Ox1. The folowing information nas been extracted from the company's accounting records: All sales are on account. Sixty percent of customer accounts are collected in the month of sale; 35 percent are collected in the following month. Uncollectibles amounting to 5 percent of sales are anticipated, and management believes that only 20 percent of the accounts outstanding on December 31, 20x0, will be recovered and that the recovery will be in January 20x1. Seventy percent of the merchandise purchases are paid for in the month of purchase; the remaining 30 percent are paid for in the month after acquisition. The December 31, 20x0, balance sheet disclosed the following selected figures: cash, $80,000; accounts receivable, $225,000; and accounts payable, $78,000. Mary and Kay, Inc., maintains a $80,000 minimum cash balance at all times. Financing is available (and retired) in $1,000 multiples at an 10 percent interest rate, with borrowings taking place at the beginning of the month and repayments occurring at the end of the month. Interest is paid at the time of repaying principal and computed on the portion of principal repaid at that time. Additional data: January $570,000 390,000 105,000 February $660,000 420,000 84,000 March $675,000 540,000 147,000 27,000 Sales revenue Merchandise purchases Cash operating costs Proceeds from sale of equipment equired: Prepare a schedule that discloses the firm's total cash collections for January through March. . Prepare a schedule that discloses the firm's total cash disbursements for January through March. . Prepare a schedule that summarizes the firm's financing cash flows for January through March.

Ox1. The folowing information nas been extracted from the company's accounting records: All sales are on account. Sixty percent of customer accounts are collected in the month of sale; 35 percent are collected in the following month. Uncollectibles amounting to 5 percent of sales are anticipated, and management believes that only 20 percent of the accounts outstanding on December 31, 20x0, will be recovered and that the recovery will be in January 20x1. Seventy percent of the merchandise purchases are paid for in the month of purchase; the remaining 30 percent are paid for in the month after acquisition. The December 31, 20x0, balance sheet disclosed the following selected figures: cash, $80,000; accounts receivable, $225,000; and accounts payable, $78,000. Mary and Kay, Inc., maintains a $80,000 minimum cash balance at all times. Financing is available (and retired) in $1,000 multiples at an 10 percent interest rate, with borrowings taking place at the beginning of the month and repayments occurring at the end of the month. Interest is paid at the time of repaying principal and computed on the portion of principal repaid at that time. Additional data: January $570,000 390,000 105,000 February $660,000 420,000 84,000 March $675,000 540,000 147,000 27,000 Sales revenue Merchandise purchases Cash operating costs Proceeds from sale of equipment equired: Prepare a schedule that discloses the firm's total cash collections for January through March. . Prepare a schedule that discloses the firm's total cash disbursements for January through March. . Prepare a schedule that summarizes the firm's financing cash flows for January through March.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter9: Profit Planning And Flexible Budgets

Section: Chapter Questions

Problem 72P: Cash Budget The controller of Feinberg Company is gathering data to prepare the cash budget for...

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

Could you please help me with the calcultions and the correct answers for required 1 and required 3.

Thanks!

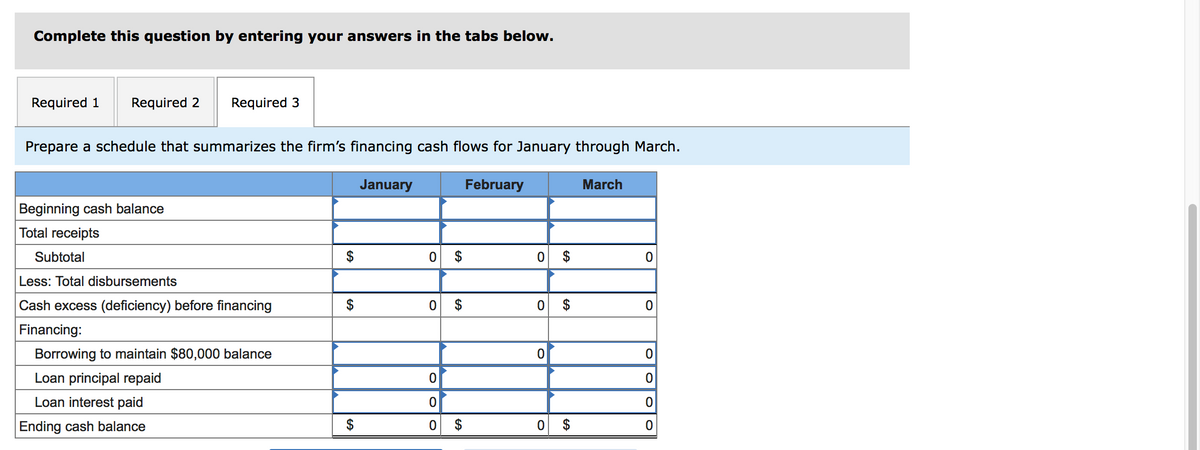

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Prepare a schedule that summarizes the firm's financing cash flows for January through March.

January

February

March

Beginning cash balance

Total receipts

Subtotal

$

0 $

이 $

Less: Total disbursements

Cash excess (deficiency) before financing

O $

Financing:

Borrowing to maintain $80,000 balance

Loan principal repaid

Loan interest paid

Ending cash balance

$

$

이 $

olo

Transcribed Image Text:Check my

work

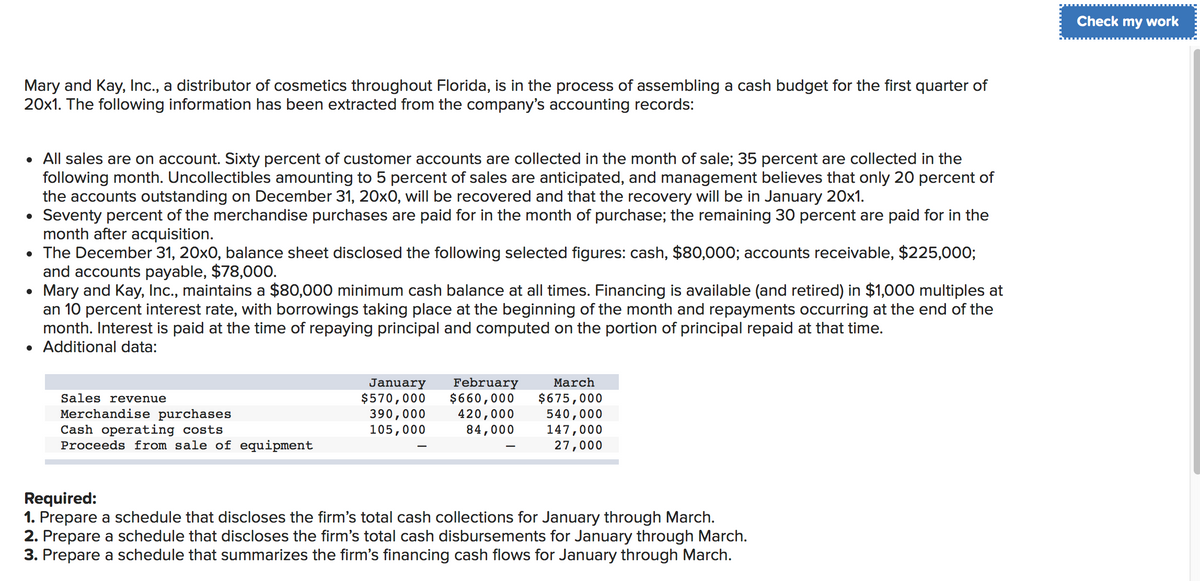

Mary and Kay, Ic., a distributor of cosmetics throughout Florida, is in the process of assembling a cash budget for the first quarter of

20x1. The following information has been extracted from the company's accounting records:

• All sales are on account. Sixty percent of customer accounts are collected in the month of sale; 35 percent are collected in the

following month. Uncollectibles amounting to 5 percent of sales are anticipated, and management believes that only 20 percent of

the accounts outstanding on December 31, 20x0, will be recovered and that the recovery will be in January 20x1.

Seventy percent of the merchandise purchases are paid for in the month of purchase; the remaining 30 percent are paid for in the

month after acquisition.

• The December 31, 20x0, balance sheet disclosed the following selected figures: cash, $80,000; accounts receivable, $225,000;

and accounts payable, $78,000.

• Mary and Kay, Inc., maintains a $80,000 minimum cash balance at all times. Financing is available (and retired) in $1,000 multiples at

an 10 percent interest rate, with borrowings taking place at the beginning of the month and repayments occurring at the end of the

month. Interest is paid at the time of repaying principal and computed on the portion of principal repaid at that time.

• Additional data:

January

$570,000

390,000

105,000

February

$660,000

420,000

84,000

March

Sales revenue

Merchandise purchases

Cash operating costs

Proceeds from sale of equipment

$675,000

540,000

147,000

27,000

Required:

1. Prepare a schedule that discloses the firm's total cash collections for January through March.

2. Prepare a schedule that discloses the firm's total cash disbursements for January through March.

3. Prepare a schedule that summarizes the firm's financing cash flows for January through March.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

How is the beginning cash balance 410,925 in March?

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning