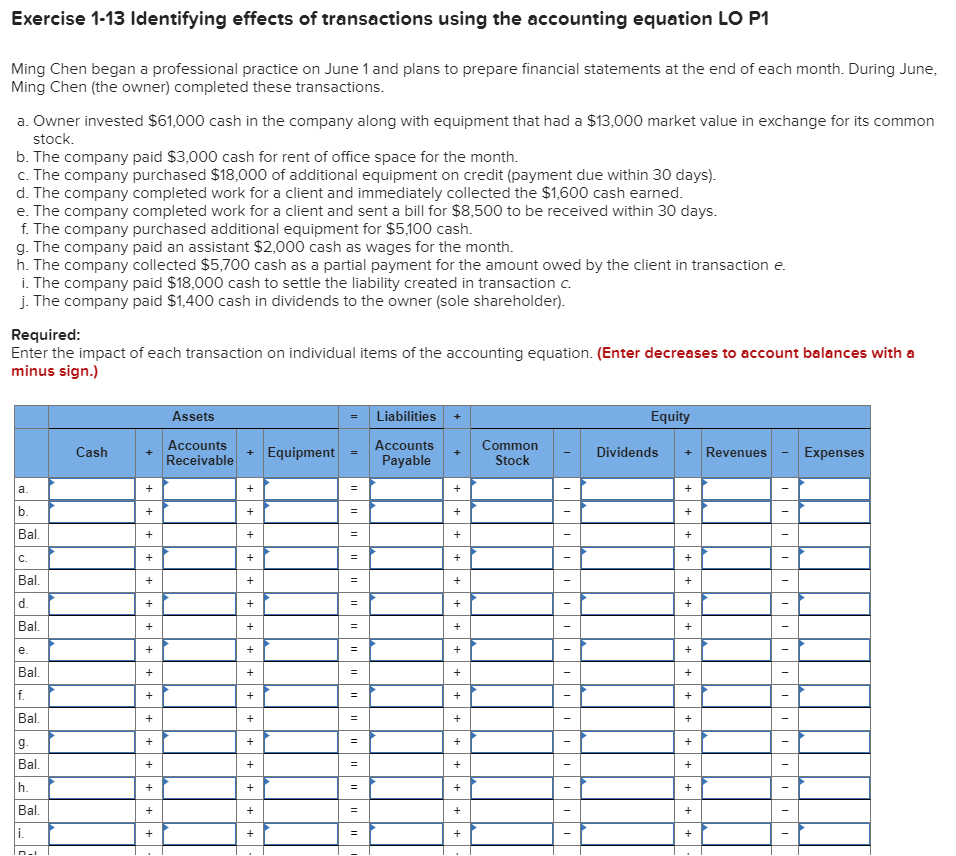

Exercise 1-13 ldentifying effects of transactions using the accounting equation LO P1 Ming Chen began a professional practice on June 1 and plans to prepare financial statements at the end of each month. During June, Ming Chen (the owner) completed these transactions. a. Owner invested $61,000 cash in the company along with equipment that had a $13,000 market value in exchange for its common stock. b. The company paid $3,000 cash for rent of office space for the month. c. The company purchased $18,000 of additional equipment on credit (payment due within 30 days). d. The company completed work for a client and immediately collected the $1,600 cash earned. e. The company completed work for a client and sent a bill for $8,500 to be received within 30 days. f. The company purchased additional equipment for $5,100 cash. g. The company paid an assistant $2,000 cash as wages for the month. h. The company collected $5,700 cash as a partial payment for the amount owed by the client in transaction e. i. The company paid $18,000 cash to settle the liability created in transaction c. j. The company paid $1,400 cash in dividends to the owner (sole shareholder). Required: Enter the impact of each transaction on individual items of the accounting equation. (Enter decreases to account balances with a minus sign.) Equity Assets Liabilities Accounts Receivable Accounts Common Stock Dividends Expenses Cash Equipment Revenues Payable a. b. %3D Bal. C. Bl, d. Bal. e. Bal. f. Bl, g. %3D Bal. h. Bl. ++ +

Exercise 1-13 ldentifying effects of transactions using the accounting equation LO P1 Ming Chen began a professional practice on June 1 and plans to prepare financial statements at the end of each month. During June, Ming Chen (the owner) completed these transactions. a. Owner invested $61,000 cash in the company along with equipment that had a $13,000 market value in exchange for its common stock. b. The company paid $3,000 cash for rent of office space for the month. c. The company purchased $18,000 of additional equipment on credit (payment due within 30 days). d. The company completed work for a client and immediately collected the $1,600 cash earned. e. The company completed work for a client and sent a bill for $8,500 to be received within 30 days. f. The company purchased additional equipment for $5,100 cash. g. The company paid an assistant $2,000 cash as wages for the month. h. The company collected $5,700 cash as a partial payment for the amount owed by the client in transaction e. i. The company paid $18,000 cash to settle the liability created in transaction c. j. The company paid $1,400 cash in dividends to the owner (sole shareholder). Required: Enter the impact of each transaction on individual items of the accounting equation. (Enter decreases to account balances with a minus sign.) Equity Assets Liabilities Accounts Receivable Accounts Common Stock Dividends Expenses Cash Equipment Revenues Payable a. b. %3D Bal. C. Bl, d. Bal. e. Bal. f. Bl, g. %3D Bal. h. Bl. ++ +

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 32BE: Brief Exercise 2-32 Journalize Transactions Galle Inc. entered into the following transactions...

Related questions

Question

Hello, I am kinda confused, how can I do this problem?

Transcribed Image Text:Exercise 1-13 ldentifying effects of transactions using the accounting equation LO P1

Ming Chen began a professional practice on June 1 and plans to prepare financial statements at the end of each month. During June,

Ming Chen (the owner) completed these transactions.

a. Owner invested $61,000 cash in the company along with equipment that had a $13,000 market value in exchange for its common

stock.

b. The company paid $3,000 cash for rent of office space for the month.

c. The company purchased $18,000 of additional equipment on credit (payment due within 30 days).

d. The company completed work for a client and immediately collected the $1,600 cash earned.

e. The company completed work for a client and sent a bill for $8,500 to be received within 30 days.

f. The company purchased additional equipment for $5,100 cash.

g. The company paid an assistant $2,000 cash as wages for the month.

h. The company collected $5,700 cash as a partial payment for the amount owed by the client in transaction e.

i. The company paid $18,000 cash to settle the liability created in transaction c.

j. The company paid $1,400 cash in dividends to the owner (sole shareholder).

Required:

Enter the impact of each transaction on individual items of the accounting equation. (Enter decreases to account balances with a

minus sign.)

Equity

Assets

Liabilities

Accounts

Receivable

Accounts

Common

Stock

Dividends

Expenses

Cash

Equipment

Revenues

Payable

a.

b.

%3D

Bal.

C.

Bl,

d.

Bal.

e.

Bal.

f.

Bl,

g.

%3D

Bal.

h.

Bl.

++ +

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning