PR 2-2A Journal entries and trial balance Obj. 1, 2, 3, 4 On October 1, 20Y6, Jay Crowley established Affordable Realty, which completed the following transactions during the month: a. Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $40,000. b. Paid rent on office and equipment for the month, $4,800. c. Purchased supplies on account, $2,150. d. Paid creditor on account, $1,100. Earned sales commissions, receiving cash, $18,750. f. Paid automobile expenses (including rental charge) for month, $1,580, and miscellaneous expenses, $800. g. Paid office salaries, $3, h. Determined that the cost of supplies used was $1,300. e. 19,000 i. Paid dividends, $1,500. WOR 3 WO Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Sup- plies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances after all posting is complete. Accounts containing only a single entry do not need a balance.

PR 2-2A Journal entries and trial balance Obj. 1, 2, 3, 4 On October 1, 20Y6, Jay Crowley established Affordable Realty, which completed the following transactions during the month: a. Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $40,000. b. Paid rent on office and equipment for the month, $4,800. c. Purchased supplies on account, $2,150. d. Paid creditor on account, $1,100. Earned sales commissions, receiving cash, $18,750. f. Paid automobile expenses (including rental charge) for month, $1,580, and miscellaneous expenses, $800. g. Paid office salaries, $3, h. Determined that the cost of supplies used was $1,300. e. 19,000 i. Paid dividends, $1,500. WOR 3 WO Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Sup- plies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances after all posting is complete. Accounts containing only a single entry do not need a balance.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter2: Analyzing Transactions

Section: Chapter Questions

Problem 2PA: Journal entries and trial balance On October 1, 20Y6, Jay Crowley established Affordable Realty,...

Related questions

Question

100%

Question 1-5 under instructions

Transcribed Image Text:DeleniIle ule net IICUME Ur net 18Ss för January.

1.

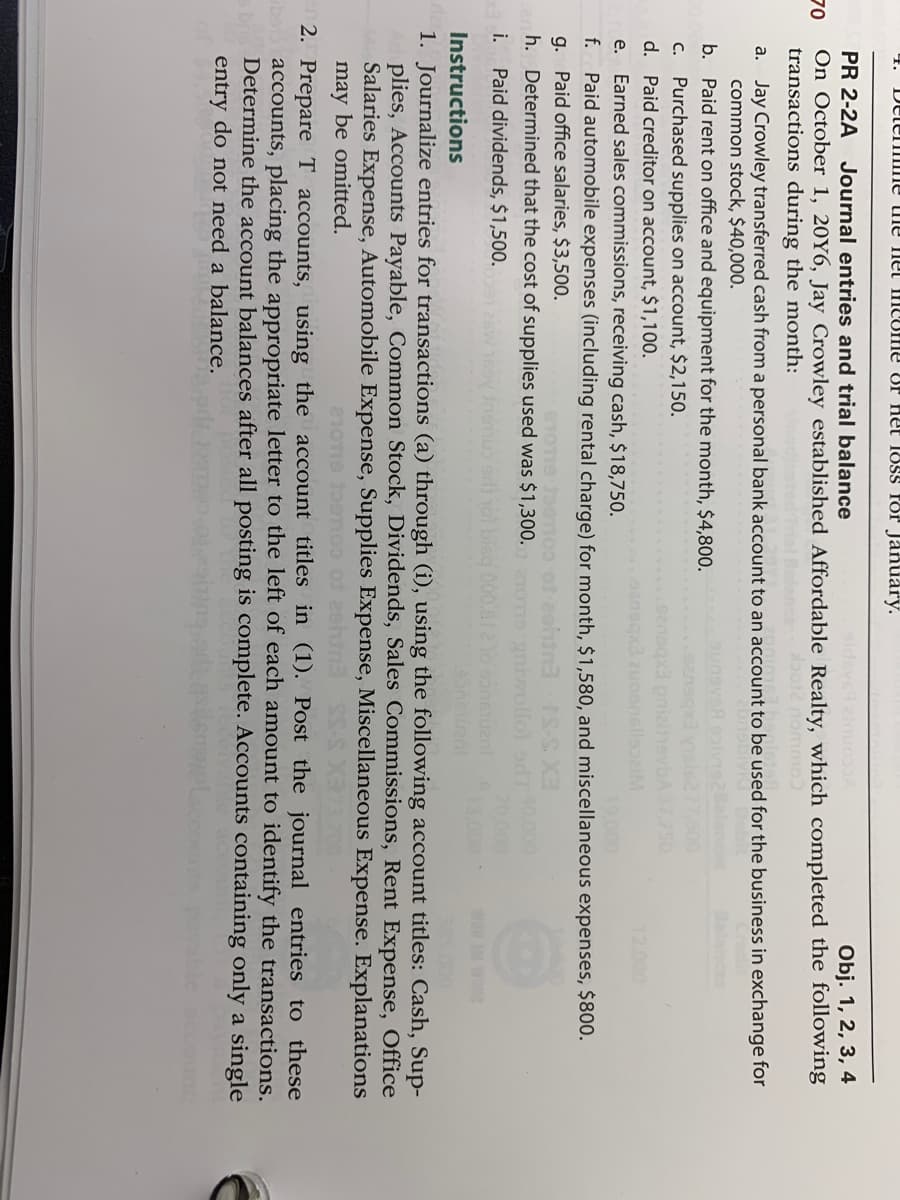

PR 2-2A Journal entries and trial balance

Obj. 1, 2, 3, 4

On October 1, 20Y6, Jay Crowley established Affordable Realty, which completed the following

transactions during the month:

70

o12 nommoƆ

a. Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for

common stock, $40,000.

b. Paid rent on office and equipment for the month, $4,800.

C. Purchased supplies on account, $2,150.

d. Paid creditor on account, $1,100.

12.000

e. Earned sales commissions, receiving cash, $18,750.

f. Paid automobile expenses (including rental charge) for month, $1,580, and miscellaneous expenses, $800.

g. Paid office salaries, $3,500.

h. Determined that the cost of supplies used was $1,300.

aniwollol or

40.00

i.

Paid dividends, $1,500.

wOR 3M WOE

Instructions

1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Sup-

plies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office

Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Explanations

may be omitted.

2. Prepare T accounts, using the account titles in (1). Post the journal entries to these

ibois accounts, placing the appropriate letter to the left of each amount to identify the transactions.

Determine the account balances after all posting is complete. Accounts containing only a single

entry do not need a balance.

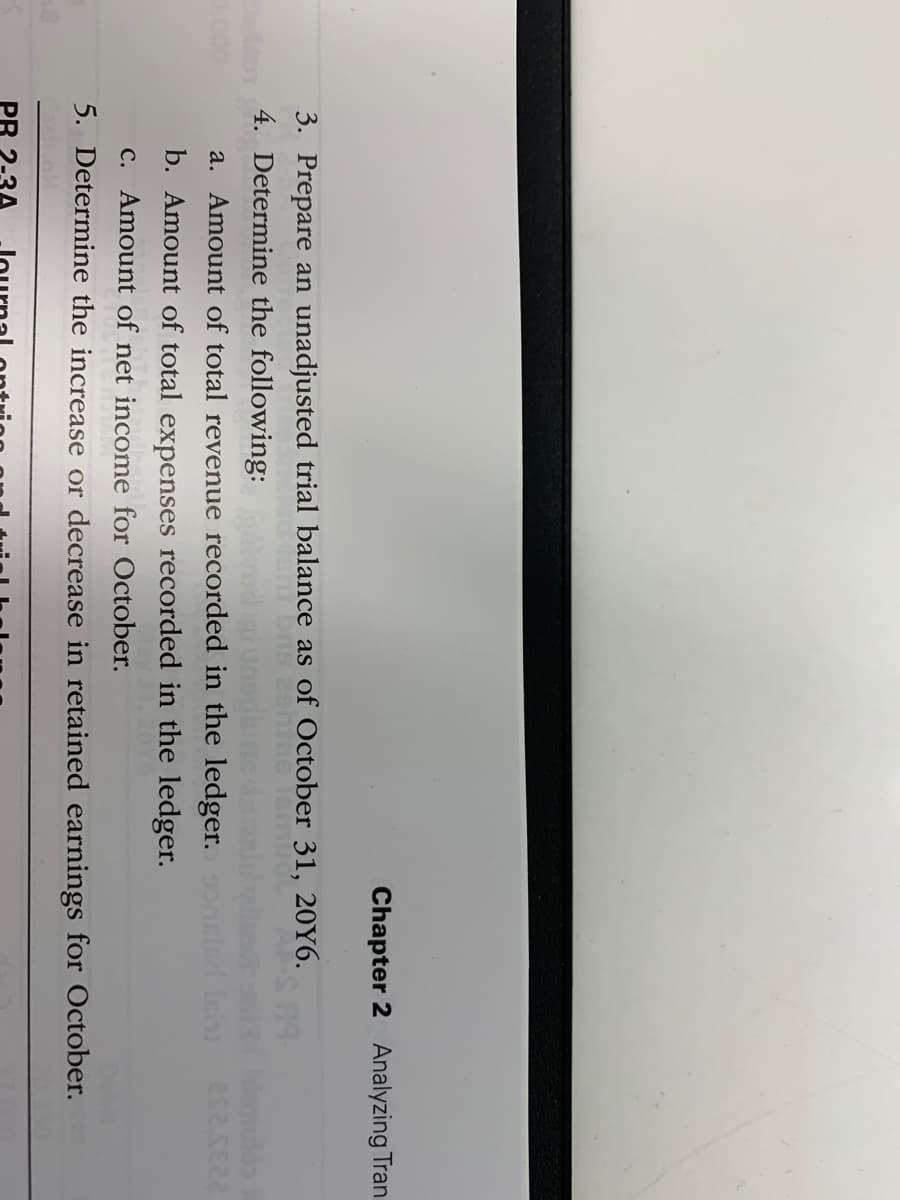

Transcribed Image Text:Chapter 2 Analyzing Tran

3. Prepare an unadjusted trial balance as of October 31, 20Y6.

4. Determine the following:

Mulds

a. Amount of total revenue recorded in the ledger.

b. Amount of total expenses recorded in the ledger.

C. Amount of net income for October.

5. Determine the increase or decrease in retained earnings for October.

PR 2-3A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage