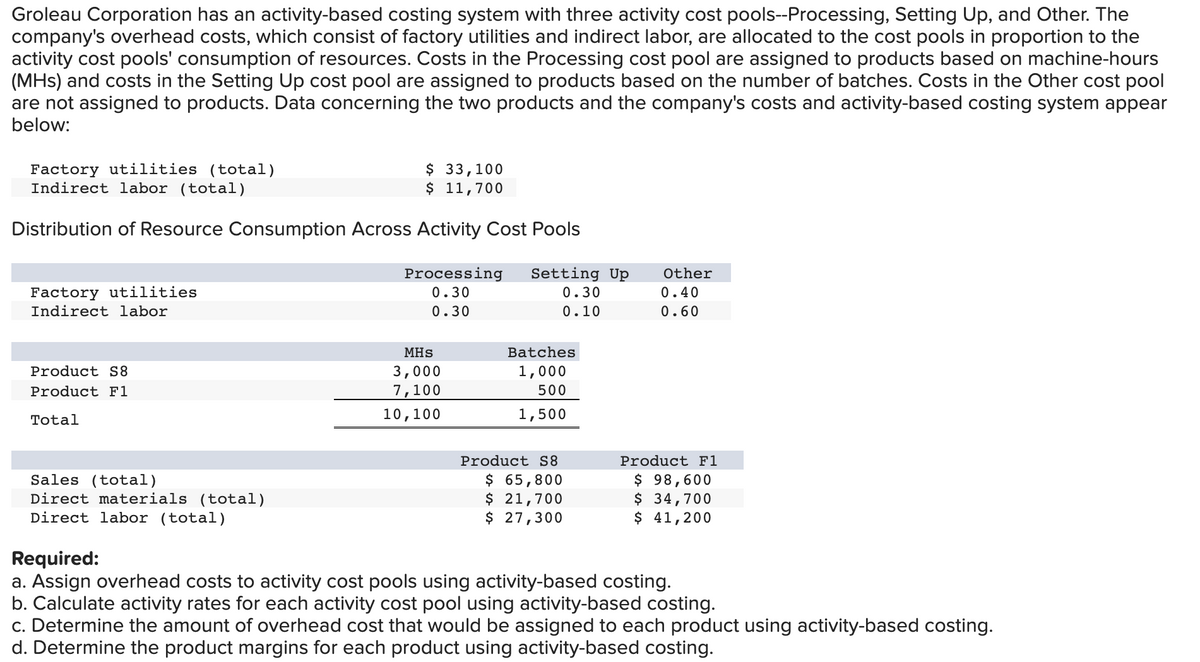

Groleau Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Costs in the Processing cost pool are assigned to products based on machine-hours (MHS) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear below: Factory utilities (total) Indirect labor (total) Distribution of Resource Consumption Across Activity Cost Pools Factory utilities Indirect labor Product S8 Product F1 Total $ 33,100 $ 11,700 Sales (total) Direct materials (total) Direct labor (total) Processing 0.30 0.30 MHS 3,000 7,100 10,100 Setting Up 0.30 0.10 Batches 1,000 500 1,500 Product S8 $ 65,800 $ 21,700 $ 27,300 Other 0.40 0.60 Product F1 $ 98,600 $ 34,700 $ 41,200 Required: a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing.

Groleau Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Costs in the Processing cost pool are assigned to products based on machine-hours (MHS) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear below: Factory utilities (total) Indirect labor (total) Distribution of Resource Consumption Across Activity Cost Pools Factory utilities Indirect labor Product S8 Product F1 Total $ 33,100 $ 11,700 Sales (total) Direct materials (total) Direct labor (total) Processing 0.30 0.30 MHS 3,000 7,100 10,100 Setting Up 0.30 0.10 Batches 1,000 500 1,500 Product S8 $ 65,800 $ 21,700 $ 27,300 Other 0.40 0.60 Product F1 $ 98,600 $ 34,700 $ 41,200 Required: a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 12E: Activity cost pools, activity rates, and product costs using activity-based costing Caldwell Home...

Related questions

Question

Subject - account

Please help me.

Thankyou.

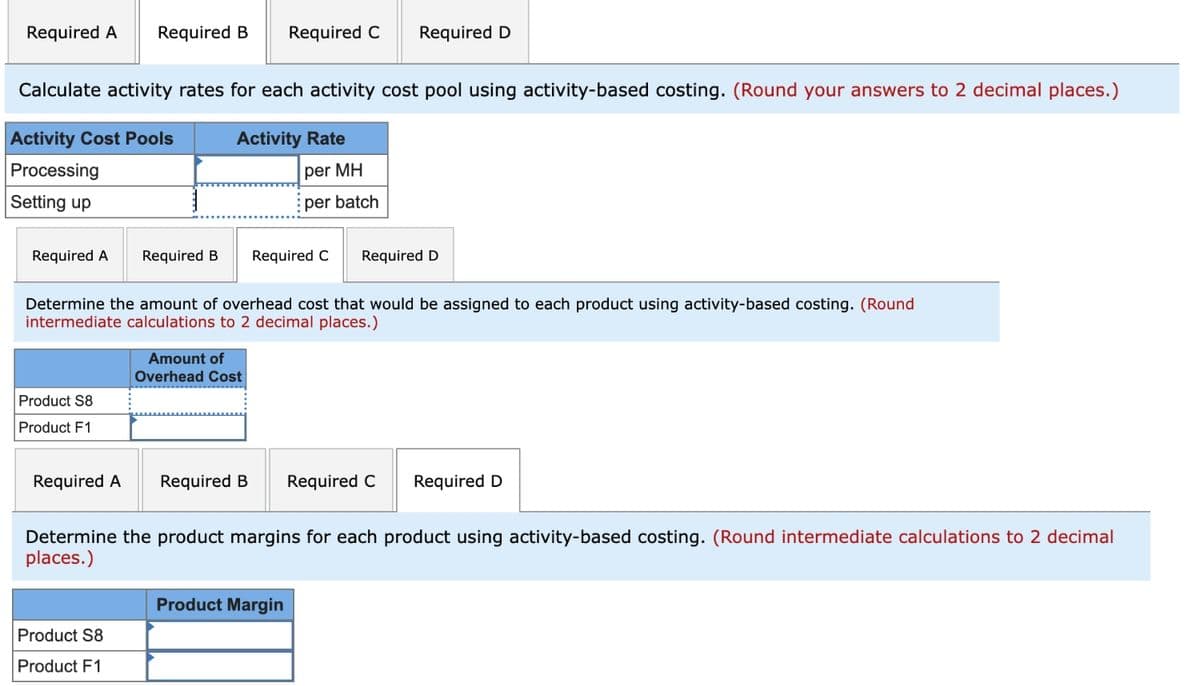

Transcribed Image Text:Required A Required B Required C Required D

Calculate activity rates for each activity cost pool using activity-based costing. (Round your answers to 2 decimal places.)

Activity Cost Pools

Activity Rate

Processing

Setting up

Required A Required B

Product S8

Product F1

Determine the amount of overhead cost that would be assigned to each product using activity-based costing. (Round

intermediate calculations to 2 decimal places.)

Amount of

Overhead Cost

per MH

per batch

Required C Required D

Product S8

Product F1

Required A Required B Required C

Determine the product margins for each product using activity-based costing. (Round intermediate calculations to 2 decimal

places.)

Product Margin

Required D

Transcribed Image Text:Groleau Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The

company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the

activity cost pools' consumption of resources. Costs in the Processing cost pool are assigned to products based on machine-hours

(MHS) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool

are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear

below:

Factory utilities (total)

Indirect labor (total)

Distribution of Resource Consumption Across Activity Cost Pools

Setting Up

0.30

0.10

Factory utilities

Indirect labor

Product S8

Product Fl

Total

Sales (total)

Direct materials (total)

Direct labor (total)

$ 33,100

$ 11,700

Processing

0.30

0.30

MHS

3,000

7,100

10,100

Batches

1,000

500

1,500

Product S8

$ 65,800

$ 21,700

$ 27,300

Other

0.40

0.60

Product Fl

$ 98,600

$ 34,700

$ 41,200

Required:

a. Assign overhead costs to activity cost pools using activity-based costing.

b. Calculate activity rates for each activity cost pool using activity-based costing.

c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

d. Determine the product margins for each product using activity-based costing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,