Patricia is asking for information on the Nunavut Payroll Tax. Who pays the and how is it calculated? Are there any special considerations or challenges he calculation of the payroll tax for the guides brought in from Alberta, askatchewan and Québec? What are the reporting and remitting requirem 'uring the year? What are the reporting requirements at year-end? Provide xamples based on the information provided in the assignment to clarify,

Patricia is asking for information on the Nunavut Payroll Tax. Who pays the and how is it calculated? Are there any special considerations or challenges he calculation of the payroll tax for the guides brought in from Alberta, askatchewan and Québec? What are the reporting and remitting requirem 'uring the year? What are the reporting requirements at year-end? Provide xamples based on the information provided in the assignment to clarify,

Chapter2: Career Planning

Section: Chapter Questions

Problem 1DTM

Related questions

Question

100%

Transcribed Image Text:cements

Unit Study Plan

Coursework

Learning Activities

NUNAVUT PAYROLL TAX

SCENARIO

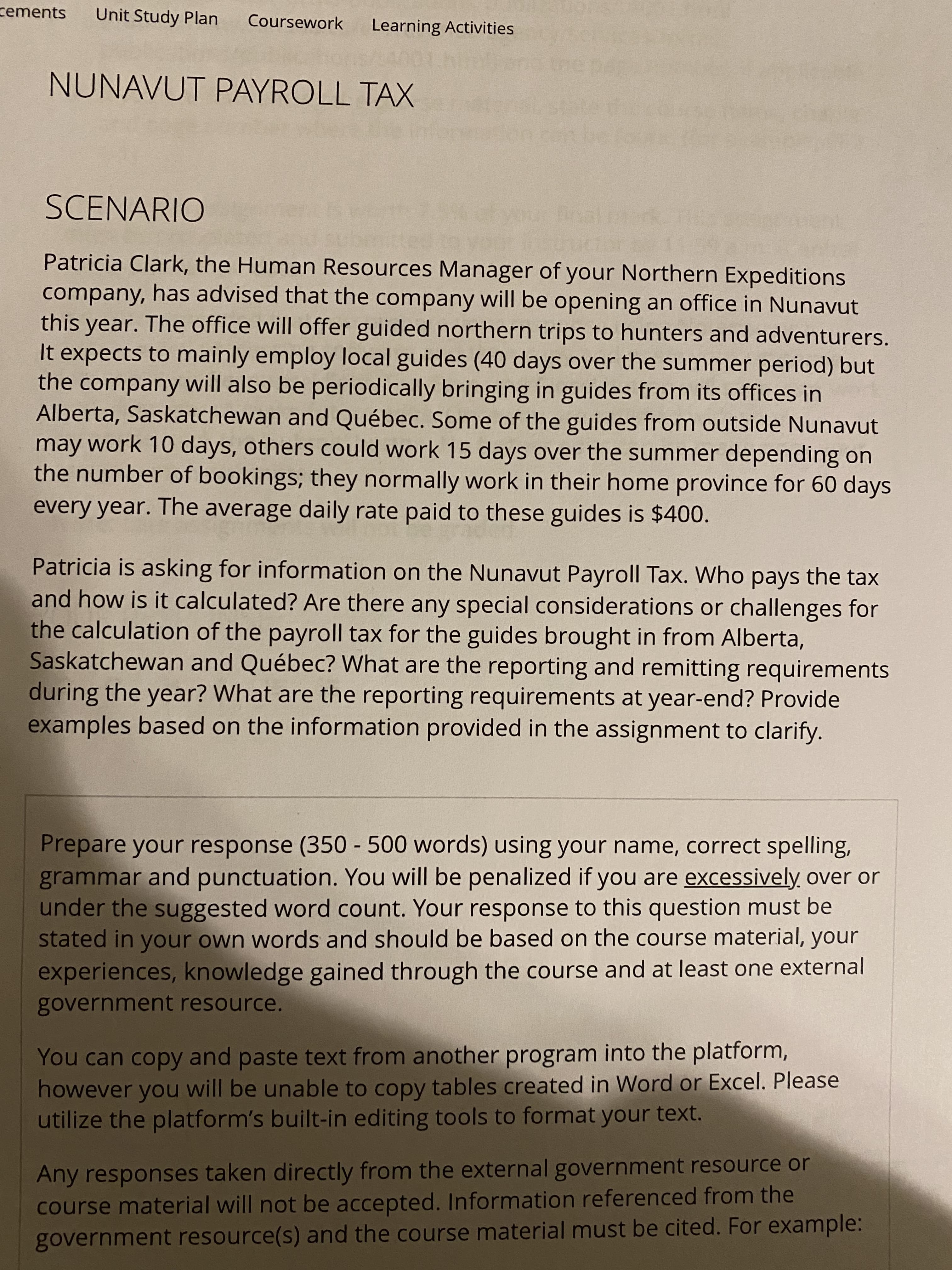

Patricia Clark, the Human Resources Manager of your Northern Expeditions

company, has advised that the company will be opening an office in Nunavut

this year. The office will offer guided northern trips to hunters and adventurers.

It expects to mainly employ local guides (40 days over the summer period) but

the company will also be periodically bringing in guides from its offices in

Alberta, Saskatchewan and Québec. Some of the guides from outside Nunavut

may work 10 days, others could work 15 days over the summer depending on

the number of bookings; they normally work in their home province for 60 days

every year. The average daily rate paid to these guides is $400.

Patricia is asking for information on the Nunavut Payroll Tax. Who pays the tax

and how is it calculated? Are there any special considerations or challenges for

the calculation of the payroll tax for the guides brought in from Alberta,

Saskatchewan and Québec? What are the reporting and remitting requirements

during the year? What are the reporting requirements at year-end? Provide

examples based on the information provided in the assignment to clarify.

Prepare your response (350 - 500 words) using your name, correct spelling,

grammar and punctuation. You will be penalized if you are excessively over or

under the suggested word count. Your response to this question must be

stated in your own words and should be based on the course material, your

experiences, knowledge gained through the course and at least one external

government resource.

You can copy and paste text from another program into the platform,

however you will be unable to copy tables created in Word or Excel. Please

utilize the platform's built-in editing tools to format your text.

Any responses taken directly from the external government resource or

course material will not be accepted. Information referenced from the

government resource(s) and the course material must be cited. For example:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College