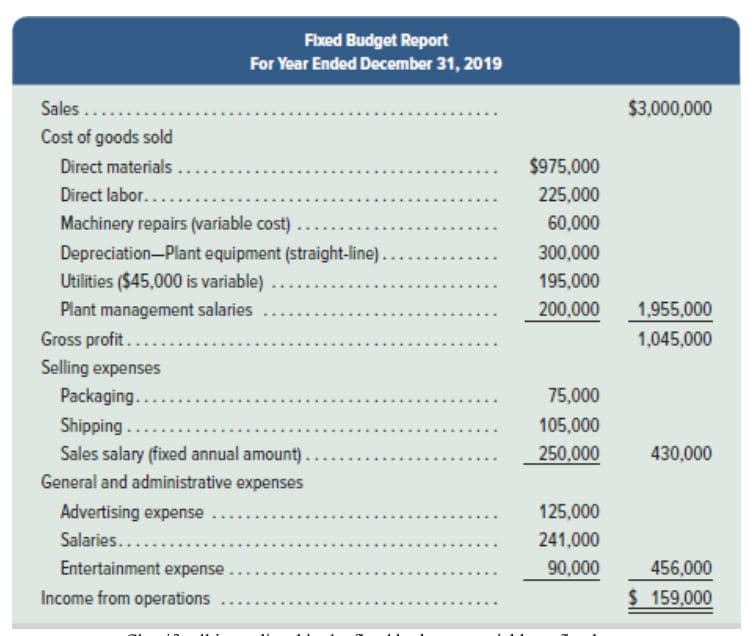

Phoenix Company’s 2019 master budget included the following fixed budget report. It is based on an expected production and sales volume of 15,000 units. a. Classify all items listed in the fixed budget as variable or fixed. b. Also determine their amounts per unit or their amounts for the year, as appropriate. c. Identify the unit variable costs in the format of variable costing, according to your findings in part a

Phoenix Company’s 2019

a. Classify all items listed in the fixed budget as variable or fixed.

b. Also determine their amounts per unit or their amounts for the year, as appropriate.

c. Identify the unit variable costs in the format of variable costing, according to your findings in part a

d. Organize a template for variable costing income statements in which the sales volume is a variable.

e. Test your template for 15,000 units sales volume to see if you get the same income as stated above

f. Find the breakeven point and provide the income statement at break even

g. Provide income statement at sales volume 12,000, 14,000, 16,000, and 18,000

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images