partnership with PYE AND TAUN as partners. Use the information provided to prepare the Statement of changes in equity for the year ended 31 December 2018. Draw this format in your answer book. PT TRADING STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBER 2018 CAPITAL ACCOUNTS PYE TAUN TOTAL Balances on 01 January 2018 Changes during the year December 2018

partnership with PYE AND TAUN as partners. Use the information provided to prepare the Statement of changes in equity for the year ended 31 December 2018. Draw this format in your answer book. PT TRADING STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBER 2018 CAPITAL ACCOUNTS PYE TAUN TOTAL Balances on 01 January 2018 Changes during the year December 2018

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 10P: Comprehensive The shareholders equity section of Superior Corporations balance sheet as of December...

Related questions

Question

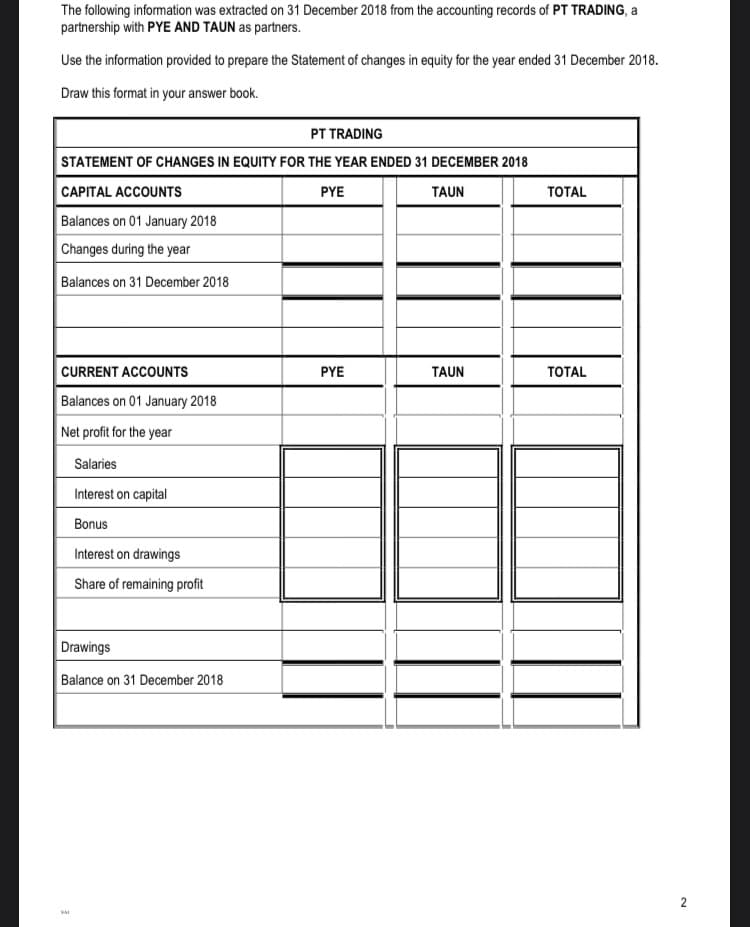

Transcribed Image Text:The following information was extracted on 31 December 2018 from the accounting records of PT TRADING, a

partnership with PYE AND TAUN as partners.

Use the information provided to prepare the Statement of changes in equity for the year ended 31 December 2018.

Draw this format in your answer book.

PT TRADING

STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBER 2018

CAPITAL ACCOUNTS

PYE

TAUN

ТOTAL

Balances on 01 January 2018

Changes during the year

Balances on 31 December 2018

CURRENT ACCOUNTS

PYE

TAUN

ТOTAL

Balances on 01 January 2018

Net profit for the year

Salaries

Interest on capital

Bonus

Interest on drawings

Share of remaining profit

Drawings

Balance on 31 December 2018

2

SAI

![FIN MAN 1B 1O Nove...

INFORMATION:

1.

Balances extracted from the General Ledger on 31 December 2018.

Capital : Pye

Capital : Taun

Current Account : Pye [01 January 2018 ]

Current Account : Taun [31 December 2018 ]

150 000

200 000

10 000 [ DR ]

2 000 [ CR]

Drawings : Pye

180 000

Drawings : Taun

Interest on Drawings : Pye

170 000

3 000

Interest on Drawings : Taun

2 600

2. The Net profit for the year was, R368 000.

3. The partnership agreement makes provision for the following :

Each partner is to receive 16% p.a. interest on their capital.

NB: Both partners had increased their capitals by R50 000 each on 01 July 2018 and was properly documented

and recorded.

Each partner receives a monthly salary as follows:

Pye, R10 000.

Taun, R9 000.

NB: Both partners' salaries were increased by 10% with effect from 01 September 2018.

Pye receives a bonus of R30 000.

Partners are to pay interest on their drawings. The amount due by them has been calculated and recorded by

the bookkeeper.

Partners are to share the remaining profits or losses in the ratio of their capitals at the beginning of the yea

3](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F23bee3c3-10a0-4d5c-864f-18cfedc8704a%2F8e77c9c5-9f86-4d5f-90f2-8a6c1d4ad5b5%2Flg5w7l3_processed.jpeg&w=3840&q=75)

Transcribed Image Text:FIN MAN 1B 1O Nove...

INFORMATION:

1.

Balances extracted from the General Ledger on 31 December 2018.

Capital : Pye

Capital : Taun

Current Account : Pye [01 January 2018 ]

Current Account : Taun [31 December 2018 ]

150 000

200 000

10 000 [ DR ]

2 000 [ CR]

Drawings : Pye

180 000

Drawings : Taun

Interest on Drawings : Pye

170 000

3 000

Interest on Drawings : Taun

2 600

2. The Net profit for the year was, R368 000.

3. The partnership agreement makes provision for the following :

Each partner is to receive 16% p.a. interest on their capital.

NB: Both partners had increased their capitals by R50 000 each on 01 July 2018 and was properly documented

and recorded.

Each partner receives a monthly salary as follows:

Pye, R10 000.

Taun, R9 000.

NB: Both partners' salaries were increased by 10% with effect from 01 September 2018.

Pye receives a bonus of R30 000.

Partners are to pay interest on their drawings. The amount due by them has been calculated and recorded by

the bookkeeper.

Partners are to share the remaining profits or losses in the ratio of their capitals at the beginning of the yea

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning