Parrish 1-3 #1Please find RE 12/31 This is the THIRD time I have had to ask this question! I need the written equation to find this amount. I do not want it put in a table format. What is the equation. Also, what if there is a Net Loss, is that subtracted from RE 1/1? I have had to ask this question three times already. The first time the answer was not clear and the equation was not given in a way that the average person could understand. The second time I was given the wrong equation. Revenues $6000Dividends Declared $1000Expenses $3000RE 1/1 $5000RE 12/231 $UNKNOWN

Parrish 1-3 #1

Please find RE 12/31

This is the THIRD time I have had to ask this question! I need the written equation to find this amount. I do not want it put in a table format. What is the equation.

Also, what if there is a Net Loss, is that subtracted from RE 1/1? I have had to ask this question three times already. The first time the answer was not clear and the equation was not given in a way that the average person could understand. The second time I was given the wrong equation.

Revenues $6000

Dividends Declared $1000

Expenses $3000

RE 1/1 $5000

RE 12/231 $UNKNOWN

The amount of net profit which a business retains with itself for some purpose is called retained earnings. This amount can be used by business for maintaining future dividend payments and for some other reasons.

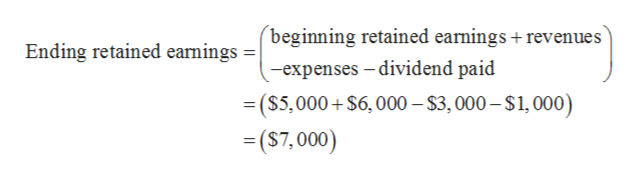

Retained earnings on 31 December is calculated as follows:

Step by step

Solved in 3 steps with 1 images