reports the llowing (In ml lick the icon to view the comparative balance sheet.) ne reguirements. by reviewing the labels for the change in stockholders' equity and then enter the amounts for each situation. (Enter an amount in each input area Input a "0" when there is no amou heses when entering net losses or numbers to be subtracted.) - X Situation #1 Requirements tockholders' equity, January 31, 2021 suance of stock The following are three situations related Timmy Company's issuance of stock and declaration and payment of dividends during the year ended January 31, 2022. For each situation, use the accounting equation and what you know from the chapter about stockholders' equity, common stock, and retained earnings to calculate the amount of Timmy's net income or net loss during the year ended January 31, 2022. 1. Timmy issued $7 million of stock and declared no dividends. 2. Timmy issued no stock but declared dividends of $18 million. 3. Timmy issued $5 million of stock and declared dividends of $22 million. Net income Dividends declared Net loss mockholders' equity, January 31, 2022

reports the llowing (In ml lick the icon to view the comparative balance sheet.) ne reguirements. by reviewing the labels for the change in stockholders' equity and then enter the amounts for each situation. (Enter an amount in each input area Input a "0" when there is no amou heses when entering net losses or numbers to be subtracted.) - X Situation #1 Requirements tockholders' equity, January 31, 2021 suance of stock The following are three situations related Timmy Company's issuance of stock and declaration and payment of dividends during the year ended January 31, 2022. For each situation, use the accounting equation and what you know from the chapter about stockholders' equity, common stock, and retained earnings to calculate the amount of Timmy's net income or net loss during the year ended January 31, 2022. 1. Timmy issued $7 million of stock and declared no dividends. 2. Timmy issued no stock but declared dividends of $18 million. 3. Timmy issued $5 million of stock and declared dividends of $22 million. Net income Dividends declared Net loss mockholders' equity, January 31, 2022

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 9E

Related questions

Question

100%

all same question

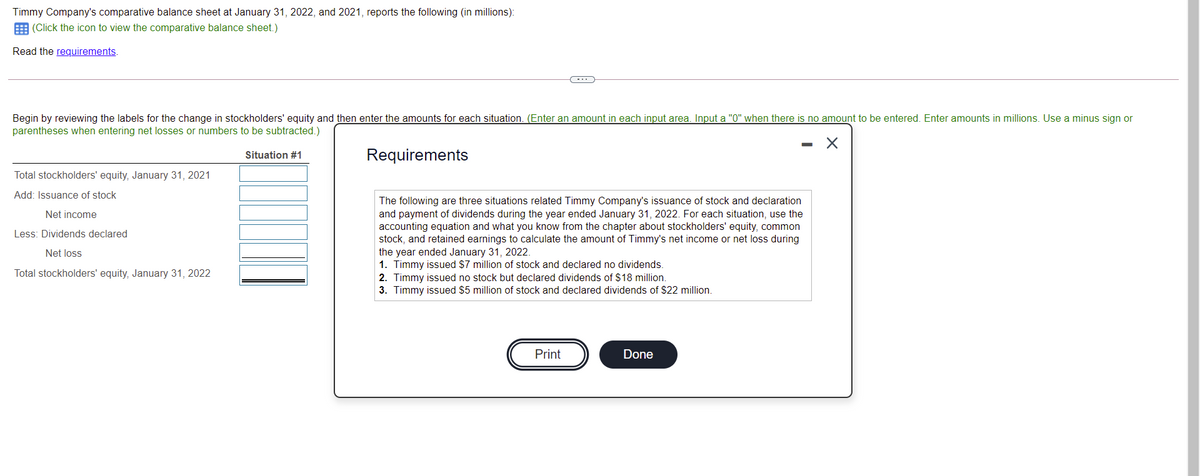

Transcribed Image Text:Timmy Company's comparative balance sheet at January 31, 2022, and 2021, reports the following (in millions):

E (Click the icon to view the comparative balance sheet.)

Read the requirements.

(-..

Begin by reviewing the labels for the change in stockholders' equity and then enter the amounts for each situation. (Enter an amount in each input area. Input a "0" when there is no amount to be entered. Enter amounts in millions. Use a minus sign or

parentheses when entering net losses or numbers to be subtracted.)

Situation #1

Requirements

Total stockholders' equity, January 31, 2021

Add: Issuance of stock

The following are three situations related Timmy Company's issuance of stock and declaration

and payment of dividends during the year ended January 31, 2022. For each situation, use the

accounting equation and what you know from the chapter about stockholders' equity, common

stock, and retained earnings to calculate the amount of Timmy's net income or net loss during

the year ended January 31, 2022.

1. Timmy issued $7 million of stock and declared no dividends.

2. Timmy issued no stock but declared dividends of $18 million.

3. Timmy issued $5 million of stock and declared dividends of $22 million.

Net income

Less: Dividends declared

Net loss

Total stockholders' equity, January 31, 2022

Print

Done

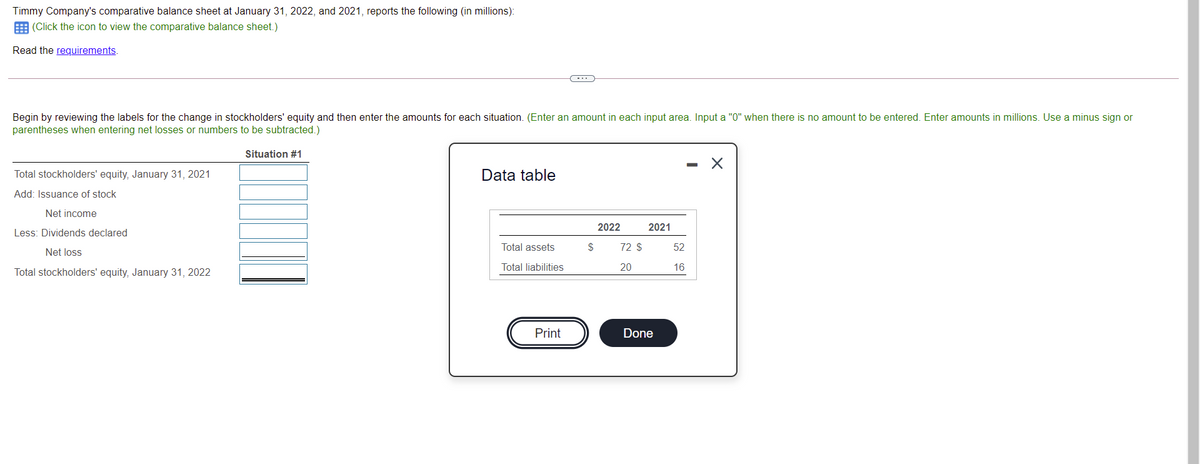

Transcribed Image Text:Timmy Company's comparative balance sheet at January 31, 2022, and 2021, reports the following (in millions):

E (Click the icon to view the comparative balance sheet.)

Read the requirements.

Begin by reviewing the labels for the change in stockholders' equity and then enter the amounts for each situation. (Enter an amount in each input area. Input a "0" when there is no amount to be entered. Enter amounts in millions. Use a minus sign or

parentheses when entering net losses or numbers to be subtracted.)

Situation #1

Total stockholders' equity, January 31, 2021

Data table

Add: Issuance of stock

Net income

2022

2021

Less: Dividends declared

Total assets

2$

72 $

52

Net loss

Total liabilities

20

16

Total stockholders' equity, January 31, 2022

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning