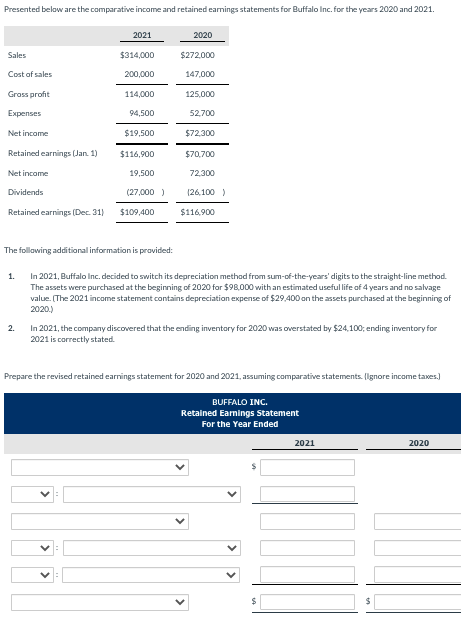

Presented below are the comparative income and retained eamings statements for Buffalo Inc. for the years 2020 and 2021. 2021 2020 Sales $314,000 $272000 Cost of sales 200,000 147,000 Gross profit 114,000 125.000 Expenses 94.500 52.700 Net income $19,500 $72.300 Retained earnings (Jan. 1) $116,900 $70.700 Net income 19,500 72300 Dividends (27.000 ) (26.100 ) Retained earnings (Dec. 31) $109,400 $116.900 The following additional information is provided: 1. In 2021, Buffalo Inc. decided to switch its depreciation method from sum-of-the-years' digits to the straight-line method. The assets were purchased at the beginning of 2020 for $98.000 with an estimated usefulife of 4 years and no salvage value. (The 2021 income statement contains depreciation expense of $29,400 on the assets purchased at the beginning of 2020) 2. In 2021, the company discovered that the ending inventory for 2020 was overstated by $24,100; ending inventory for 2021 is correctly stated. Prepare the revised retained earnings statement for 2020 and 2021, assuming comparative statements. lignore income taxes) BUFFALO INC. Retained Earnings Statement For the Year Ended 2021 2020

Presented below are the comparative income and retained eamings statements for Buffalo Inc. for the years 2020 and 2021. 2021 2020 Sales $314,000 $272000 Cost of sales 200,000 147,000 Gross profit 114,000 125.000 Expenses 94.500 52.700 Net income $19,500 $72.300 Retained earnings (Jan. 1) $116,900 $70.700 Net income 19,500 72300 Dividends (27.000 ) (26.100 ) Retained earnings (Dec. 31) $109,400 $116.900 The following additional information is provided: 1. In 2021, Buffalo Inc. decided to switch its depreciation method from sum-of-the-years' digits to the straight-line method. The assets were purchased at the beginning of 2020 for $98.000 with an estimated usefulife of 4 years and no salvage value. (The 2021 income statement contains depreciation expense of $29,400 on the assets purchased at the beginning of 2020) 2. In 2021, the company discovered that the ending inventory for 2020 was overstated by $24,100; ending inventory for 2021 is correctly stated. Prepare the revised retained earnings statement for 2020 and 2021, assuming comparative statements. lignore income taxes) BUFFALO INC. Retained Earnings Statement For the Year Ended 2021 2020

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 1E

Related questions

Question

100%

Transcribed Image Text:Presented below are the comparative income and retained eamings statements for Buffalo Inc. for the years 2020 and 2021.

2021

2020

Sales

$314,000

$272,000

Cost of sales

200,000

147,000

Gross profit

114,000

125,000

Еxpenses

94,500

52,700

Net income

$19,500

$72,300

Retained earnings (Jan. 1)

$116,900

$70,700

Net income

19,500

72,300

Dividends

(27,000 )

(26,100 )

Retained earnings (Dec. 31)

$109,400

$116,900

The follawing additional information is provided:

In 2021, Buffalo Inc. decided to switch its depreciation method from sum-of-the-years' digits to the straight-line method.

The assets were purchased at the beginning of 2020 for $98,000 with an estimated useful life of 4 years and no salvage

value. (The 2021 income statement contains depreciation expense of $29,400 on the assets purchased at the beginning of

2020.)

1.

In 2021, the company discovered that the ending inventory for 2020 was overstated by $24,100; ending inventory for

2021 is correctly stated.

2.

Prepare the revised retained earnings statement for 2020 and 2021, assuming comparative statements. (lgnore income taxes.)

BUFFALO INC.

Retained Earnings Statement

For the Year Ended

2021

2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning