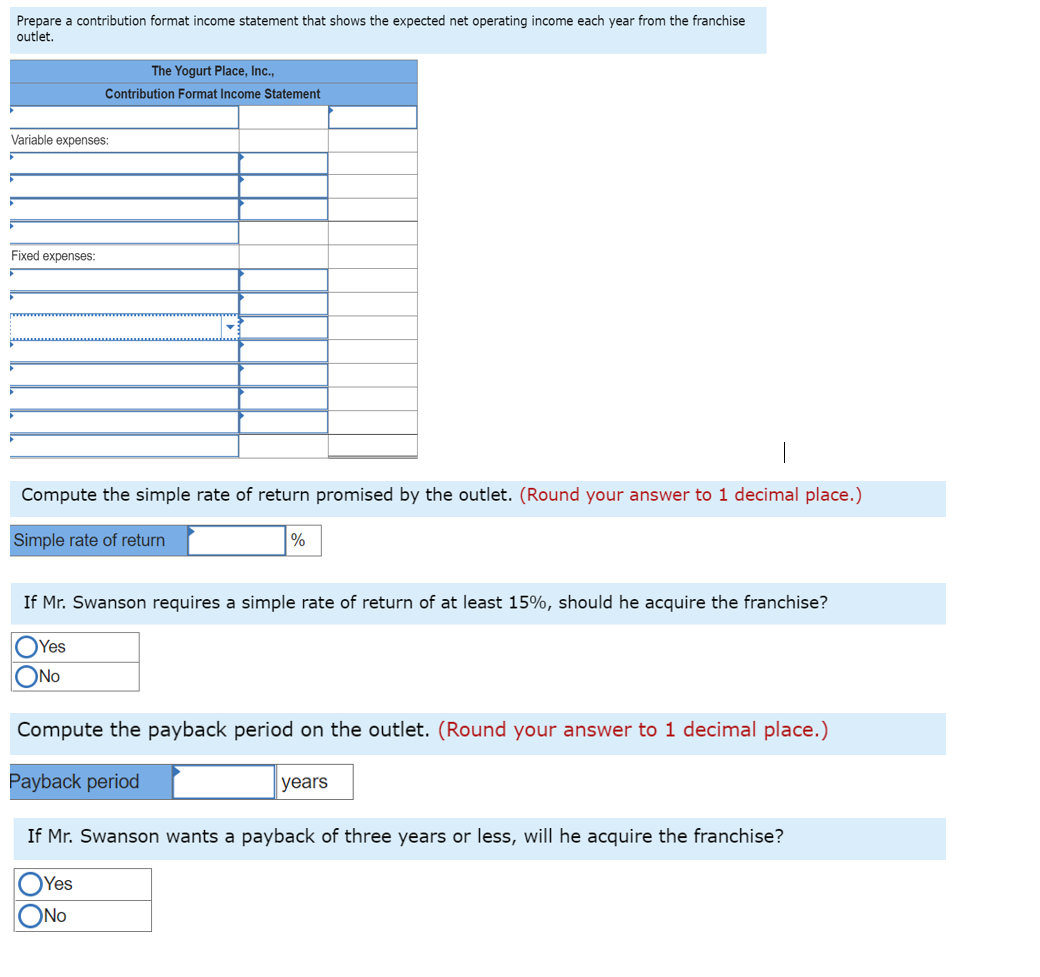

Prepare a contribution format income statement that shows the expected net operating income each year from the franchise outlet. The Yogurt Place, Inc., Contribution Format Income Statement Wariable expenses: Fixed expenses:

Q: A company is planning to manufacture rocking chairs. The fixed cost is $40,000 and the cost pre…

A: Revenue means amount to be received from sale of goods and services. Sales revenue can be calculated…

Q: An organization's objective is to increase its production by 20 percent next year. How do you…

A: Line organization is hierarchical structure with an organization. On the other hand a staff function…

Q: Ronald has a Burger Restaurant located near a local University. The restaurant not only sells two…

A: Average contribution Margin :— It is the multiplication of sales mix and contribution margin of each…

Q: Analyze Star Stream's cost-volume-profit relationships Star Stream is a subscription-based video…

A: Break even point is that point at which business is recovering its fixed and variable costs only.…

Q: There is a company running a subscription-based business. A marketing manager of this company found…

A: The customer's LTV: The customer's Life Time Value or LTV is a measure of the value of the projected…

Q: Shannon Company segments its income statement into its North and South Divisions. The company's…

A:

Q: Assume that you are the president of your company and paid a year-end bonus according to the amount…

A: Given: The president of the company paid an year-end bonus as per the net income.

Q: Consider the info provided below as well as the financial statements and answer the questions that…

A: Ratio analysis: This is the quantitative analysis of financial statements of a business enterprise.…

Q: Atlantis Company is placing an ad in the local paper to advertise its products . The ad will run for…

A: Advertising Cost allocated to Product A = Total Advertising Cost X Percentage of Floor Space…

Q: Ronald has a Burger Restaurant located near a local University. The restaurant not only sells two…

A: Lets understand the basics. Break even point is a point at which no profit no loss condition arise.…

Q: ution margin income statement for the first month (in July) that reflects $2,400,000 in sales…

A: 1.d CONTRIBUTION INCOME STATEMENT Particulars Amount…

Q: A company is considering the following three compensation plans for the salespeople listed in the…

A: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-parts at a…

Q: The Houston Armadillos, a minor-league baseball team, play their weekly games in a small stadium…

A: Cost-Volume-Profit (CVP) Analysis: It is a method followed to analyze the relationship between the…

Q: Tabuk’s Manufacturing Company has two divisions: Garden Division and Farm Division. The following…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: 4. The company issues bonds and uses the proceeds to purchase machinery and equipment that increases…

A: 1. Margin = Net operating income/ Sales 2. Turnover= Sales/ Operating assets 3. ROI = Margin *…

Q: Contribution Margin and Contribution Margin Ratio For a recent year, Wicker Company-owned…

A: Contribution margin = Sales - Total Variable costs Contribution margin ratio = Contribution…

Q: For a recent year, Wicker Company-owned restaurants had the following sales and expenses (in…

A: Contribution margin is calculated by subtracting variable expenses from the sales revenue of a…

Q: Olongapo Sports Corporation distributes two premium golf balls—the Flight Dynamic and the Sure Shot.…

A: Break even point (BEP): Breakeven is the point where total expenses are equal to total revenue. at…

Q: Prepare a contribution margin format income statement; answer what-ifquestions Shown here is an…

A: Hello. Since your question has multiple sub-parts, we will solve the first three sub-parts for you.…

Q: Contribution Margin and Contribution Margin Ratio For a recent year, McDonald's (MCD) company-owned…

A: Introduction: The contribution margin between the price of a product and the associated variable…

Q: Olongapo Sports Corporation is the distributor in the Philippines of two premium golf balls—the…

A:

Q: Using Excel spreadsheet / worksheet, determine Anna's profit. Attach excel solution.

A: Operating income refers to the income or gross profit generated by the company from its operations…

Q: Prepare a new contribution format income statement under each of the following conditions (consider…

A:

Q: Below is the amount of labor employed by a starting business which makes bags out of recycled…

A: Total cost alludes to the total amount of money spent by a company to create products and services.…

Q: Consider the info provided below as well as the financial statements and answer the questions that…

A: Ratio analysis: This is the quantitative analysis of financial statements of a business enterprise.…

Q: Tabouk’s Manufacturing Company has two divisions: Garden Division and Farm Division. The following…

A: Breakeven point refers to that point of sale where the company neither earns any profit nor suffers…

Q: eBook Contribution Margin and Contribution Margin Ratio For a recent year, McDooley's, a…

A: Income statement:: Sales Revenue::$279,000 .. Less: Variable Cost Food and paper:::$74,140..…

Q: Contribution Margin and Contribution Margin Ratio For a recent year, Wicker Company-owned…

A: Under cost volume profit (CVP) analysis, contribution margin is a concept which provides information…

Q: During the current year, XYZ Company increased its variable SG&A expenses while keeping fixed…

A: Cost-Volume-Profit Analysis (CVP Analysis): CVP Analysis is a tool of cost accounting that measures…

Q: Contribution Margin and Contribution Margin Ratio For a recent year, Wicker Company-owned…

A: Contribution margin = Sales - Variable Cost Variable Cost are 1. Food and packaging =$10226 2.…

Q: Hydro Systems Engineering Associates, Inc., provides consulting services to city water authorities.…

A: Given that, Contribution margin = 15% Annual fixed cost = $245000 Income tax rate = 30% The…

Q: Contribution Margin and Contribution Margin Ratio For a recent year, Wicker Company-owned…

A: Contribution Margin Ratio:- This ratio shows how much money is available to cover the fixed cost.…

Q: Consider the info provided below as well as the financial statements and answer the questions that…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: An example of an uncontrollable cost would include all of the following except ________. A) hourly…

A: Uncontrollable costs are those cost which can not be controlled by the management.

Q: An auto parts supplier sells Hardy-brand batteries to car dealers and auto mechanics. The annual…

A: Given information : Annual demand (D) : 1,200 batteries Item cost (S) : $20 Holding cost (H) : $8.4…

Q: ns in the month of March. Its Effective Capacity is 170 tax returns and its Design Capacity is 175…

A: Efficiency and utilization refer to the performance indicators that are used to measure how…

Q: ycle to The following revenue and the cost data are for Round Manufacturing's radial saws. The RM…

A: The income statement shows how much profit or loss an organization generated during a reporting…

Q: Shannon Company segments its income statement into its North and South Divisions. The company's…

A: The contribution margin is computed by subtracting the variable expenses from the sales. The…

Q: Corporation manufactures housewares products that are sold through a network of external sales…

A: Segregate the variable cost and fixed cost for easy calculation of contribution margin, break even…

Q: Park and West, LLC, provides consulting services to retail merchandisers in the Midwest. In 2019,…

A: Income Statement: The Income Statement is one of a company’s core financial statements that shows…

Q: In the current year, Big Burgers, Inc., expanded its fast-food operations by opening several new…

A:

Q: breakeven point of the Company

A: Definition: Break Even Point: It is the amount necessary for covering up the variable and fixed…

Q: A general manager wants to know the economic service life of currently owned machines. The market…

A: Annual worth of project consist of equivalent annual cost of annual cost, equivalent annual cost of…

Q: Calculate the Return on Investment from the following responsibility report data using total revenue…

A: Return on Investment(taking revenue as base)=Total Revenue-Total ExpensesTotal Revenue×100

Q: Easton Company makes and sells scooters. Easton incurred the following costs in its most recent…

A: Relevant costs are the avoidable costs. These are incurred or considered only when some specific…

Q: Assume that total sales revenue for 2018 is projected to be $1,153,549. Assume also the following…

A: Computation of total cost Packaged cans and bottles + kegs + shrinkage + contract labor + direct…

Q: a) Kwik supermart has ordered the following supplies over the last year from various suppliers:…

A: Solution:- Average price charged by the new supplier will be the 11% less than the average of the…

Q: At the conclusion of her first month of operating Val's Donut Shop, Val computed the following…

A: Weekly Profit = Weekly Sales - Weekly Expenses Again, Monthly Sales = Sum of all weekly Sales(week…

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.Keith Golding has decided to purchase a personal computer. He has narrowed his choices to two: Brand A and Brand B. Both brands have the same processing speed, hard disk capacity, RAM, graphics card memory, and basic software support package. Both come from companies with good reputations. The selling price for each is identical. After some review, Keith discovers that the cost of operating and maintaining Brand A over a three-year period is estimated to be 200. For Brand B, the operating and maintenance cost is 600. The sales agent for Brand A emphasized the lower operating and maintenance cost. She claimed that it was lower than any other PC brand. The sales agent for Brand B, however, emphasized the service reputation of the product. She provided Keith with a copy of an article appearing in a PC magazine that rated service performance of various PC brands. Brand B was rated number one. Based on all the information, Keith decided to buy Brand B. Required: 1. What is the total product purchased by Keith? 2. Is the Brand A company pursuing a cost leadership or differentiation strategy? The Brand B company? Explain. 3. When asked why he purchased Brand B, Keith replied, I think Brand B offered more value than Brand A. What are the possible sources of this greater value? If Keiths reaction represents the majority opinion, what suggestions could you offer to help improve the strategic position of Brand A?Shonda & Shonda is a company that does land surveys and engineering consulting. They have an opportunity to purchase new computer equipment that will allow them to render their drawings and surveys much more quickly. The new equipment will cost them an additional $1.200 per month, but they will be able to increase their sales by 10% per year. Their current annual cost and break-even figures are as follows: A. What will be the impact on the break-even point if Shonda & Shonda purchases the new computer? B. What will be the impact on net operating income if Shonda & Shonda purchases the new computer? C. What would be your recommendation to Shonda & Shonda regarding this purchase?

- Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows: The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of 945,000 with terms of 2/10, n/30; the companys policy is to take all purchase discounts. The freight on the equipment would be 11,000, and installation costs would total 22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of 12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of 2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of 1,500. Rather than replace the equipment, one of Jonfrans production managers has suggested that the waste containers be purchased. One supplier has quoted a price of 27 per container. This price is 8 less than Jonfrans current manufacturing cost, which is as follows: Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at 45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate. Required: 1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative. 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative. 3. Which should Jonfran domake or buy the containers? What qualitative factors should be considered? (CMA adapted)Global Reach, Inc., is considering opening a new warehouse to serve the Southwest region. Darnell Moore, controller for Global Reach, has been reading about the advantages of foreign trade zones. He wonders if locating in one would be of benefit to his company, which imports about 90 percent of its merchandise (e.g., chess sets from the Philippines, jewelry from Thailand, pottery from Mexico, etc.). Darnell estimates that the new warehouse will store imported merchandise costing about 16.78 million per year. Inventory shrinkage at the warehouse (due to breakage and mishandling) is about 8 percent of the total. The average tariff rate on these imports is 5.5 percent. Required: 1. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in tariffs? Why? (Round your answer to the nearest dollar.) 2. Suppose that, on average, the merchandise stays in a Global Reach warehouse for nine months before shipment to retailers. Carrying cost for Global Reach is 6 percent per year. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.) 3. Suppose that the shifting economic situation leads to a new tariff rate of 13 percent, and a new carrying cost of 6.5 percent per year. To combat these increases, Global Reach has instituted a total quality program emphasizing reducing shrinkage. The new shrinkage rate is 7 percent. Given this new information, if Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.)Paul Swanson has an opportunity to acquire a franchise from The Yogurt Place, Inc., to dispense frozenyogurt products under The Yogurt Place name. Mr. Swanson has assembled the following informationrelating to the franchise:a. A suitable location in a large shopping mall can be rented for $3,500 per month.b. Remodeling and necessary equipment would cost $270,000. The equipment would have a 15-yearlife and an $18,000 salvage value. Straight-line depreciation would be used, and the salvage valuewould be considered in computing depreciation.c. Based on similar outlets elsewhere, Mr. Swanson estimates that sales would total $300,000 per year.Ingredients would cost 20% of sales.d. Operating costs would include $70,000 per year for salaries, $3,500 per year for insurance, and$27,000 per year for utilities. In addition, Mr. Swanson would have to pay a commission to TheYogurt Place, Inc., of 12.5% of sales.Required:(Ignore income taxes.)1. Prepare a contribution format income statement that…

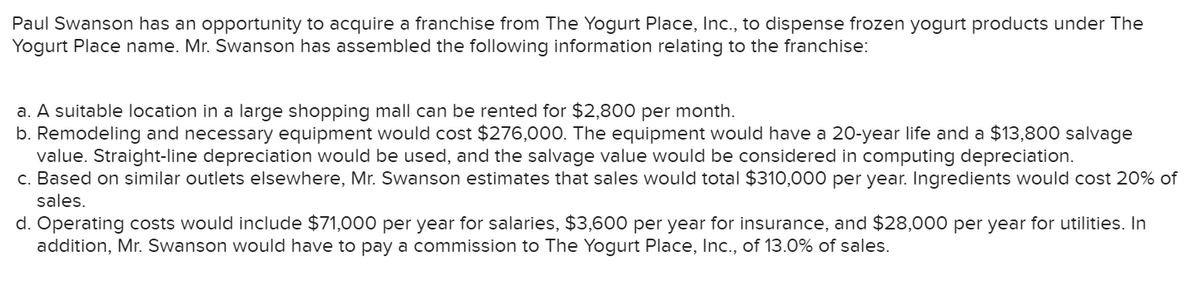

- Paul Swanson has an opportunity to acquire a franchise from The Yogurt Place, Inc., to dispense frozen yogurt products under The Yogurt Place name. Mr. Swanson has assembled the following information relating to the franchise: a. A suitable location in a large shopping mall can be rented for $3,400 per month. b. Remodeling and necessary equipment would cost $312,000. The equipment would have a 20-year life and a $15,600 salvage value. Straight-line depreciation would be used, and the salvage value would be considered in computing depreciation. c. Based on similar outlets elsewhere, Mr. Swanson estimates that sales would total $370,000 per year. Ingredients would cost 20% of sales. d. Operating costs would include $77,000 per year for salaries, $4,200 per year for insurance, and $34,000 per year for utilities. In addition, Mr. Swanson would have to pay a commission to The Yogurt Place, Inc., of 11.0% of sales. Required: 1. Prepare a contribution format income statement that shows the…Paul Swanson has an opportunity to acquire a franchise from The Yogurt Place, Incorporated, to dispense frozen yogurt products under The Yogurt Place name. Mr. Swanson has assembled the following information relating to the franchise: A suitable location in a large shopping mall can be rented for $3,200 per month. Remodeling and necessary equipment would cost $300,000. The equipment would have a 20-year life and a $15,000 salvage value. Straight-line depreciation would be used, and the salvage value would be considered in computing depreciation. Based on similar outlets elsewhere, Mr. Swanson estimates that sales would total $350,000 per year. Ingredients would cost 20% of sales. Operating costs would include $75,000 per year for salaries, $4,000 per year for insurance, and $32,000 per year for utilities. In addition, Mr. Swanson would have to pay a commission to The Yogurt Place, Incorporated, of 15.0% of sales. Required: 1. Prepare a contribution format income statement that…Paul Swanson has an opportunity to acquire a franchise from The Yogurt Place, Inc., to dispense frozen yogurt products under The Yogurt Place name. Mr. Swanson has assembled the following information relating to the franchise: A suitable location in a large shopping mall can be rented for $4,300 per month. Remodeling and necessary equipment would cost $366,000. The equipment would have a 20-year life and a $18,300 salvage value. Straight-line depreciation would be used, and the salvage value would be considered in computing depreciation. Based on similar outlets elsewhere, Mr. Swanson estimates that sales would total $460,000 per year. Ingredients would cost 20% of sales. Operating costs would include $86,000 per year for salaries, $5,100 per year for insurance, and $43,000 per year for utilities. In addition, Mr. Swanson would have to pay a commission to The Yogurt Place, Inc., of 12.0% of sales. Required: 1. Prepare a contribution format income statement that shows the expected…

- Dunn Inc. owns and operates a number of hardware stores in the New England region. Recently, the company has decided to locate another store in a rapidly growing area of Maryland. The company is trying to decide whether to purchase or lease the building and related facilities. Purchase: The company can purchase the site, construct the building, and purchase all store fixtures. The cost would be $1,850,000. An immediate down payment of $400,000 is required, and the remaining $1,450,000 would be paid off over 5 years at $350,000 per year (including interest payments made at end of year). The property is expected to have a useful life of 12 years, and then it will be sold for $500,000. As the owner of the property, the company will have the following out-of-pocket expenses each period. Property taxes (to be paid at the end of each year) $40,000 Insurance (to be paid at the beginning of each year) 27,000 Other (primarily maintenance which occurs at the end of each year) 16,000…You are the CFO of Carla Vista, Inc.a retailer of the exercise machine Carla Vista6 and related accessoriesYour firm is considering opening a new store in Los AngelesThe store will have a life of 20 yearsIt will generate annual sales of 5,900 exercise machinesand the price of each machine is $2,950. The annual sales of accessories will be $600,000, and the operating expenses of running the stor including labor and rentwill amount to 50 percent of the revenues from the exercise machines. The initial investment in the store wi equal $26,800,000 and will be fully depreciated on a straightline basis over the 20-year life of the storeYour firm will need to invest $3,000,000 in additional working capital immediately and recover it at the end of the investmentYour firm's marginal tax rate is 30 percent. The opportunity cost of opening up the store is 13.00 percent What are the incremental free cash flows from this project at the beginning of the project as well as in years 1-19 and 20? (Do…Now that Tracy has completed her first year in her business, she would like to expand to another location. She has looked at a property near Ft. Lee. She feels this is a prime location since she could provide cupcakes for events and office celebrations at Ft. Lee. She can purchase the property for $48,000 and believes she can build a building with all of the equipment for an additional $148,000. The estimated sales at the new location is $223,000 with a net operating income of $53,000. The minimum acceptable return for these types of investments is 23%. Tracy remembers studying return on investment and residual income from her college classes but needs you to do the calculations and explain what the numbers mean. A.explaining residual income and return on investment on this new venture. B.Calculate both, explain your calculations, and if this will be a good investment for her. Your paper is to be at least one page.