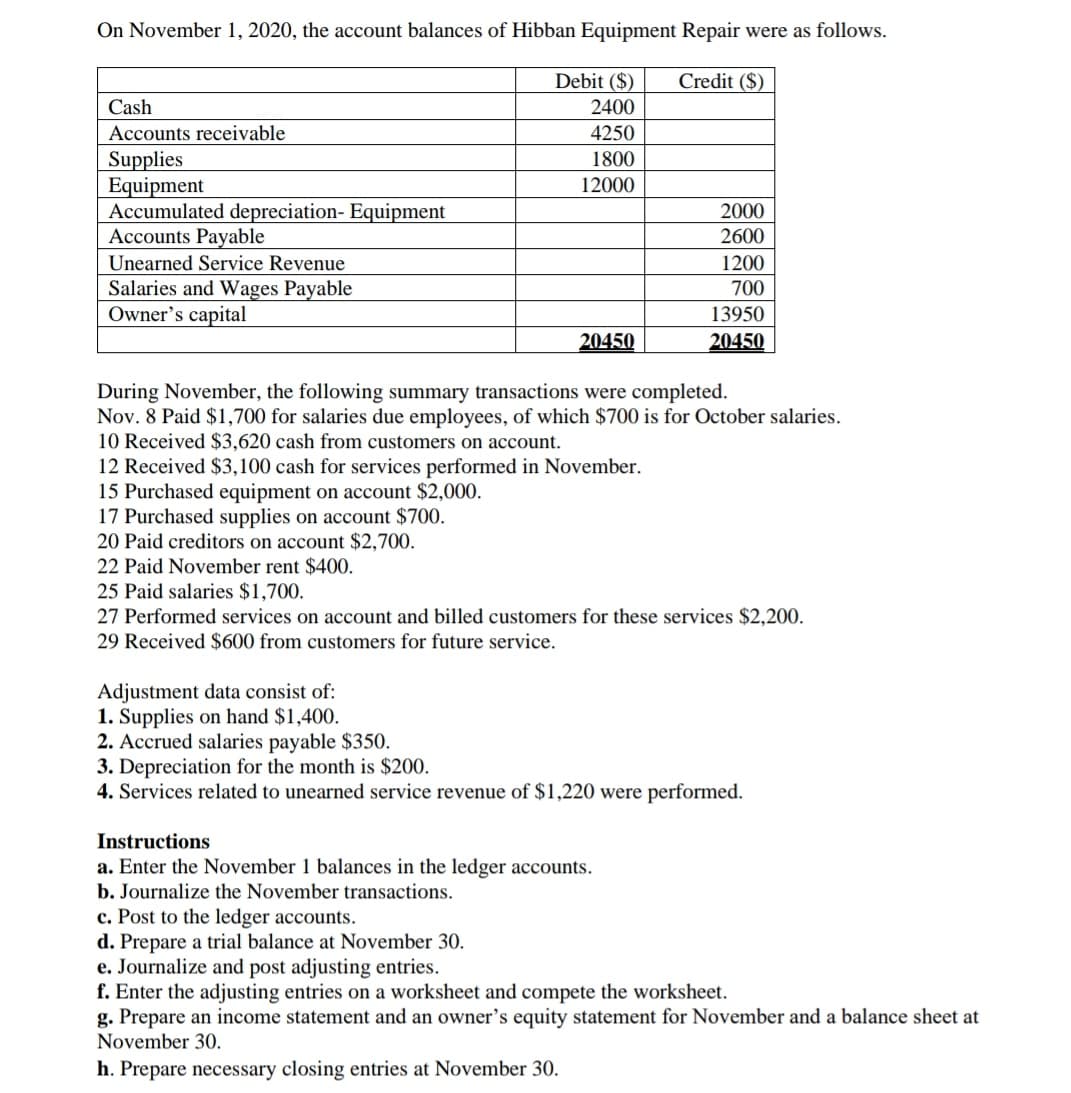

On November 1, 2020, the account balances of Hibban Equipment Repair were as follows. Debit ($) 2400 Credit ($) Cash Accounts receivable 4250 Supplies Equipment Accumulated depreciation- Equipment Accounts Payable 1800 12000 2000 2600 Unearned Service Revenue 1200 Salaries and Wages Payable Owner's capital 700 13950 20450 20450 During November, the following summary transactions were completed. Nov. 8 Paid $1,700 for salaries due employees, of which $700 is for October salaries. 10 Received $3,620 cash from customers on account. 12 Received $3,100 cash for services performed in November. 15 Purchased equipment on account $2,000. 17 Purchased supplies on account $700. 20 Paid creditors on account $2,700. 22 Paid November rent $400. 25 Paid salaries $1,700. 27 Performed services on account and billed customers for these services $2,200. 29 Received $600 from customers for future service. Adjustment data consist of: 1. Supplies on hand $1,400. 2. Accrued salaries payable $350. 3. Depreciation for the month is $200. 4. Services related to unearned service revenue of $1,220 were performed. Instructions a. Enter the November 1 balances in the ledger accounts. b. Journalize the November transactions. c. Post to the ledger accounts.

On November 1, 2020, the account balances of Hibban Equipment Repair were as follows. Debit ($) 2400 Credit ($) Cash Accounts receivable 4250 Supplies Equipment Accumulated depreciation- Equipment Accounts Payable 1800 12000 2000 2600 Unearned Service Revenue 1200 Salaries and Wages Payable Owner's capital 700 13950 20450 20450 During November, the following summary transactions were completed. Nov. 8 Paid $1,700 for salaries due employees, of which $700 is for October salaries. 10 Received $3,620 cash from customers on account. 12 Received $3,100 cash for services performed in November. 15 Purchased equipment on account $2,000. 17 Purchased supplies on account $700. 20 Paid creditors on account $2,700. 22 Paid November rent $400. 25 Paid salaries $1,700. 27 Performed services on account and billed customers for these services $2,200. 29 Received $600 from customers for future service. Adjustment data consist of: 1. Supplies on hand $1,400. 2. Accrued salaries payable $350. 3. Depreciation for the month is $200. 4. Services related to unearned service revenue of $1,220 were performed. Instructions a. Enter the November 1 balances in the ledger accounts. b. Journalize the November transactions. c. Post to the ledger accounts.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 10DQ

Related questions

Question

You shoud slove the qustion which is given in picture.

Thank you in advance.

Transcribed Image Text:On November 1, 2020, the account balances of Hibban Equipment Repair were as follows.

Debit ($)

Credit ($)

Cash

2400

Accounts receivable

4250

Supplies

Equipment

Accumulated depreciation- Equipment

Accounts Payable

1800

12000

2000

2600

1200

Unearned Service Revenue

Salaries and Wages Payable

Owner's capital

700

13950

20450

20450

During November, the following summary transactions were completed.

Nov. 8 Paid $1,700 for salaries due employees, of which $700 is for October salaries.

10 Received $3,620 cash from customers on account.

12 Received $3,100 cash for services performed in November.

15 Purchased equipment on account $2,000.

17 Purchased supplies on account $700.

20 Paid creditors on account $2,700.

22 Paid November rent $400.

25 Paid salaries $1,700.

27 Performed services on account and billed customers for these services $2,200.

29 Received $600 from customers for future service.

Adjustment data consist of:

1. Supplies on hand $1,400.

2. Accrued salaries payable $350.

3. Depreciation for the month is $200.

4. Services related to unearned service revenue of $1,220 were performed.

Instructions

a. Enter the November 1 balances in the ledger accounts.

b. Journalize the November transactions.

c. Post to the ledger accounts.

d. Prepare a trial balance at November 30.

e. Journalize and post adjusting entries.

f. Enter the adjusting entries on a worksheet and compete the worksheet.

g. Prepare an income statement and an owner's equity statement for November and a balance sheet at

November 30.

h. Prepare necessary closing entries at November 30.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning