Read the case study provided below and answer the questions that follow. COMFYCHAIRS LIMITED Comfychairs Limited commenced business on 01 November 2021. It manufactures a special type of chair designed to alleviate back pain. During the first month of operations 500 chairs were produced of which 300 were sold. The selling price was R1 500 per chair. The manufacturing costs for November 2021 included direct materials of R240 per unit, direct labour of R150 per unit, variable manufacturing overheads of R90 per unit and fixed manufacturing overheads of R120 000 per month. Fixed administration costs amounted to R60 000 per month. Marketing costs included a sales commission of 5% of the sales revenue and advertising costs of 4% of the sales revenue. During December 2021, 1 000 chairs were produced whilst 800 were sold. During this month the variable manufacturing costs per unit increased by 10% but all other costs remained the same or were determined in the same way as for November 2021. The selling price for chairs sold during December 2021 was increased by 5% because of the increase in some costs. Comfychairs Limited uses the first-in-first-out method in the management of its inventories. The directors asked for your help in producing the income statements using the variable costing and absorption costing methods. They say that they will use the statement that shows the higher profit when presenting the financial statements to the shareholders. nswer ALL the questions in this section. RUESTION 1 Prepare the Income Statement for the month ended 31 December 2021 using the absorption costing method.

Read the case study provided below and answer the questions that follow. COMFYCHAIRS LIMITED Comfychairs Limited commenced business on 01 November 2021. It manufactures a special type of chair designed to alleviate back pain. During the first month of operations 500 chairs were produced of which 300 were sold. The selling price was R1 500 per chair. The manufacturing costs for November 2021 included direct materials of R240 per unit, direct labour of R150 per unit, variable manufacturing overheads of R90 per unit and fixed manufacturing overheads of R120 000 per month. Fixed administration costs amounted to R60 000 per month. Marketing costs included a sales commission of 5% of the sales revenue and advertising costs of 4% of the sales revenue. During December 2021, 1 000 chairs were produced whilst 800 were sold. During this month the variable manufacturing costs per unit increased by 10% but all other costs remained the same or were determined in the same way as for November 2021. The selling price for chairs sold during December 2021 was increased by 5% because of the increase in some costs. Comfychairs Limited uses the first-in-first-out method in the management of its inventories. The directors asked for your help in producing the income statements using the variable costing and absorption costing methods. They say that they will use the statement that shows the higher profit when presenting the financial statements to the shareholders. nswer ALL the questions in this section. RUESTION 1 Prepare the Income Statement for the month ended 31 December 2021 using the absorption costing method.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

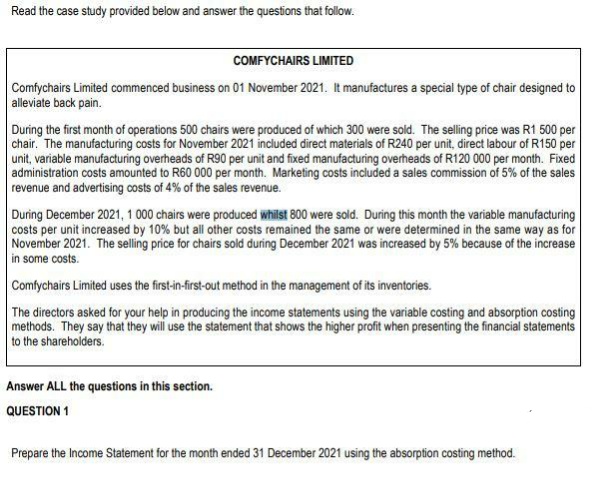

Transcribed Image Text:Read the case study provided below and answer the questions that follow.

COMFYCHAIRS LIMITED

Comfychairs Limited commenced business on 01 November 2021. It manufactures a special type of chair designed to

alleviate back pain.

During the first month of operations 500 chairs were produced of which 300 were sold. The selling price was R1 500 per

chair. The manufacturing costs for November 2021 included direct materials of R240 per unit, direct labour of R150 per

unit, variable manufacturing overheads of R90 per unit and fixed manufacturing overheads of R120 000 per month. Fixed

administration costs amounted to R60 000 per month. Marketing costs included a sales commission of 5% of the sales

revenue and advertising costs of 4% of the sales revenue.

During December 2021, 1 000 chairs were produced whilst 800 were sold. During this month the variable manufacturing

costs per unit increased by 10% but all other costs remained the same or were determined in the same way as for

November 2021. The selling price for chairs sold during December 2021 was increased by 5% because of the increase

in some costs.

Comfychairs Limited uses the first-in-first-out method in the management of its inventories.

The directors asked for your help in producing the income statements using the variable costing and absorption costing

methods. They say that they will use the statement that shows the higher profit when presenting the financial statements

to the shareholders.

Answer ALL the questions in this section.

QUESTION 1

Prepare the Income Statement for the month ended 31 December 2021 using the absorption costing method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Prepare the Income Statement for the month ended 31 December 2021 using the variable costing method.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education