PR 2-1A Entries into T accounts and trial balance OBJ. 1, 2, 3, 4 Connie Young, an architect, opened an office on October 1, 2019. During the month, she completed the following transactions connected with her professional practice: a. Transferred cash from a personal bank account to an account to be used for the busi- ness, $36,000. b. Paid October rent for office and workroom, $2,400. c. Purchased used automobile for $32,800, paying $7,800 cash and giving a note payable for the remainder. d. Purchased office and computer equipment on account, $9,000. e. Paid cash for supplies, $2,150. ishdag, som f. Paid cash for annual insurance policies, $4,000. g. Received cash from client for plans delivered, $12,200. h. Paid cash for miscellaneous expenses, $815. i. Paid cash to creditors on account, $4,500.

PR 2-1A Entries into T accounts and trial balance OBJ. 1, 2, 3, 4 Connie Young, an architect, opened an office on October 1, 2019. During the month, she completed the following transactions connected with her professional practice: a. Transferred cash from a personal bank account to an account to be used for the busi- ness, $36,000. b. Paid October rent for office and workroom, $2,400. c. Purchased used automobile for $32,800, paying $7,800 cash and giving a note payable for the remainder. d. Purchased office and computer equipment on account, $9,000. e. Paid cash for supplies, $2,150. ishdag, som f. Paid cash for annual insurance policies, $4,000. g. Received cash from client for plans delivered, $12,200. h. Paid cash for miscellaneous expenses, $815. i. Paid cash to creditors on account, $4,500.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter7: Financial Statements For A Proprietorship

Section: Chapter Questions

Problem 1CP

Related questions

Question

Transcribed Image Text:ting expenses

3. Operating income

b.

Comment on the results of your horizontal analysis in part (a).

C. Based upon Exercise 2-23, compare and comment on the operating results of Target

and Costco for the recent year.

lems: Series A

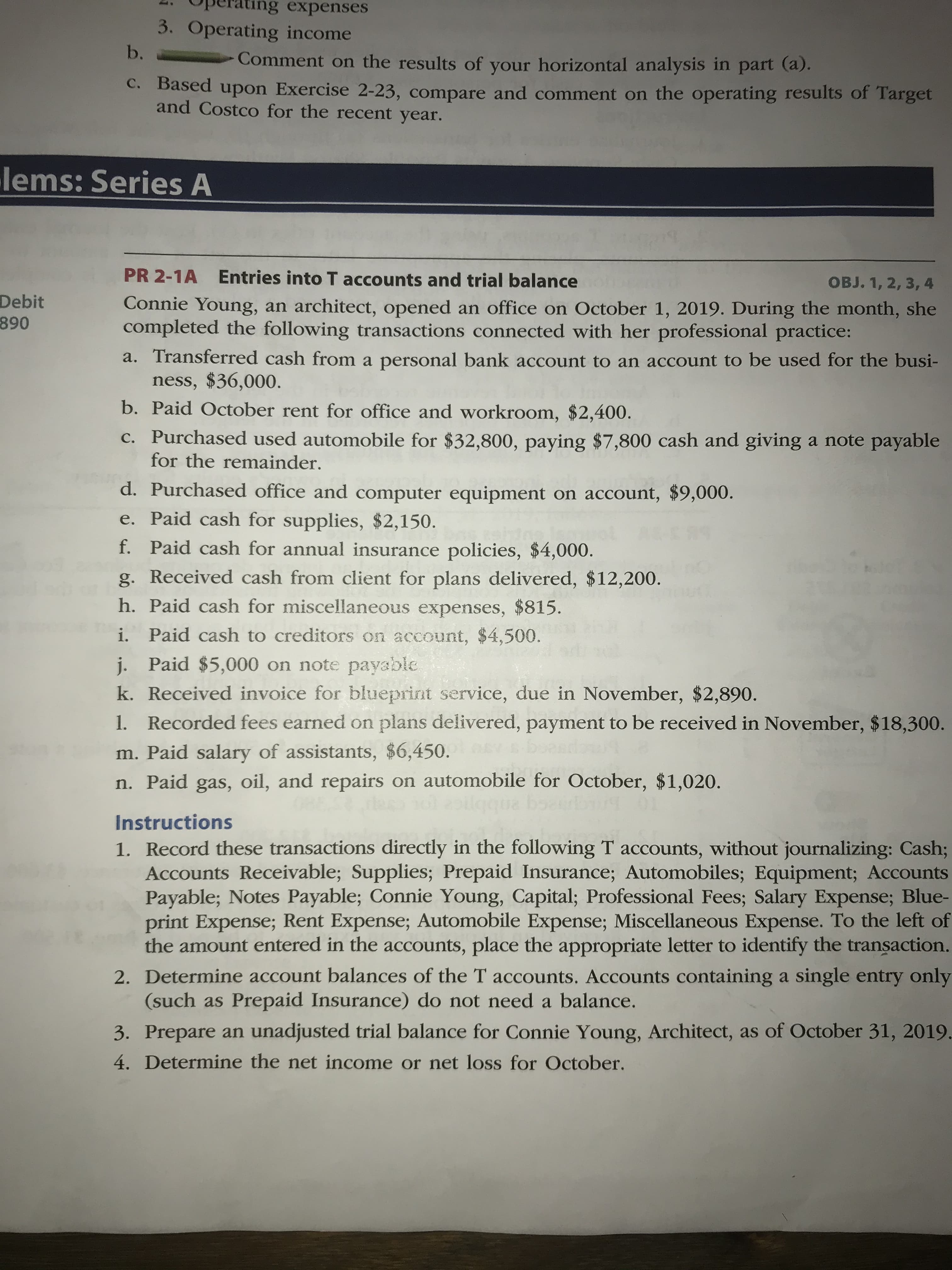

PR 2-1A Entries into T accounts and trial balance

OBJ. 1, 2, 3, 4

Debit

890

Connie Young, an architect, opened an office on October 1, 2019. During the month, she

completed the following transactions connected with her professional practice:

a. Transferred cash from a personal bank account to an account to be used for the busi-

ness, $36,000.

b. Paid October rent for office and workroom, $2,400.

c. Purchased used automobile for $32,800, paying $7,800 cash and giving a note payable

for the remainder.

d. Purchased office and computer equipment on account, $9,000.

e. Paid cash for supplies, $2,150.

f. Paid cash for annual insurance policies, $4,000.

g. Received cash from client for plans delivered, $12,200.

h. Paid cash for miscellaneous expenses, $815.

i. Paid cash to creditors on account, $4,500.

j. Paid $5,000 on note payable

k. Received invoice for blueprint service, due in November, $2,890.

1. Recorded fees earned on plans delivered, payment to be received in November, $18,300.

m. Paid salary of assistants, $6,450.

n. Paid gas, oil, and repairs on automobile for October, $1,020.

Instructions

1. Record these transactions directly in the following T accounts, without journalizing: Cash;

Accounts Receivable; Supplies; Prepaid Insurance; Automobiles; Equipment; Accounts

Payable; Notes Payable; Connie Young, Capital; Professional Fees; Salary Expense; Blue-

print Expense; Rent Expense; Automobile Expense; Miscellaneous Expense. To the left of

the amount entered in the accounts, place the appropriate letter to identify the transaction.

2. Determine account balances of the T accounts. Accounts containing a single entry only

(such as Prepaid Insurance) do not need a balance.

3. Prepare an unadjusted trial balance for Connie Young, Architect, as of October 31, 2019.

4. Determine the net income or net loss for October.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 15 images

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning