Plymouth and Brockton Bus Lines (P&B) is a regional bus transportation company that operates in Eastem Massachusetts, New Hampshire, Maine, and Rhode Island. The company is in the process of choosing between two bus models for its new dedicated hourly service between Boston Logan International Airport and Manchester-Boston Regional Airport. One model, the OR-5000, is more expensive to purchase and maintain but will have a longer operational life than the other model, the SNS-2000. P&B's discount rate is 11.1%. The company plans to continue with one of the two models for the foreseeable future. Based on the purchase and operational costs of each model sbown below, which model should it choose? (Note: dollar amounts are in thousands) Model Year 0 Year 2 -$3.8 -%$42.1 Year 1 Year 3 -$3.8 - $2.1 Year 4 Year 5 Year 6 Year 7 OR-5000 SNS-2000 -%24202 -$102 -$3.8 -$2.1 - $3.8 -$2.1 -$3.8 - $3.8 -$3.8 Part A) Based on the costs of each model, which should it choose? (Select the best choice below.) O A. P&B should choose OR-5000 because the equivalent annual annuity of its costs is smaller. O B. P&B should choose the OR-5000 because it lasts longer. O C. P&B should choose the SNS-2000 because the equivalent annual annuity of its costs is smaller. O R. P&B should choose the SNS-2000 because the NPV of its costs is smaller.

Plymouth and Brockton Bus Lines (P&B) is a regional bus transportation company that operates in Eastem Massachusetts, New Hampshire, Maine, and Rhode Island. The company is in the process of choosing between two bus models for its new dedicated hourly service between Boston Logan International Airport and Manchester-Boston Regional Airport. One model, the OR-5000, is more expensive to purchase and maintain but will have a longer operational life than the other model, the SNS-2000. P&B's discount rate is 11.1%. The company plans to continue with one of the two models for the foreseeable future. Based on the purchase and operational costs of each model sbown below, which model should it choose? (Note: dollar amounts are in thousands) Model Year 0 Year 2 -$3.8 -%$42.1 Year 1 Year 3 -$3.8 - $2.1 Year 4 Year 5 Year 6 Year 7 OR-5000 SNS-2000 -%24202 -$102 -$3.8 -$2.1 - $3.8 -$2.1 -$3.8 - $3.8 -$3.8 Part A) Based on the costs of each model, which should it choose? (Select the best choice below.) O A. P&B should choose OR-5000 because the equivalent annual annuity of its costs is smaller. O B. P&B should choose the OR-5000 because it lasts longer. O C. P&B should choose the SNS-2000 because the equivalent annual annuity of its costs is smaller. O R. P&B should choose the SNS-2000 because the NPV of its costs is smaller.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 20P: The Aubey Coffee Company is evaluating the within-plant distribution system for its new roasting,...

Related questions

Question

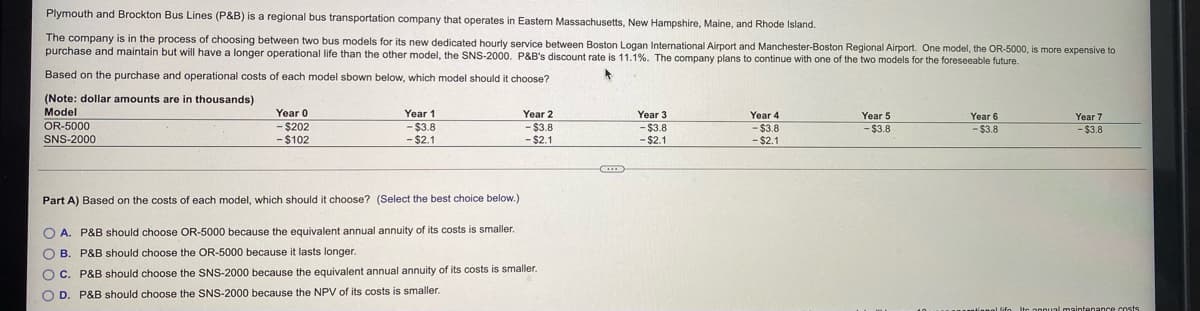

Transcribed Image Text:Plymouth and Brockton Bus Lines (P&B) is a regional bus transportation company that operates in Eastern Massachusetts, New Hampshire, Maine, and Rhode Island.

The company is in the process of choosing between two bus models for its new dedicated hourly service between Boston Logan International Airport and Manchester-Boston Regional Airport. One model, the OR-5000, is more expensive to

purchase and maintain but will have a longer operational life than the other model, the SNS-2000. P&B's discount rate is 11.1%. The company plans to continue with one of the two models for the foreseeable future.

Based on the purchase and operational costs of each model sbown below, which model should it choose?

(Note: dollar amounts are in thousands)

Model

Year 0

Year 1

Year 2

Year 3

-$3.8

- $2.1

Year 4

Year 5

Year 6

Year 7

OR-5000

- $202

- $102

-%243.8

- $2.1

- $3.8

- $2.1

-$3.8

- $2.1

-$3.8

- $3.8

- $3.8

SNS-2000

Part A) Based on the costs of each model, which should it choose? (Select the best choice below.)

O A. P&B should choose OR-5000 because the equivalent annual annuity of its costs is smaller.

O B. P&B should choose the OR-5000 because it lasts longer.

O C. P&B should choose the SNS-2000 because the equivalent annual annuity of its costs is smaller.

O D. P&B should choose the SNS-2000 because the NPV of its costs is smaller.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning