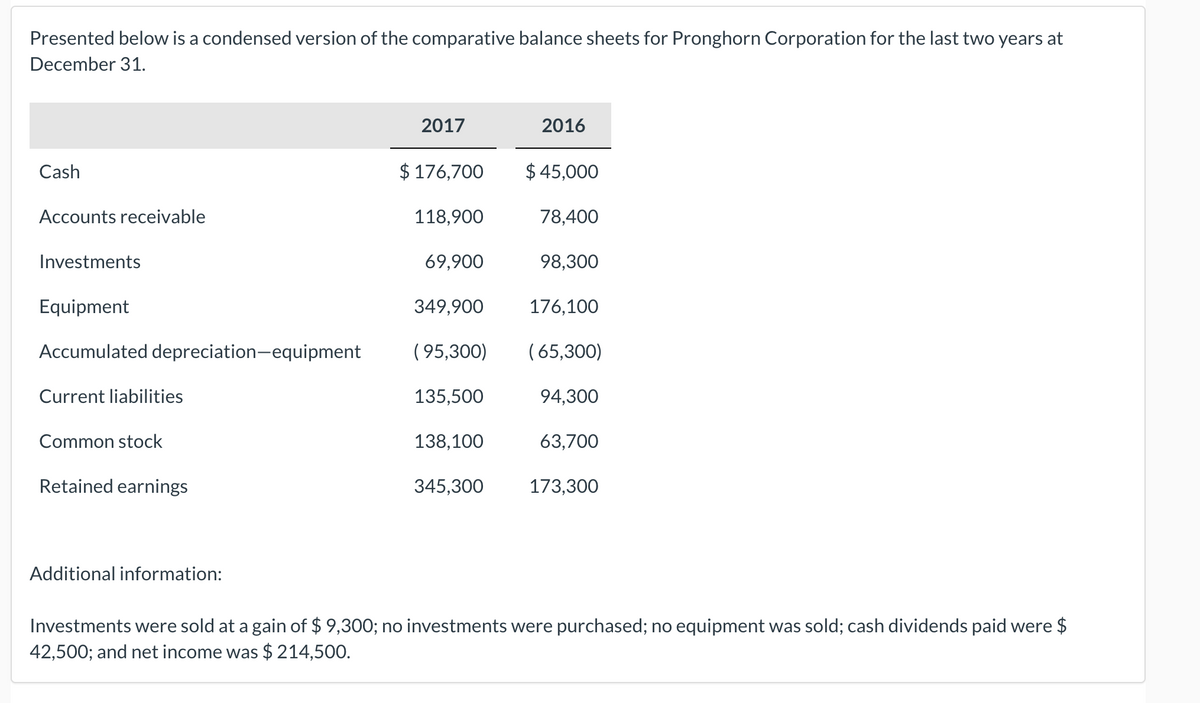

Presented below is a condensed version of the comparative balance sheets for Pronghorn Corporation for the last two years at December 31. 2017 2016 Cash $ 176,700 $ 45,000 Accounts receivable 118,900 78,400 Investments 69,900 98,300 Equipment 349,900 176,100 Accumulated depreciation-equipment ( 95,300) (65,300) Current liabilities 135,500 94,300 Common stock 138,100 63,700 Retained earnings 345,300 173,300 Additional information: Investments were sold at a gain of $ 9,300; no investments were purchased; no equipment was sold; cash dividends paid were $ 42,500; and net income was $ 214,500.

Presented below is a condensed version of the comparative balance sheets for Pronghorn Corporation for the last two years at December 31. 2017 2016 Cash $ 176,700 $ 45,000 Accounts receivable 118,900 78,400 Investments 69,900 98,300 Equipment 349,900 176,100 Accumulated depreciation-equipment ( 95,300) (65,300) Current liabilities 135,500 94,300 Common stock 138,100 63,700 Retained earnings 345,300 173,300 Additional information: Investments were sold at a gain of $ 9,300; no investments were purchased; no equipment was sold; cash dividends paid were $ 42,500; and net income was $ 214,500.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 6MCQ

Related questions

Question

100%

Transcribed Image Text:Determine Pronghorn Corporation's free cash flow. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in

parenthesis e.g. (15,000).)

Free cash flow

$4

%24

Transcribed Image Text:Presented below is a condensed version of the comparative balance sheets for Pronghorn Corporation for the last two years at

December 31.

2017

2016

Cash

$ 176,700

$ 45,000

Accounts receivable

118,900

78,400

Investments

69,900

98,300

Equipment

349,900

176,100

Accumulated depreciation-equipment

( 95,300)

(65,300)

Current liabilities

135,500

94,300

Common stock

138,100

63,700

Retained earnings

345,300

173,300

Additional information:

Investments were sold at a gain of $ 9,300; no investments were purchased; no equipment was sold; cash dividends paid were $

42,500; and net income was $ 214,500.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT