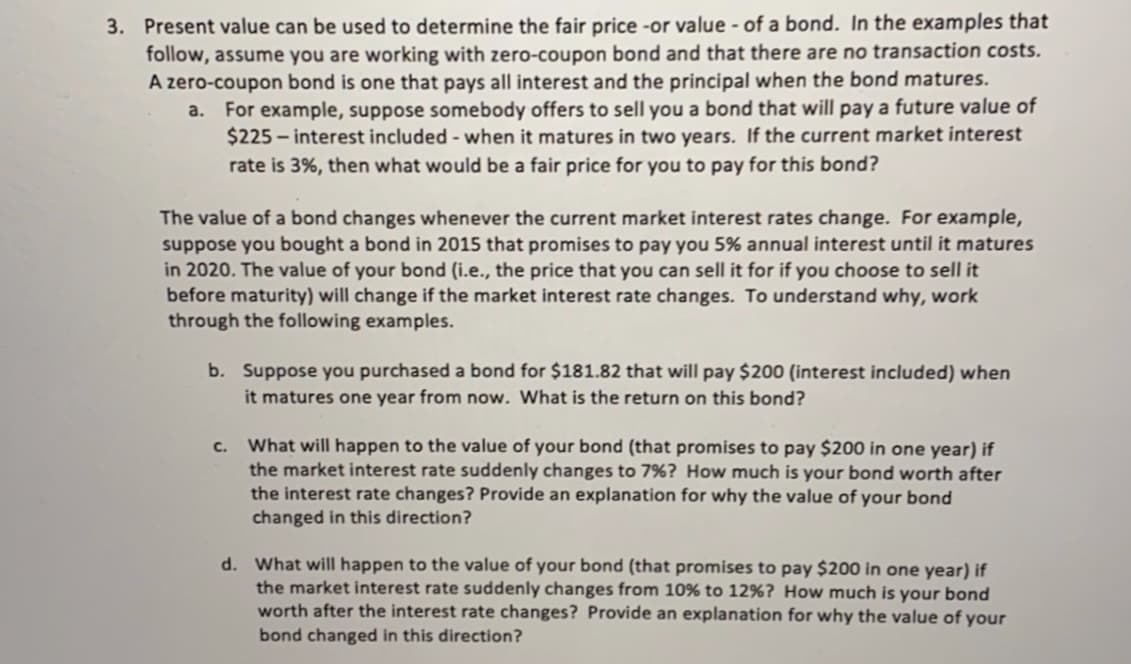

Present value can be used to determine the fair price -or value - of a bond. In the examples that follow, assume you are working with zero-coupon bond and that there are no transaction costs. A zero-coupon bond is one that pays all interest and the principal when the bond matures. a. For example, suppose somebody offers to sell you a bond that will pay a future value of $225 – interest included - when it matures in two years. If the current market interest rate is 3%, then what would be a fair price for you to pay for this bond? The value of a bond changes whenever the current market interest rates change. For example, suppose you bought a bond in 2015 that promises to pay you 5% annual interest until it matures in 2020. The value of your bond (i.e., the price that you can sell it for if you choose to sell it before maturity) will change if the market interest rate changes. To understand why, work through the following examples. b. Suppose you purchased a bond for $181.82 that will pay $200 (interest included) when it matures one year from now. What is the return on this bond? c. What will happen to the value of your bond (that promises to pay $200 in one year) if the market interest rate suddenly changes to 7%? How much is your bond worth after the interest rate changes? Provide an explanation for why the value of your bond changed in this direction?

Present value can be used to determine the fair price -or value - of a bond. In the examples that follow, assume you are working with zero-coupon bond and that there are no transaction costs. A zero-coupon bond is one that pays all interest and the principal when the bond matures. a. For example, suppose somebody offers to sell you a bond that will pay a future value of $225 – interest included - when it matures in two years. If the current market interest rate is 3%, then what would be a fair price for you to pay for this bond? The value of a bond changes whenever the current market interest rates change. For example, suppose you bought a bond in 2015 that promises to pay you 5% annual interest until it matures in 2020. The value of your bond (i.e., the price that you can sell it for if you choose to sell it before maturity) will change if the market interest rate changes. To understand why, work through the following examples. b. Suppose you purchased a bond for $181.82 that will pay $200 (interest included) when it matures one year from now. What is the return on this bond? c. What will happen to the value of your bond (that promises to pay $200 in one year) if the market interest rate suddenly changes to 7%? How much is your bond worth after the interest rate changes? Provide an explanation for why the value of your bond changed in this direction?

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter8: Savings,investment And The Financial System

Section: Chapter Questions

Problem 7PA

Related questions

Question

Transcribed Image Text:3. Present value can be used to determine the fair price -or value - of a bond. In the examples that

follow, assume you are working with zero-coupon bond and that there are no transaction costs.

A zero-coupon bond is one that pays all interest and the principal when the bond matures.

For example, suppose somebody offers to sell you a bond that will pay a future value of

$225 – interest included - when it matures in two years. If the current market interest

rate is 3%, then what would be a fair price for you to pay for this bond?

a.

The value of a bond changes whenever the current market interest rates change. For example,

suppose you bought a bond in 2015 that promises to pay you 5% annual interest until it matures

in 2020. The value of your bond (i.e., the price that you can sell it for if you choose to sell it

before maturity) will change if the market interest rate changes. To understand why, work

through the following examples.

b. Suppose you purchased a bond for $181.82 that will pay $200 (interest included) when

it matures one year from now. What is the return on this bond?

What will happen to the value of your bond (that promises to pay $200 in one year) if

the market interest rate suddenly changes to 7%? How much is your bond worth after

the interest rate changes? Provide an explanation for why the value of your bond

changed in this direction?

с.

d. What will happen to the value of your bond (that promises to pay $200 in one year) if

the market interest rate suddenly changes from 10% to 12%? How much is your bond

worth after the interest rate changes? Provide an explanation for why the value of your

bond changed in this direction?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning