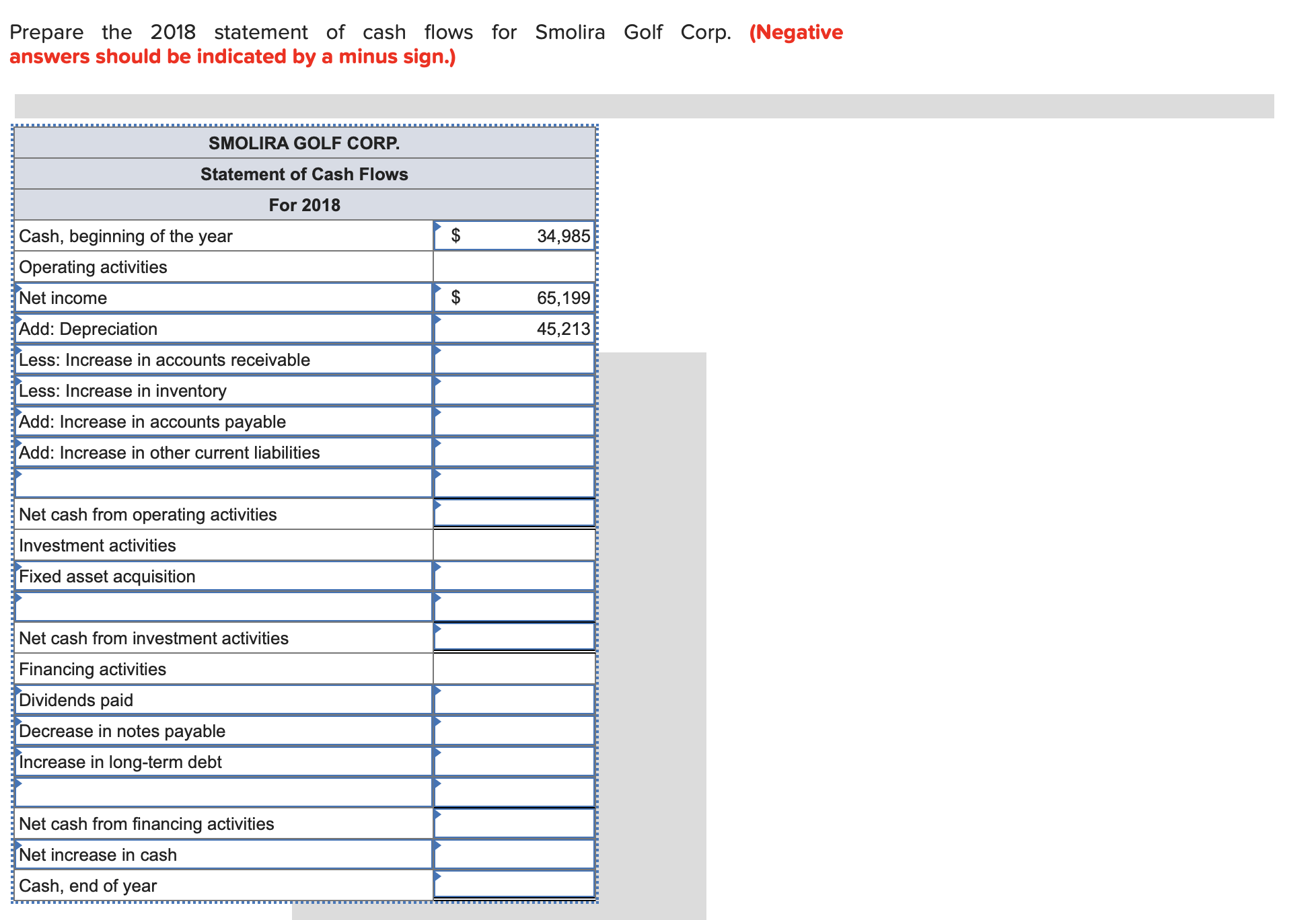

Prepare the 2018 statement of cash flows for Smolira Golf Corp. answers should be indicated by a minus sign.) (Negative SMOLIRA GOLF CORP. Statement of Cash Flows For 2018 Cash, beginning of the year 2$ 34,985 Operating activities Net income 65,199 Add: Depreciation 45,213 Less: Increase in accounts receivable Less: Increase in inventory Add: Increase in accounts payable Add: Increase in other current liabilities Net cash from operating activities Investment activities Fixed asset acquisition Net cash from investment activities Financing activities Dividends paid Decrease in notes payable Increase in long-term debt Net cash from financing activities Net increase in cash Cash, end of year

Prepare the 2018 statement of cash flows for Smolira Golf Corp. answers should be indicated by a minus sign.) (Negative SMOLIRA GOLF CORP. Statement of Cash Flows For 2018 Cash, beginning of the year 2$ 34,985 Operating activities Net income 65,199 Add: Depreciation 45,213 Less: Increase in accounts receivable Less: Increase in inventory Add: Increase in accounts payable Add: Increase in other current liabilities Net cash from operating activities Investment activities Fixed asset acquisition Net cash from investment activities Financing activities Dividends paid Decrease in notes payable Increase in long-term debt Net cash from financing activities Net increase in cash Cash, end of year

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 27BE

Related questions

Question

| Some recent financial statements for Smolira Golf Corp. follow. |

| SMOLIRA GOLF CORP. 2017 and 2018 Balance Sheets |

||||||||||||||||

| Assets | Liabilities and Owners’ Equity | |||||||||||||||

| 2017 | 2018 | 2017 | 2018 | |||||||||||||

| Current assets | Current liabilities | |||||||||||||||

| Cash | $ | 34,985 | $ | 38,388 | Accounts payable | $ | 37,662 | $ | 42,882 | |||||||

| Accounts receivable | 18,101 | 28,306 | Notes payable | 19,608 | 16,650 | |||||||||||

| Inventory | 3,790 | 42,872 | Other | 20,404 | 25,114 | |||||||||||

| Total | $ | 56,876 | $ | 109,566 | Total | $ | 77,674 | $ | 84,646 | |||||||

| Long-term debt | $ | 118,000 | $ | 179,157 | ||||||||||||

| Owners’ equity | ||||||||||||||||

| Common stock and paid-in surplus | $ | 55,600 | $ | 55,600 | ||||||||||||

| |

270,497 | 310,696 | ||||||||||||||

| Fixed assets | ||||||||||||||||

| Net plant and equipment | $ | 464,895 | $ | 520,533 | Total | $ | 326,097 | $ | 366,296 | |||||||

| Total assets | $ | 521,771 | $ | 630,099 | Total liabilities and owners’ equity | $ | 521,771 | $ | 630,099 | |||||||

| SMOLIRA GOLF CORP. 2018 Income Statement |

|||||||

| Sales | $ | 509,454 | |||||

| Cost of goods sold | 361,428 | ||||||

| |

45,213 | ||||||

| Earnings before interest and taxes | $ | 102,813 | |||||

| Interest paid | 20,283 | ||||||

| Taxable income | $ | 82,530 | |||||

| Taxes (21%) | 17,331 | ||||||

| Net income | $ | 65,199 | |||||

| Dividends | $ | 25,000 | |||||

| Retained earnings | 40,199 | ||||||

|

Prepare the 2018 statement of |

Transcribed Image Text:Prepare the 2018 statement of cash flows for Smolira Golf Corp.

answers should be indicated by a minus sign.)

(Negative

SMOLIRA GOLF CORP.

Statement of Cash Flows

For 2018

Cash, beginning of the year

2$

34,985

Operating activities

Net income

65,199

Add: Depreciation

45,213

Less: Increase in accounts receivable

Less: Increase in inventory

Add: Increase in accounts payable

Add: Increase in other current liabilities

Net cash from operating activities

Investment activities

Fixed asset acquisition

Net cash from investment activities

Financing activities

Dividends paid

Decrease in notes payable

Increase in long-term debt

Net cash from financing activities

Net increase in cash

Cash, end of year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning