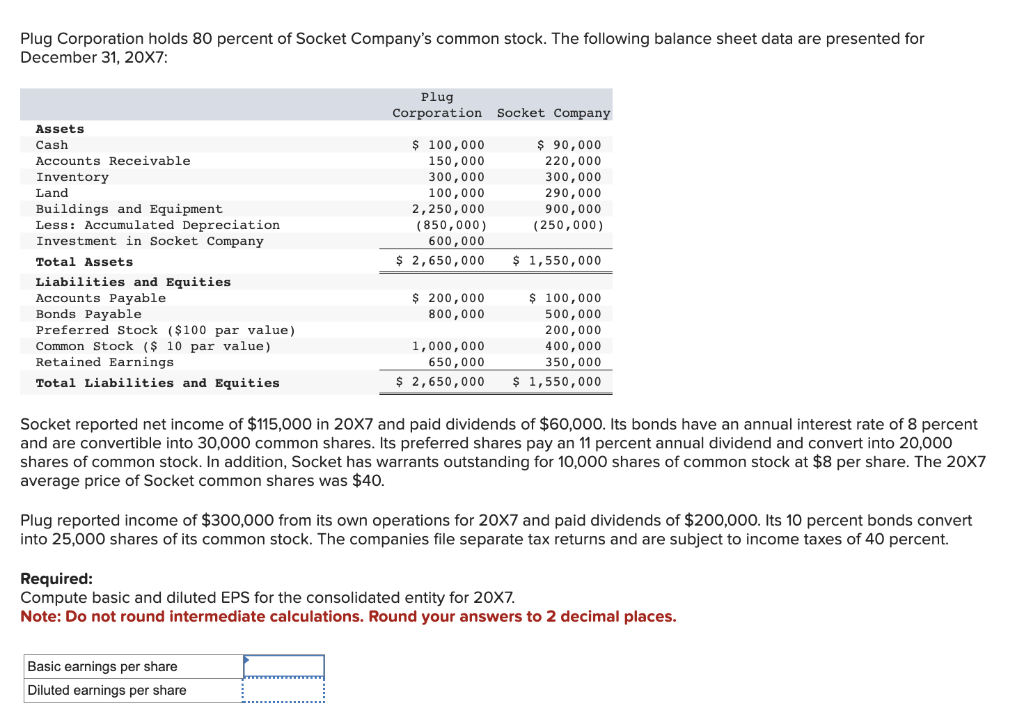

Plug Corporation holds 80 percent of Socket Company's common stock. The following balance sheet data are presented for December 31, 20X7: Assets Cash Accounts Receivable Inventory Land Buildings and Equipment Less: Accumulated Depreciation Investment in Socket Company Total Assets Liabilities and Equities Accounts Payable Bonds Payable Preferred Stock ($100 par value) Common Stock ($ 10 par value) Retained Earnings Total Liabilities and Equities Plug Corporation Socket Company $ 100,000 150,000 300,000 100,000 2,250,000 (850,000) 600,000 $ 2,650,000 Basic earnings per share Diluted earnings per share $ 200,000 800,000 1,000,000 650,000 $ 2,650,000 $ 90,000 220,000 300,000 290,000 900,000 (250,000) $1,550,000 $ 100,000 500,000 200,000 400,000 350,000 $ 1,550,000 Socket reported net income of $115,000 in 20X7 and paid dividends of $60,000. Its bonds have an annual interest rate of 8 percent and are convertible into 30,000 common shares. Its preferred shares pay an 11 percent annual dividend and convert into 20,000 shares of common stock. In addition, Socket has warrants outstanding for 10,000 shares of common stock at $8 per share. The 20X7 average price of Socket common shares was $40. Plug reported income of $300,000 from its own operations for 20X7 and paid dividends of $200,000. Its 10 percent bonds convert into 25,000 shares of its common stock. The companies file separate tax returns and are subject to income taxes of 40 percent. Required: Compute basic and diluted EPS for the consolidated entity for 20X7. Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

Plug Corporation holds 80 percent of Socket Company's common stock. The following balance sheet data are presented for December 31, 20X7: Assets Cash Accounts Receivable Inventory Land Buildings and Equipment Less: Accumulated Depreciation Investment in Socket Company Total Assets Liabilities and Equities Accounts Payable Bonds Payable Preferred Stock ($100 par value) Common Stock ($ 10 par value) Retained Earnings Total Liabilities and Equities Plug Corporation Socket Company $ 100,000 150,000 300,000 100,000 2,250,000 (850,000) 600,000 $ 2,650,000 Basic earnings per share Diluted earnings per share $ 200,000 800,000 1,000,000 650,000 $ 2,650,000 $ 90,000 220,000 300,000 290,000 900,000 (250,000) $1,550,000 $ 100,000 500,000 200,000 400,000 350,000 $ 1,550,000 Socket reported net income of $115,000 in 20X7 and paid dividends of $60,000. Its bonds have an annual interest rate of 8 percent and are convertible into 30,000 common shares. Its preferred shares pay an 11 percent annual dividend and convert into 20,000 shares of common stock. In addition, Socket has warrants outstanding for 10,000 shares of common stock at $8 per share. The 20X7 average price of Socket common shares was $40. Plug reported income of $300,000 from its own operations for 20X7 and paid dividends of $200,000. Its 10 percent bonds convert into 25,000 shares of its common stock. The companies file separate tax returns and are subject to income taxes of 40 percent. Required: Compute basic and diluted EPS for the consolidated entity for 20X7. Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Please help me with all answers thankuh.

Transcribed Image Text:Plug Corporation holds 80 percent of Socket Company's common stock. The following balance sheet data are presented for

December 31, 20X7:

Assets

Cash

Accounts Receivable

Inventory

Land

Buildings and Equipment

Less: Accumulated Depreciation

Investment in Socket Company

Total Assets

Liabilities and Equities

Accounts Payable

Bonds Payable

Preferred Stock ($100 par value)

Common Stock ($ 10 par value)

Retained Earnings.

Total Liabilities and Equities

Plug

Corporation Socket Company

$ 100,000

150,000

300,000

100,000

2,250,000

(850,000)

600,000

$ 2,650,000

Basic earnings per share

Diluted earnings per share

$ 200,000

800,000

$ 90,000

220,000

300,000

290,000

900,000

(250,000)

$ 1,550,000

$ 100,000

500,000

200,000

400,000

1,000,000

650,000

350,000

$ 2,650,000 $ 1,550,000

Socket reported net income of $115,000 in 20X7 and paid dividends of $60,000. Its bonds have an annual interest rate of 8 percent

and are convertible into 30,000 common shares. Its preferred shares pay an 11 percent annual dividend and convert into 20,000

shares of common stock. In addition, Socket has arrants outstanding for 10,000 shares of common stock at $8 per share. The 20X7

average price of Socket common shares was $40.

Plug reported income of $300,000 from its own operations for 20X7 and paid dividends of $200,000. Its 10 percent bonds convert

into 25,000 shares of its common stock. The companies file separate tax returns and are subject to income taxes of 40 percent.

Required:

Compute basic and diluted EPS for the consolidated entity for 20X7.

Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you