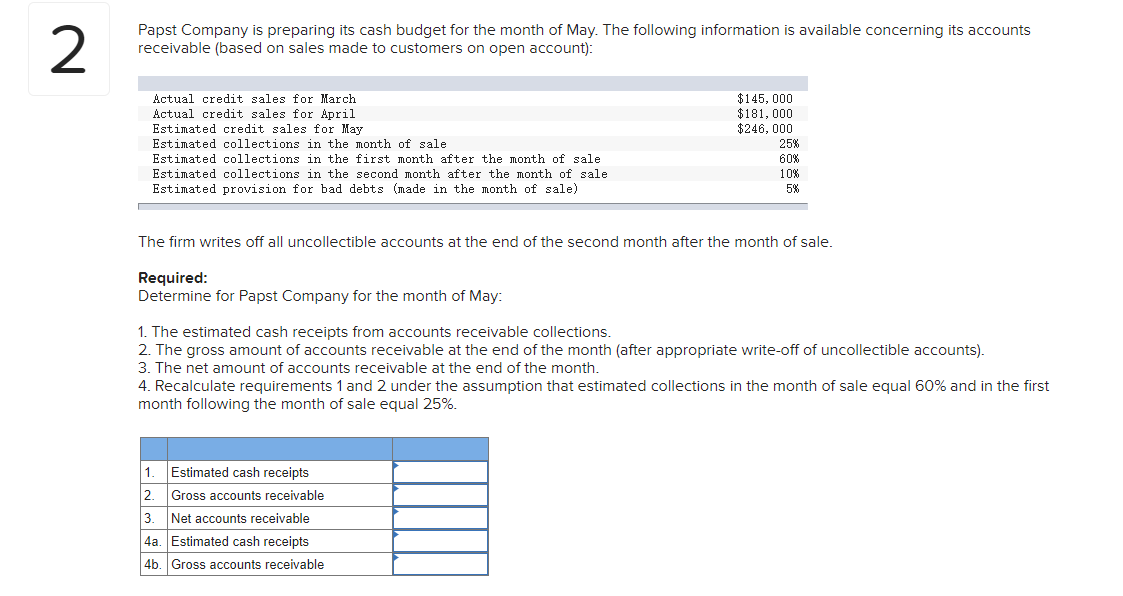

Papst Company is preparing its cash budget for the month of May. The following information is available concerning its accounts receivable (based on sales made to customers on open account): $145, 000 $181, 000 $246, 000 25% 60% 10% 5% Actual credit sales for March Actual credit sales for April Estimated credit sales for May Estimated collections in the month of sale Estimated collections in the first month after the month of sale Estimated collections in the second month after the month of sale Estimated provision for bad debts (made in the month of sale) The firm writes off all uncollectible accounts at the end of the second month after the month of sale. Required: Determine for Papst Company for the month of May: 1. The estimated cash receipts from accounts receivable collections. 2. The gross amount of accounts receivable at the end of the month (after appropriate write-off of uncollectible accounts). 3. The net amount of accounts receivable at the end of the month. 4. Recalculate requirements 1 and 2 under the assumption that estimated collections in the month of sale equal 60% and in the first month following the month of sale equal 25%. 1. Estimated cash receipts 2. Gross accounts receivable 3. Net accounts receivable 4a. Estimated cash receipts 4b. Gross accounts receivable

Papst Company is preparing its cash budget for the month of May. The following information is available concerning its accounts receivable (based on sales made to customers on open account): $145, 000 $181, 000 $246, 000 25% 60% 10% 5% Actual credit sales for March Actual credit sales for April Estimated credit sales for May Estimated collections in the month of sale Estimated collections in the first month after the month of sale Estimated collections in the second month after the month of sale Estimated provision for bad debts (made in the month of sale) The firm writes off all uncollectible accounts at the end of the second month after the month of sale. Required: Determine for Papst Company for the month of May: 1. The estimated cash receipts from accounts receivable collections. 2. The gross amount of accounts receivable at the end of the month (after appropriate write-off of uncollectible accounts). 3. The net amount of accounts receivable at the end of the month. 4. Recalculate requirements 1 and 2 under the assumption that estimated collections in the month of sale equal 60% and in the first month following the month of sale equal 25%. 1. Estimated cash receipts 2. Gross accounts receivable 3. Net accounts receivable 4a. Estimated cash receipts 4b. Gross accounts receivable

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 18E

Related questions

Question

2

Transcribed Image Text:2

Papst Company is preparing its cash budget for the month of May. The following information is available concerning its accounts

receivable (based on sales made to customers on open account):

Actual credit sales for March

Actual credit sales for April

Estimated credit sales for May

$145, 000

$181, 000

$246, 000

Estimated collections in the month of sale

25%

Estimated collections in the first month after the month of sale

60%

Estimated collections in the second month after the month of sale

10%

Estimated provision for bad debts (made in the month of sale)

5%

The firm writes off all uncollectible accounts at the end of the second month after the month of sale.

Required:

Determine for Papst Company for the month of May:

1. The estimated cash receipts from accounts receivable collections.

2. The gross amount of accounts receivable at the end of the month (after appropriate write-off of uncollectible accounts).

3. The net amount of accounts receivable at the end of the month.

4. Recalculate requirements 1 and 2 under the assumption that estimated collections in the month of sale equal 60% and in the first

month following the month of sale equal 25%.

1

Estimated cash receipts

2

Gross accounts receivable

Net accounts receivable

4a. Estimated cash receipts

4b. Gross accounts receivable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College