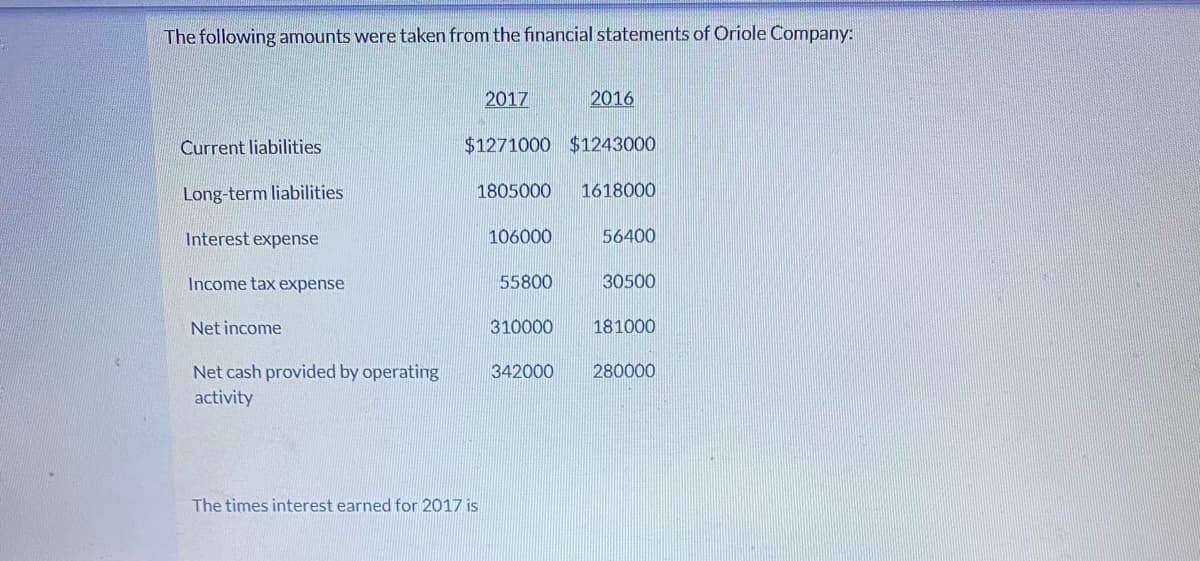

The following amounts were taken from the financial statements of Oriole Company: 2017 2016 Current liabilities $1271000 $1243000 Long-term liabilities 1805000 1618000 Interest expense 106000 56400 Income tax expense 55800 30500 Net income 310000 181000 Net cash provided by operating 342000 280000 activity The times interest earned for 2017 is

The following amounts were taken from the financial statements of Oriole Company: 2017 2016 Current liabilities $1271000 $1243000 Long-term liabilities 1805000 1618000 Interest expense 106000 56400 Income tax expense 55800 30500 Net income 310000 181000 Net cash provided by operating 342000 280000 activity The times interest earned for 2017 is

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 15GI: Jordan Company recognized a 5,000 unrealized holding gain on investment in Starbuckss common stock...

Related questions

Question

Transcribed Image Text:The following amounts were taken from the financial statements of Oriole Company:

2017

2016

Current liabilities

$1271000 $1243000

Long-term liabilities

1805000

1618000

Interest expense

106000

56400

Income tax expense

55800

30500

Net income

310000

181000

342000

280000

Net cash provided by operating

activity

The times interest earned for 2017 is

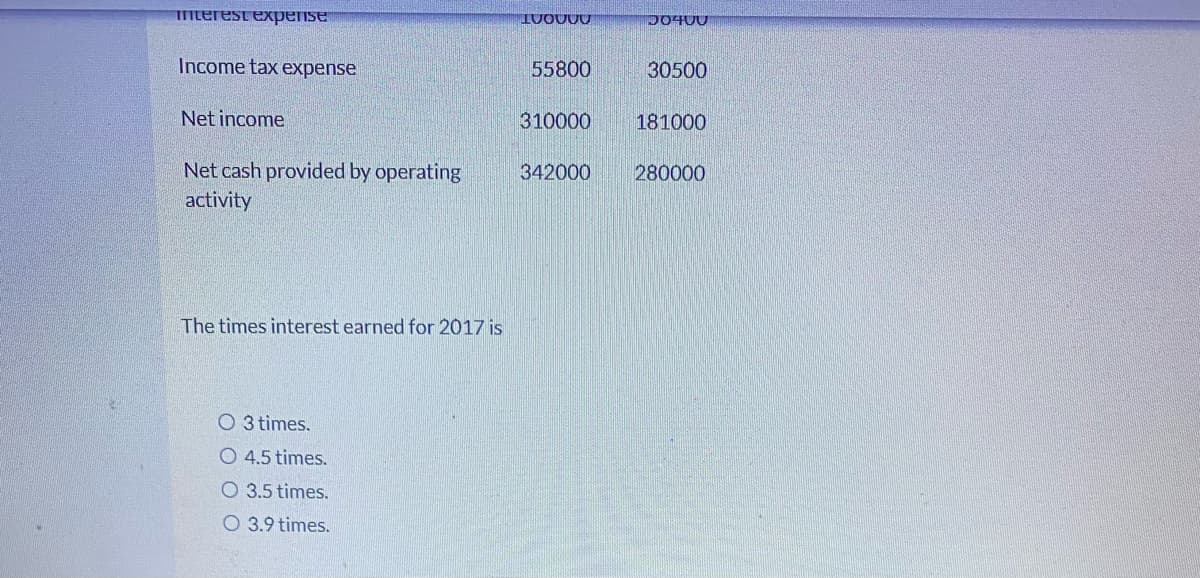

Transcribed Image Text:D0400

asuadxə isəja

Income tax expense

55800

30500

Net income

310000

181000

Net cash provided by operating

342000

280000

activity

The times interest earned for 2017 is

O 3 tìmes.

O 4.5 times.

O 3.5 times.

O 3.9 times.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning