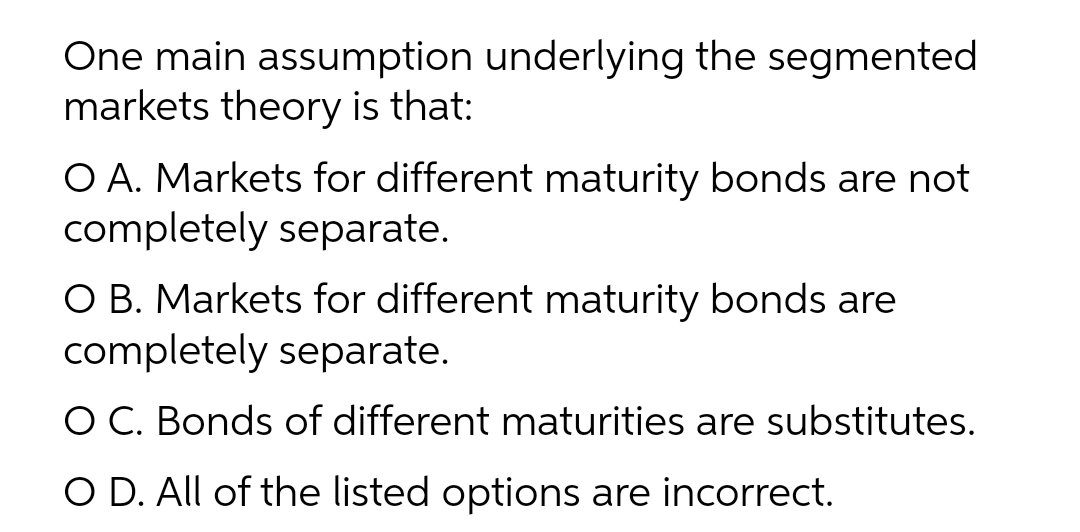

One main assumption underlying the segmented markets theory is that: O A. Markets for different maturity bonds are not completely separate. O B. Markets for different maturity bonds are completely separate. O C. Bonds of different maturities are substitutes. O D. All of the listed options are incorrect.

Q: To achieve the potential gains from international trade, O A. Brazil should produce both quinoa and…

A: Cross-national economic exchanges are referred to as international trade. Consumer commodities, such…

Q: How to allocate limited resources to their best use is the very first and fundamental principle that…

A: Resource allocation based on best practices: 1. Get a realistic picture of demand and delivery…

Q: . The CIT School of Engineering needs P20,000,000.00 to pay for the building renovation in 6 years.…

A: A sum of money today is worth more than a sum of money in the future, according to the notion of…

Q: __________ When fresh vegetables are shipped to Oklahoma from Mexico, which utility is added?a.…

A: The total satisfaction that a consumer receives from the consumption of an item or service is…

Q: Mr. Lopez is planning for her retired life. She has 10 more years of service. He would like to…

A: *Answer:

Q: (b) Define the followings: (i) Industrial Relations; (ii) Total Worker; (iii) Enlightened Trade…

A: i) Industrial relations is a multidisciplinary academic aspect that studies the employment…

Q: 1. Suppose a constant cost, perfectly competitive industry is composed of identical fims where the…

A: Introduction We have given a perfectly competitive industry. a) Supply of the firm is given as: SC…

Q: Is the following true, false or uncertain? Assume that workers supply effort based on their…

A: Governments use contractionary fiscal policy to reduce government expenditure or raise taxes.These…

Q: Jumbo Enterprises is the sole producer of jumbo jets in the economy. Demand for jets is given by…

A:

Q: Income inequality is not good for economic development for the reason that _______. a. Income…

A: In economics, income inequality refers to a large gap in income distribution across people, groups,…

Q: can someone pls explain if marginal product function (i.) and (ii) are either convex or concave?…

A: Production function represents the technological relationship between input ( labour and capital )…

Q: a) The construction of a beach-front resort has led to erosion of the seabed, destruction of corals…

A: Hi! Thank you for the question As per the honor code, We’ll answer the first question since the…

Q: 5.4 In theory, what is the slope (value) of the indifference curve at Mrs. Bain's utility…

A: Answer (5.4) The slope of the indifference curve is called the marginal rate of substitution, which…

Q: Mandatory outlays a) cannot be altered once they are made into law. O b) require changes in existing…

A: The federal funds can be divided into mandatory outlays, and discretionary outlays. The mandatory…

Q: In a market economy, the compensation of labour is determined by the interaction of demand and…

A: A market economy is a type of economic system where the economy is regulated by demand and supply…

Q: Which of the following is true about BRIC countries: O a. There is low prospects of growth O b. To…

A: BRICS is an abbreviation for the strong gathering of the world's driving developing business sector…

Q: Consider the game shown below. In this game, players 1 and 2 must move at the same time without…

A: In the mentioned question both players plays their game together and get their best payoff.

Q: Consider the two-period household-maximization model discussed in class. The model is modified in…

A: Representative household refers to the unit of households representing the entire economy. This…

Q: A marginal tax rate is a) the tax rate paid on a worker's next dollar of income. O b) the total tax…

A: Marginal Tax Rate : The Marginal tax rate can be defined as the the tax rate that is applicable for…

Q: 5.3 What is the slope (value) of Mrs. Bain budget line? 5.4 In theory, what is the slope (value) of…

A: Marginal rate of substitution (MRS): - it is the rate that shows the number of units of one good…

Q: 2. The following table depicted a computer manufacturer's total cost of producing computer: Quantity…

A: Quantity Price (TC) FC VC AVC ATC MC 0 500000 500000 0 0 0 0 1 540000 500000 40000 40000 540000…

Q: 7). Spending promises made by govemments that are effectively a debt despite the fact that they are…

A: Hi! Thank you for the question As per the honor code, We’ll answer the first question since the…

Q: consumer

A: In an economy, the business cycle is used to explain the changes behavior of the market in a…

Q: n asset that is book-depreciated over a 5-year period by the straight line method has C3 = P…

A: Depreciation charge per year = P1,170,000 Life of asset = 5 years Book value after 3 year =…

Q: A firm purchased 12-years ago a computerized machine worth P 645214. As the life of the machine was…

A: in this question:- A firm purchased 12-years ago a computerized machine and this machine worth P…

Q: In order to produce 100 oatmeat cookies, GoodieCookieco inous an average total cost of 025 per cooke…

A: "Total cost in economics is the cost which the firm incur to produce a certain units of output."

Q: draw the marginal and average cost curves of companies p and q where Firm p: Cost= 4Q Firm q: Cost =…

A: Answer - Average Cost = Average cost is cost per unit Marginal cost = It is the cost a firm…

Q: Aside from advertising, how can monopolistically competitive firms increase demand for their…

A: Dear Student, as you have posted multiple questions but according to the policies and guidelines of…

Q: Number of Total Costs of Total Benefits from Total Costs of Total Benefits from Hours Production…

A: The cost that depicts the change in total cost with respect to change in total quantity is being…

Q: Mark sold his house. In addition to cash, he took a mortgage on the house. The mortgage will be paid…

A: Monthly payments of P12, 345, for 10 years interest rate = 1% time in months = 10*12 = 120 months

Q: 1. Use the following information from a fictional economy: Consumption,C = 250 + 0.8 Yd Investment,…

A:

Q: Economic development is unsuccessful to stabilize population growth in LDCs because of certain…

A: The increase in the number of human beings On the planet is known as population growth.Our…

Q: In the game shown below, Player 1 can move Up or Down, and Player 2 can move Left or Right. The…

A: Given date , In the game shown below ,Player 1 can move up or down, and player 2 can move left or…

Q: Matt's utility over consumption of goods 1, 2, 3, and 4 is given by u (21, 12, x3, x4) = min {x1,…

A: We have utility function of x1, x2 x3 and x4. And amount of (x1, x2, x3, x4) =(1, 2, 3, 4)

Q: Which of the following is an example of an excise tax? O a) cigarette tax O b) social insurance tax…

A: Excise tax is the tax which consumers don't pay directly to the government. It is an indirect tax.

Q: If the marginal propensity to save is low a. The spending multiplier will be reduced b.…

A: In an economy, the marginal propensity to save refers to the amount of additional income that is…

Q: Rational expectations theory sees errors in predicting inflation as O a) beneficial. b) random. O)…

A: Inflation means the rate of rising prices during a particular time period.

Q: What seasonal adjustment factor would you recommend be used in making future June forecasts? 5.5% O…

A:

Q: 1. Use the following information from a fictional economy: Consumption,C= 250 + 0.8 Yd Investment, I…

A:

Q: Indicate which of these are a reason that market inefficiencies persist? Check all that apply.…

A: Market efficiency explains the ability of the firms to generate output from the available resources.…

Q: Suppose you take a 15-year mortgage for a house that costs $208,556. Assume the following: • The…

A: Annual interest rate (r) = 3.9% Minimum down payment = 10% of 208,556 =10100×208,556=20,855.6…

Q: has the greatest advantage of lower cost labor, regional suppliers, and local knowledge when making…

A: A strategy where greatest advantage of lower-cost labor, regional suppliers, and local knowledge is…

Q: 11. In which market structure will a firm choose to stay in business (i.e. not shut down) when P<AVC…

A:

Q: Contractionary fiscal policy occurs when the a) government decreases spending or decreases taxes to…

A: The use of the government spending and the tax policies to impact economic circumstances, notably…

Q: 10.)Suppose that Jacques, Julia, Cat, and Guy are potential suppliers of catering services for…

A: 10) Given Information, Suppose that Jacques, Julia, Cat, and Guy are potential suppliers of catering…

Q: An air-conditioning part has a unit selling price of P55, variable cost of P30 per unit and total…

A: Break even point refers to a point at which the total cost of production is equal to the total…

Q: Beta's Price Policy High Low A $20 B $30 High $20 $10 Alpha's Price Policy C $10 D $15 Low $30 $15…

A: Given the game

Q: True or false question below. In the United States, the Federal Deposit Insurance Corporation…

A: Federal Deposit Insurance Corporation, is an agency created in 1933 after great depression to…

Q: 1. When Lorenz curves are __________. a. more curved the greater is the degree of income inequality…

A: The Lorenz curve is the graphical representation of the inequality in the economy. The graph…

Q: Last year you bought a house for $200,.000, and you sell the house this year for $230.000,…

A: Answer; 1) inflation = (115.5/110) - 1 = 0.05 or 5% Capital gain = 230000-200000 = 30000 Tax on gain…

Step by step

Solved in 2 steps

- . Wood, the receiver of Stanton Oil Company, suedStanton’s shareholders to recover dividends paid to themfor three years, claiming that at the time these dividendswere declared, Stanton was in fact insolvent. Wood didnot allege that the present creditors were also creditorswhen the dividends were paid. Were the dividendswrongfully paid? ExplainDeacon Corporation has just announced its intent to undertake a three-for-one stock split at the end of the next quarter. How will this announcement most likely affect trading activity for Deacon shares? O Investors will likely show increased interest in purchasing Deacon shares, thus leading to an increase in the current price per share. Investors will likely start dumping Deacon shares, thus leading to a decrease in the current price per share. Investors will likely be indifferent to the announcement, and Deacon's share price and trading volume will remain at their current levels. O Investors will likely begin to show a strong preference for purchasing odd lots of the firm's shares, thus leading to a decline in the price of round lots. eTextbook and Media1. When the price of the underlying financial instrument exceeds the exercise [strike] price of a call option, the option is said to be: *a. ripe for a put.b. out of the running.c. in the money.d. dead on the money. 2. An option that gives the holder the right to sell a stock at a specified price at some time in the future is called a (n) *a. Put optionb. Covered optionc. Out of the money optiond. Call option 3. When a company proposes to issue its shares to its existing shareholders, it is called a (n) *a. Rights issueb. Initial public offeringc. Private placementd. Secondary issuance

- A Company's stock currently pays a dividend of $5 dollars per year and you expect that dividend to grow by 3% every year, forever, such that next year you expect the dividend to be 5.15, to be 5.3045 the year after that, and so on. If your discount rate is 9%, a fair price for this stock today is_____.If your discount rate were to fall to 7%, holding all else the same, the fair price of the stock would increase to_________.AIR, an airline company, used to deal only in derivatives of futures and swaps to hedge its jet fuel market risk. However, in the mid2003, AIR started trading in speculative derivative options and took a bullish view of the jet fuel market.The company predicted correctly but by the end of 2003, AIR revised its strategy to a bearish stance.The CEO signed contracts with several banks, buying put options and selling call options, but the prices soared above the strike priceof the call, and AIR faced a large deficit.1. Explain how AIR could have floored the losses through an adequate risk management procedureDespite mark to market losses of $30 million by mid 2004, the CEO increased AIR exposure.In addition, the trading was not disclosed in the financial statements, and AIR accounted for the options at intrinsic value, ignoringthe time value component.From March 2003, AIR started trading options on its own account.AIR was unable to meet some of the margin calls, resulting in the company…- Could you give further explanation in the meaning of "Min(X-S,0)" in Profit from Call Option equation & "Max(X-S,0)" in Profit from Put Option equation above for who has little basic concept of option and stock? - What's make investor decide to short option because I see that short position has more chance to loss the money, what's occur before between open long status and short status in the same strike price? - What's called spot price? $42 or $43

- A buyer or seller must consider a number of risks when evaluating whether a long-term contract is necessary or even desirable. Three primary questions must be asked when developing a long-term contract and considering the risks: What is the potential for opportunism? In other words, how likely is the supplier to take advantage of the purchaser (or vice versa)? Is this the right supplier to engage in a long-term contract? C.Is there a fair distribution of risk and gains between the parties involved?Are derivatives similar to insurance in that both have an indefinite life spans, allow for the transfer of risk from one party to another or allow for the transformation of the underlying risk itself? First explain why one or more of the options above are correct. Secondly explain why, if any of the remaining options are incorrect. Your justification/s should be one sentence for each of the points above, in bullet point format.QUESTION 8 Consider the market for a bond which has a face value of $2,000, pays a coupon of $100, and matures in 1 year (that is, you will get the face value and one coupon payment next year). Suppose the orignal demand for such bonds is given by P=4,000-2Q, and that the supply of such bonds is given by P=1,000+Q. Keeping this supply curve fixed, suppose the demand curve next year will be given by P=3,400-2Q. What would be my rate of return if I bought the bond at the equilibrium price today and sold it at the equilibrium price tomorrow? 5% -.05% 10% -5%

- As and example of a possible investment restriction, an insurer mah only be allowed to invest up to 20 percent of its assets in common stock. What penalty is imposed upon the insurer that invests 30 percent of available assets in common stock?A. The additional 10 percent must be disposed of by year endB. The state regulators would impose a 10 percent fine on the insurer.C. The additional 10 percent would be a nonadmitted asset.D. The additional 10 percent would only be listed at cost.6. Risk-averse people will choose different asset portfolios than people who are not risk averse. Over a long period of time, we would expect thatA.every risk-averse person will earn a higher rate of return than every non-risk averse person.B.every risk-averse person will earn a lower rate of return than every non-risk averse person.C.the average risk-averse person will earn a higher rate of return than the average non-risk averse person.D.the average risk-averse person will earn a lower rate of return than the average non-risk averse person. 7.The real exchange rate equals the relative A.price of domestic and foreign currency.B.price of domestic and foreign goods.C.rate of domestic and foreign interest. D.None of the above is correct. 8.According to the theory of liquidity preference, an increase in the price level causes theA.interest rate and investment to rise.B.interest rate and investment to fall.C.interest rate to rise and investment to fall.D.interest rate to fall and…Suppose that instead Einar short sells 200 shares of German Power Weak Inc. at $40 each. NASDUCK now sets a margin requirement of 30%.(e) How much cash does Einar need to invest?(f) Calculate the margin call of NASDUCK if the price increases to $44.(g) Suppose the price falls to $25. How much cash can Einar take out from his margin account?(h) Suppose he takes out 50% of the amount in part (g). At what price threshold will Einar face a margin call by NASDUCK?