Peter Corporation acquired an 80% interest in Stern Corporation several years ago when the book values and fair values of Stern's assets and liabilities were equal. At the time of acquisition, the cost of the 80% interest was equal to 80% of the book value of Stern's net assets. Separate company income statements for Peter and Stern for the year ended December 31, 2014 are summarized as follows: Required: Prepare a consolidated income statement for Peter Corporation and Subsidiary for 2014.

Peter Corporation acquired an 80% interest in Stern Corporation several years ago when the book values and fair values of Stern's assets and liabilities were equal. At the time of acquisition, the cost of the 80% interest was equal to 80% of the book value of Stern's net assets. Separate company income statements for Peter and Stern for the year ended December 31, 2014 are summarized as follows: Required: Prepare a consolidated income statement for Peter Corporation and Subsidiary for 2014.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 5RE: Longmire Sons nude sales un credit to Alderman Sports totaling 500,000 on April 18. The cost of the...

Related questions

Question

100%

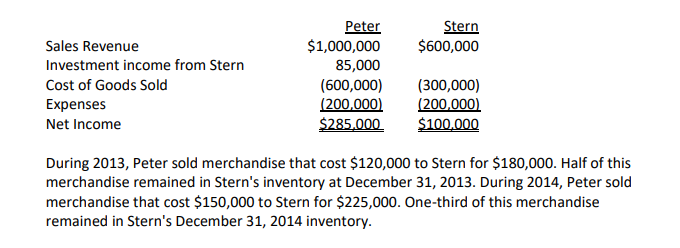

Peter Corporation acquired an 80% interest in Stern Corporation several years ago when the book values and fair values of Stern's assets and liabilities were equal. At the time of acquisition, the cost of the 80% interest was equal to 80% of the book value of Stern's net assets. Separate company income statements for Peter and Stern for the year ended December 31, 2014 are summarized as follows:

Required:

Prepare a consolidated income statement for Peter Corporation and Subsidiary for 2014.

Transcribed Image Text:Peter

$1,000,000

Stern

$600,000

Sales Revenue

Investment income from Stern

85,000

(300,000)

(200,000)

$100,000

Cost of Goods Sold

(600,000)

(200,000)

$285,000

Expenses

Net Income

During 2013, Peter sold merchandise that cost $120,000 to Stern for $180,000. Half of this

merchandise remained in Stern's inventory at December 31, 2013. During 2014, Peter sold

merchandise that cost $150,000 to Stern for $225,000. One-third of this merchandise

remained in Stern's December 31, 2014 inventory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning