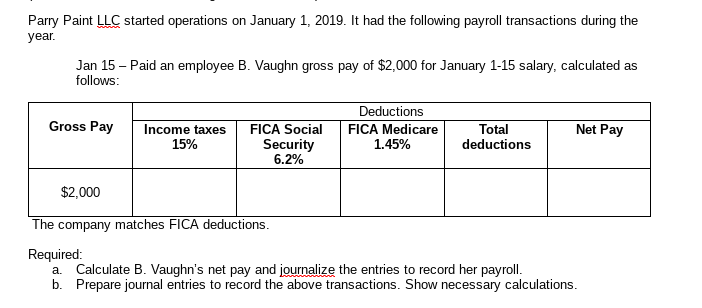

Parry Paint LLC started operations on January 1, 2019. It had the following payroll transactions during the year. Jan 15 - Paid an employee B. Vaughn gross pay of $2,000 for January 1-15 salary, calculated as follows: Deductions FICA Medicare 1.45% Gross Pay Income taxes FICA Social Total deductions Net Pay 15% Security 6.2% $2,000 The company matches FICA deductions. Required: a Calculate B. Vaughn's net pay and journalize the entries to record her payroll. b. Prepare journal entries to record the above transactions. Show necessary calculations.

Parry Paint LLC started operations on January 1, 2019. It had the following payroll transactions during the year. Jan 15 - Paid an employee B. Vaughn gross pay of $2,000 for January 1-15 salary, calculated as follows: Deductions FICA Medicare 1.45% Gross Pay Income taxes FICA Social Total deductions Net Pay 15% Security 6.2% $2,000 The company matches FICA deductions. Required: a Calculate B. Vaughn's net pay and journalize the entries to record her payroll. b. Prepare journal entries to record the above transactions. Show necessary calculations.

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 5E

Related questions

Question

Transcribed Image Text:Parry Paint LLC started operations on January 1, 2019. It had the following payroll transactions during the

year.

Jan 15 - Paid an employee B. Vaughn gross pay of $2,000 for January 1-15 salary, calculated as

follows:

Deductions

FICA Medicare

Gross Pay

Net Pay

Income taxes

15%

FICA Social

Total

deductions

Security

6.2%

1.45%

$2,000

The company matches FICA deductions.

Required:

a. Calculate B. Vaughn's net pay and journalize the entries to record her payroll.

b. Prepare journal entries to record the above transactions. Show necessary calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub