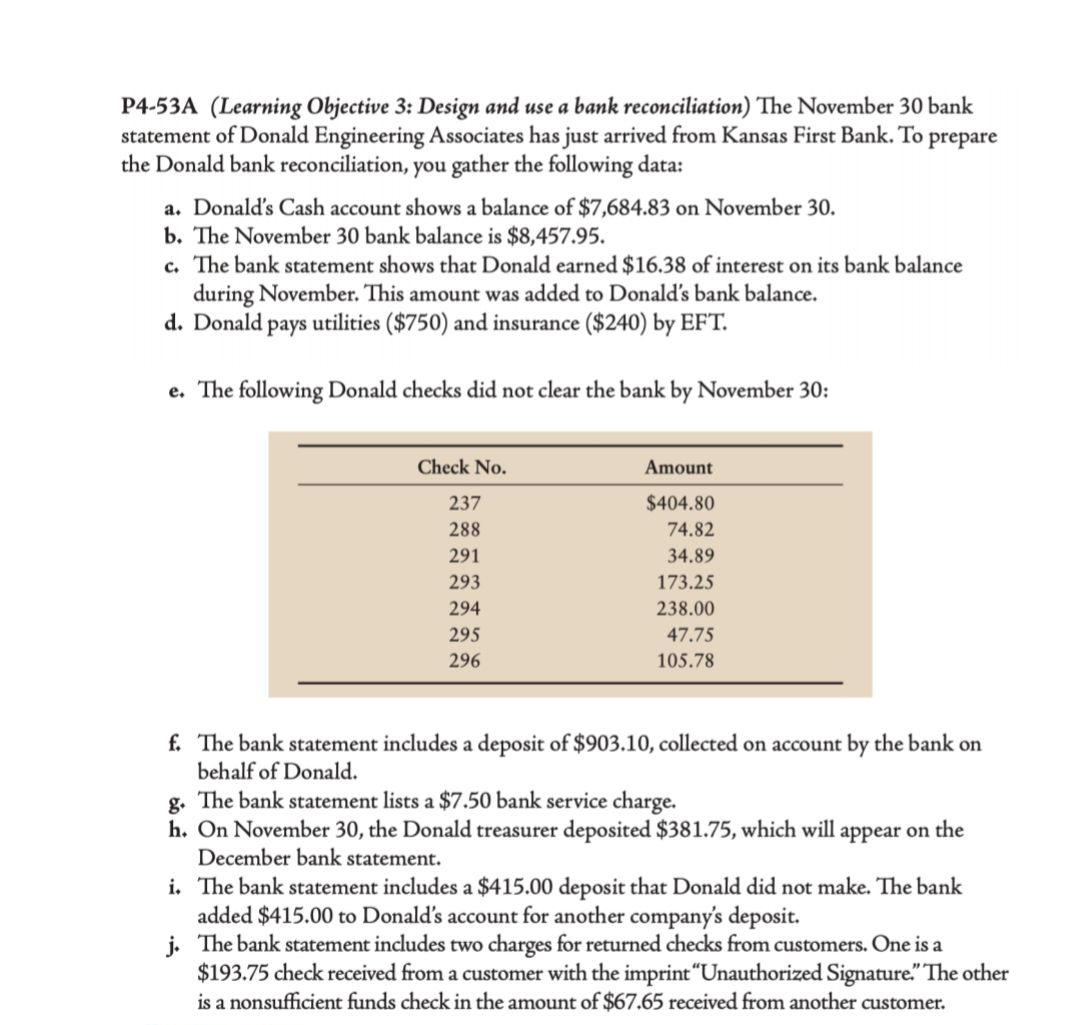

P4.4B The August 31 bank statement of Palm Harbor Apartments has just arrived from Florida First Bank To prepare the Palm Harbor bank reconciliation, your gather the following data: a Palm Harbor's Cash account shows a balance of $3,366.14 on August 31 b. The August 31 bank balance is $4,484 22 E The bank statement shows that Palm Harbor earned $38 19 of interest on its bank bal- ance during August. This amount was added to Palm Harbors bank balance d. Palm Harbor pays utilities ($750) and insurance ($290) by EFT e. The following Palm Harbor checks did not clear the bank by August 31 Check No. Amount 237 $ 46.10 288 141 00 291 293 578.05 11.87 609 51 294 8.88 295 296 101 63 * The bank statement includes a deposit of $891.17, collected by the bank on behalf of Paim Harbor Apartments Of the total, $811 81 is collection of a note receivable, and the remainder is interest revenue. * The bank statement lists a $10.50 bank service charge OAugust 31, the Palm Harbor treasurer deposited S16.15, which will appeat cn the September bank statement. bank statement includes a $300 00 deposit that Palm Harbor did not make The bank credited Palm Harbor for another companys deposit I The bank statement includes two charges for returned checks fron customers. One isa $395.00 check received from a customer with the imprint "Unauthortzed Signarure *The other is a nonsufficient funds check in the amount of $146.67 received from another customer.

P4.4B The August 31 bank statement of Palm Harbor Apartments has just arrived from Florida First Bank To prepare the Palm Harbor bank reconciliation, your gather the following data: a Palm Harbor's Cash account shows a balance of $3,366.14 on August 31 b. The August 31 bank balance is $4,484 22 E The bank statement shows that Palm Harbor earned $38 19 of interest on its bank bal- ance during August. This amount was added to Palm Harbors bank balance d. Palm Harbor pays utilities ($750) and insurance ($290) by EFT e. The following Palm Harbor checks did not clear the bank by August 31 Check No. Amount 237 $ 46.10 288 141 00 291 293 578.05 11.87 609 51 294 8.88 295 296 101 63 * The bank statement includes a deposit of $891.17, collected by the bank on behalf of Paim Harbor Apartments Of the total, $811 81 is collection of a note receivable, and the remainder is interest revenue. * The bank statement lists a $10.50 bank service charge OAugust 31, the Palm Harbor treasurer deposited S16.15, which will appeat cn the September bank statement. bank statement includes a $300 00 deposit that Palm Harbor did not make The bank credited Palm Harbor for another companys deposit I The bank statement includes two charges for returned checks fron customers. One isa $395.00 check received from a customer with the imprint "Unauthortzed Signarure *The other is a nonsufficient funds check in the amount of $146.67 received from another customer.

Required 1. Prepare the bank reconciliation for Palm Harbor Apartments. 2. Journalize the August 31 transactions needed to update Palm Harbor's Cash account. Include an explanation for each entry. 3. How will your learning from solving this problem help you manage a business?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps