Partially completed T-accounts and additional information for Dumfries Designs for the month of August follow: Materials Inventory Debit Credit BB (8/1) 165,200 682,200 610,200 Work-in-Process Inventory Debit Credit BB (8/1) 307,200 Labor 597,400 Finished Goods Inventory Debit Credit BB (8/1) 589,200 960,800 777,700 Cost of Goods Sold Debit Credit Manufacturing Overhead Control Debit Credit 482,920 Applied Manufacturing Overhead Debit Credit 473,800 Additional information for August follows: The labor wage rate was $29 per hour. During the month, sales revenue was $1,732,000, and selling and administrative costs were $324,800. This company has no indirect materials or supplies. The company applies manufacturing overhead on the basis of direct labor-hours. Required: What was the cost of direct materials issued to production during August? What was the over- or underapplied manufacturing overhead for August? What was the manufacturing overhead application rate in August? What was the cost of products completed during August? What was the balance of the Work-in-Process Inventory account at the end of August? What was the operating profit for August? Any over- or underapplied overhead is written off to Co

Partially completed T-accounts and additional information for Dumfries Designs for the month of August follow: Materials Inventory Debit Credit BB (8/1) 165,200 682,200 610,200 Work-in-Process Inventory Debit Credit BB (8/1) 307,200 Labor 597,400 Finished Goods Inventory Debit Credit BB (8/1) 589,200 960,800 777,700 Cost of Goods Sold Debit Credit Manufacturing Overhead Control Debit Credit 482,920 Applied Manufacturing Overhead Debit Credit 473,800 Additional information for August follows: The labor wage rate was $29 per hour. During the month, sales revenue was $1,732,000, and selling and administrative costs were $324,800. This company has no indirect materials or supplies. The company applies manufacturing overhead on the basis of direct labor-hours. Required: What was the cost of direct materials issued to production during August? What was the over- or underapplied manufacturing overhead for August? What was the manufacturing overhead application rate in August? What was the cost of products completed during August? What was the balance of the Work-in-Process Inventory account at the end of August? What was the operating profit for August? Any over- or underapplied overhead is written off to Co

Chapter5: Process Costing

Section: Chapter Questions

Problem 14PA: Loanstar had 100 units in beginning inventory before starting 950 units and completing 800 units....

Related questions

Question

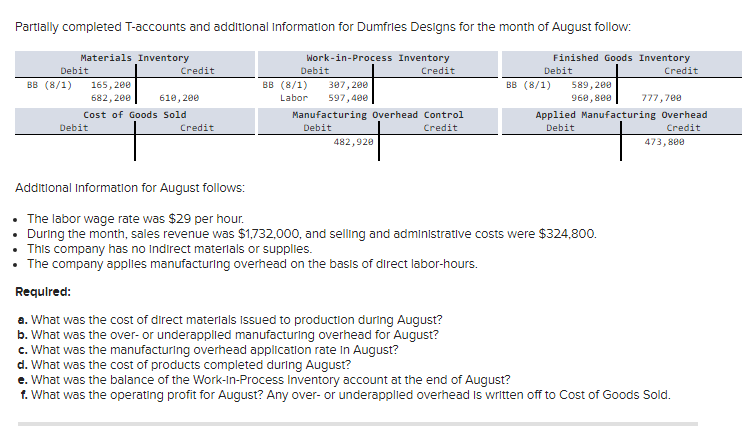

Partially completed T-accounts and additional information for Dumfries Designs for the month of August follow:

| Materials Inventory | |||

|---|---|---|---|

| Debit | Credit | ||

| BB (8/1) | 165,200 | ||

| 682,200 | 610,200 |

| Work-in-Process Inventory | |||

|---|---|---|---|

| Debit | Credit | ||

| BB (8/1) | 307,200 | ||

| Labor | 597,400 |

| Finished Goods Inventory | |||

|---|---|---|---|

| Debit | Credit | ||

| BB (8/1) | 589,200 | ||

| 960,800 | 777,700 |

| Cost of Goods Sold | |||

|---|---|---|---|

| Debit | Credit | ||

| Manufacturing Overhead Control | |||

|---|---|---|---|

| Debit | Credit | ||

| 482,920 | |||

| Applied Manufacturing Overhead | |||

|---|---|---|---|

| Debit | Credit | ||

| 473,800 | |||

Additional information for August follows:

- The labor wage rate was $29 per hour.

- During the month, sales revenue was $1,732,000, and selling and administrative costs were $324,800.

- This company has no indirect materials or supplies.

- The company applies manufacturing overhead on the basis of direct labor-hours.

Required:

-

What was the cost of direct materials issued to production during August?

-

What was the over- or underapplied manufacturing overhead for August?

-

What was the manufacturing overhead application rate in August?

-

What was the cost of products completed during August?

-

What was the balance of the Work-in-Process Inventory account at the end of August?

-

What was the operating profit for August? Any over- or underapplied overhead is written off to Cost of Goods Sold.

Transcribed Image Text:Partially completed T-accounts and additional Information for Dumfries Designs for the month of August follow:

Work-in-Process Inventory

Finished Goods Inventory

Credit

Debit

Credit

Materials Inventory

Debit

BB (8/1)

Credit

165,200

682, 200 610, 200

Cost of Goods Sold

Debit

Credit

Debit

BB (8/1)

307,200

Labor 597,400

Manufacturing Overhead Control

Debit

Credit

482,920

BB (8/1)

589, 200

960,800

777,700

Applied Manufacturing Overhead

Debit

Credit

Additional Information for August follows:

• The labor wage rate was $29 per hour.

During the month, sales revenue was $1,732,000, and selling and administrative costs were $324,800.

This company has no indirect materials or supplies.

The company applies manufacturing overhead on the basis of direct labor-hours.

Required:

a. What was the cost of direct materials issued to production during August?

b. What was the over- or underapplied manufacturing overhead for August?

473,800

c. What was the manufacturing overhead application rate in August?

d. What was the cost of products completed during August?

e. What was the balance of the Work-In-Process Inventory account at the end of August?

f. What was the operating profit for August? Any over- or underapplied overhead is written off to Cost of Goods Sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning