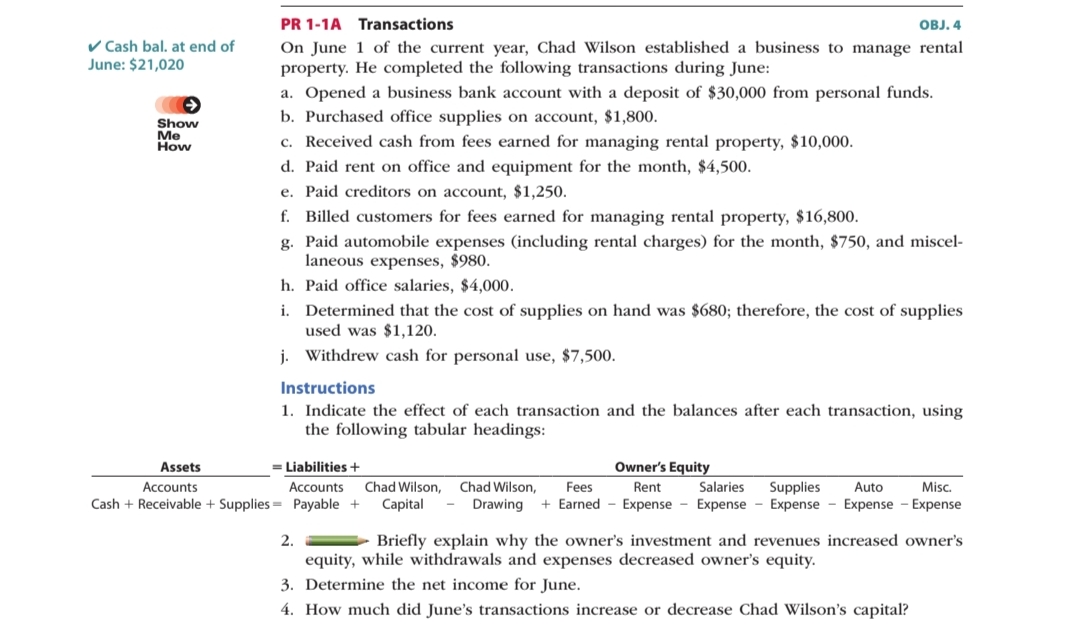

PR 1-1A Transactions OBJ, 4 v Cash bal. at end of June: $21,020 On June 1 of the current year, Chad Wilson established a business to manage rental property. He completed the following transactions during June: a. Opened a business bank account with a deposit of $30,000 from personal funds. b. Purchased office supplies on account, $1,800. c. Received cash from fees earned for managing rental property, $10,000. d. Paid rent on office and equipment for the month, $4,500. Show Me How e. Paid creditors on account, $1,250. f. Billed customers for fees earned for managing rental property, $16,800. g. Paid automobile expenses (including rental charges) for the month, $750, and miscel- laneous expenses, $980. h. Paid office salaries, $4,000. i. Determined that the cost of supplies on hand was $680; therefore, the cost of supplies used was $1,120. j. Withdrew cash for personal use, $7,500. Instructions 1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings: Assets = Liabilities + Owner's Equity Chad Wilson, Supplies Expense - Expense - Expense Accounts Accounts Chad Wilson, Fees Rent Salaries Auto Misc. Cash + Receivable + Supplies - Payable + Capital - Drawing + Earned - Expense - Expense Briefly explain why the owner's investment and revenues increased owner's 2. equity, while withdrawals and expenses decreased owner's equity. 3. Determine the net income for June. 4. How much did June's transactions increase or decrease Chad Wilson's capital?

PR 1-1A Transactions OBJ, 4 v Cash bal. at end of June: $21,020 On June 1 of the current year, Chad Wilson established a business to manage rental property. He completed the following transactions during June: a. Opened a business bank account with a deposit of $30,000 from personal funds. b. Purchased office supplies on account, $1,800. c. Received cash from fees earned for managing rental property, $10,000. d. Paid rent on office and equipment for the month, $4,500. Show Me How e. Paid creditors on account, $1,250. f. Billed customers for fees earned for managing rental property, $16,800. g. Paid automobile expenses (including rental charges) for the month, $750, and miscel- laneous expenses, $980. h. Paid office salaries, $4,000. i. Determined that the cost of supplies on hand was $680; therefore, the cost of supplies used was $1,120. j. Withdrew cash for personal use, $7,500. Instructions 1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings: Assets = Liabilities + Owner's Equity Chad Wilson, Supplies Expense - Expense - Expense Accounts Accounts Chad Wilson, Fees Rent Salaries Auto Misc. Cash + Receivable + Supplies - Payable + Capital - Drawing + Earned - Expense - Expense Briefly explain why the owner's investment and revenues increased owner's 2. equity, while withdrawals and expenses decreased owner's equity. 3. Determine the net income for June. 4. How much did June's transactions increase or decrease Chad Wilson's capital?

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 1.4APR: Transactions; financial statements On August 1, 2018, Brooke Kline established Western Realty....

Related questions

Topic Video

Question

Transcribed Image Text:PR 1-1A Transactions

OBJ, 4

v Cash bal. at end of

June: $21,020

On June 1 of the current year, Chad Wilson established a business to manage rental

property. He completed the following transactions during June:

a. Opened a business bank account with a deposit of $30,000 from personal funds.

b. Purchased office supplies on account, $1,800.

c. Received cash from fees earned for managing rental property, $10,000.

d. Paid rent on office and equipment for the month, $4,500.

Show

Me

How

e. Paid creditors on account, $1,250.

f. Billed customers for fees earned for managing rental property, $16,800.

g. Paid automobile expenses (including rental charges) for the month, $750, and miscel-

laneous expenses, $980.

h. Paid office salaries, $4,000.

i. Determined that the cost of supplies on hand was $680; therefore, the cost of supplies

used was $1,120.

j. Withdrew cash for personal use, $7,500.

Instructions

1. Indicate the effect of each transaction and the balances after each transaction, using

the following tabular headings:

Assets

= Liabilities +

Owner's Equity

Chad Wilson,

Supplies

Expense - Expense - Expense

Accounts

Accounts

Chad Wilson,

Fees

Rent

Salaries

Auto

Misc.

Cash + Receivable + Supplies - Payable +

Capital

- Drawing + Earned - Expense - Expense

Briefly explain why the owner's investment and revenues increased owner's

2.

equity, while withdrawals and expenses decreased owner's equity.

3. Determine the net income for June.

4.

How much did June's transactions increase or decrease Chad Wilson's capital?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning