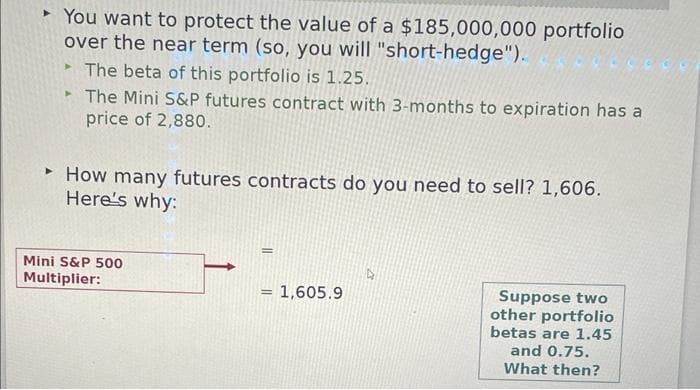

► You want to protect the value of a $185,000,000 portfolio over the near term (so, you will "short-hedge"). The beta of this portfolio is 1.25. ► The Mini S&P futures contract with 3-months to expiration has a price of 2,880. ▸ How many futures contracts do you need to sell? 1,606. Here's why: Mini S&P 500 Multiplier: = 1,605.9 Suppose two other portfolio betas are 1.45 and 0.75. What then?

► You want to protect the value of a $185,000,000 portfolio over the near term (so, you will "short-hedge"). The beta of this portfolio is 1.25. ► The Mini S&P futures contract with 3-months to expiration has a price of 2,880. ▸ How many futures contracts do you need to sell? 1,606. Here's why: Mini S&P 500 Multiplier: = 1,605.9 Suppose two other portfolio betas are 1.45 and 0.75. What then?

Chapter11: Managing Transaction Exposure

Section: Chapter Questions

Problem 35QA

Related questions

Question

Ef 611.

Transcribed Image Text:➤

► You want to protect the value of a $185,000,000 portfolio

over the near term (so, you will "short-hedge").

The beta of this portfolio is 1.25.

► The Mini S&P futures contract with 3-months to expiration has a

price of 2,880.

➤

▸ How many futures contracts do you need to sell? 1,606.

Here's why:

Mini S&P 500

Multiplier:

=

= 1,605.9

Suppose two

other portfolio

betas are 1.45

and 0.75.

What then?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you