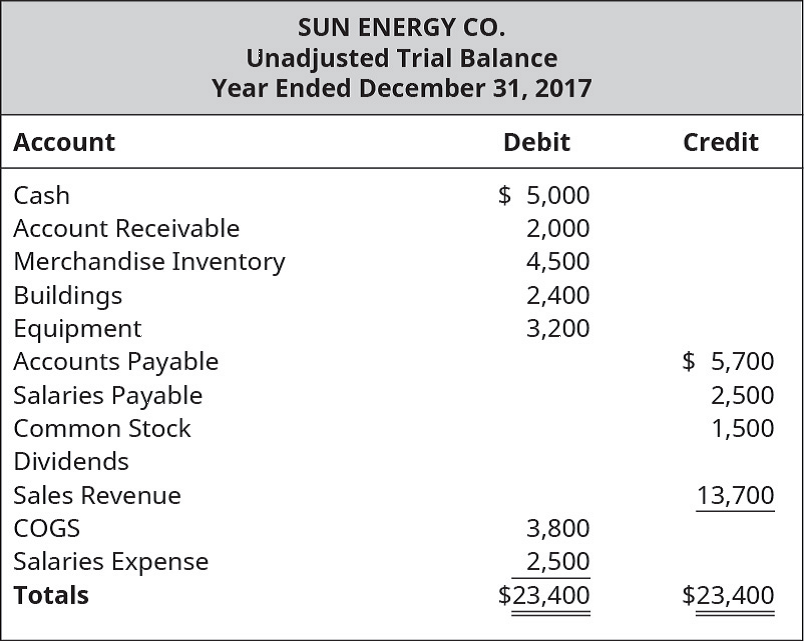

Following is the unadjusted

You are also given the following supplemental information: A pending lawsuit, claiming $2,700 in damages, is considered likely to favor the plaintiff and can be reasonably estimated. Sun Energy Co. believes a customer may win a lawsuit for $3,500 in damages, but the outcome is only reasonably possible to occur. Sun Energy calculated warranty expense estimates of $210.

A. Using the unadjusted trial balance and supplemental information for Sun Energy Co., construct an income statement for the year ended December 31, 2017. Pay particular attention to expenses resulting from contingencies.

B. Construct a balance sheet, for December 31, 2017, from the given unadjusted trial balance, supplemental information, and income statement for Sun Energy Co., paying particular attention to contingent liabilities.

C. Prepare any necessary

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Principles of Accounting Volume 1

Additional Business Textbook Solutions

Principles of Management

Financial Accounting (12th Edition) (What's New in Accounting)

Managerial Accounting (4th Edition)

Cost Accounting (15th Edition)

Horngren's Accounting (12th Edition)

Construction Accounting And Financial Management (4th Edition)

- Following is the unadjusted trial balance for Pens Unlimited on December 31, 2017. You are also given the following supplemental information: A pending lawsuit, claiming $4,200 in damages, is considered likely to favor the plaintiff and can be reasonably estimated. Pens Unlimited believes a customer may win a lawsuit for $5,000 in damages, but the outcome is only reasonably possible to occur. Pens Unlimited records warranty estimates on the basis of 2% of annual sales revenue. A. Using the unadjusted trial balance and supplemental information for Pens Unlimited, construct an income statement for the year ended December 31, 2017. Pay particular attention to expenses resulting from contingencies. B. Construct a balance sheet, for December 31, 2017, from the given unadjusted trial balance, supplemental information, and income statement for Pens Unlimited. Pay particular attention to contingent liabilities. C. Prepare any necessary contingent liability note disclosures for Pens Unlimited. Only give one to three sentences for each contingency note disclosure.arrow_forwardAxel Brick Company has a lawsuit pending from a customer claiming $100,000 in damages. Axel's attorney advises the likelihood the customer will win the lawsuit is reasonably probable. GAAP requires at a minimum that this contingent liability be... A. Disclosed in a note to the financial statements B. Record as a liability on the balance sheet C. Record as an expense on the income statementarrow_forwardOn December 31, 2019, Home Company was a defendant in a pending lawsuit. The suit arose from the alleged defect of a product that Home sold in 2015. In the opinion of Home’s attorney, it is probable that Home will have to pay P500,000 and it is reasonably possible that Home will have to pay additional P100,000 as a result of this lawsuit. What amount needs to be disclosed only?arrow_forward

- The following selected circumstances relate to pending lawsuits for Erismus, Inc. Erismus’s fiscal year ends on December 31. Financial statements are issued in March 2017. Erismus prepares its financial statements according to U.S. GAAP. Required: Indicate the amount of asset or liability that Erismus would record, and explain your answer. 1. Erismus is defending against a lawsuit. Erismus’s management believes the company has a slightly worse than 50/50 chance of eventually prevailing in court, and that if it loses, the judgment will be $1,000,000. 2. Erismus is defending against a lawsuit. Erismus’s management believes it is probable that the company will lose in court. If it loses, management believes that damages could fall anywhere in the range of $2,000,000 to $4,000,000, with any damage in that range equally likely. 3. Erismus is defending against a lawsuit. Erismus’s management believes it is probable that the company will lose in court. If it loses, management believes that…arrow_forwardOn November 5, 2020, a Dunn Company truck was in an accident with an auto driven by Bell. The entity received notice on January 12, 2021 of a lawsuit for P700,000 damages for personal injuries suffered by Bell. The entity's counsel believed it is probable that Bell will be awarded an estimated amount in the range between P200,000 and P500,000. The possible outcomes are equally likely. The accounting year ends on December 31 and the 2020 financial statements were issued on March 31, 2021. What amount of provision should be accrued on December 31, 2020?arrow_forwardROSE Company entered into a lawsuit on December 20, 2021 and recognized on the same date a provision of ₱2,000,000. On February 28, 2022, when the financial statements for the year ended December 31, 2021 had not yet been authorized for issue, the case was settled and the court decided the final total damages to be paid by the entity at ₱3,000,000. In addition, the Company has a loan payable of ₱2,000,000 due on June 30, 2022. On January 1, 2022, before the authorization of the issuance of financial statements, the bank agreed to refinance the loan, extending the maturity to June 30, 2024. Also, another loan amounting to ₱7,000,000 due on December 1, 2022 was obtained by the Company on January 2, 2022 from BPI. ROSE Company has the discretion to refinance or roll over the loan for at least twelve months from December 31, 2022. At what amount should the non-current liability be presented in the statement of financial position? ₱ 2,000,000 ₱…arrow_forward

- ROSE Company entered into a lawsuit on December 20, 2021 and recognized on the same date a provision of ₱2,000,000. On February 28, 2022, when the financial statements for the year ended December 31, 2021 had not yet been authorized for issue, the case was settled and the court decided the final total damages to be paid by the entity at ₱3,000,000. In addition, the Company has a loan payable of ₱2,000,000 due on June 30, 2022. On January 1, 2022, before the authorization of the issuance of financial statements, the bank agreed to refinance the loan, extending the maturity to June 30, 2024. Also, another loan amounting to ₱7,000,000 due on December 1, 2022 was obtained by the Company on January 2, 2022 from BPI. ROSE Company has the discretion to refinance or roll over the loan for at least twelve months from December 31, 2022. REQUIRED: 1. At what amount should the current liability be presented in the statement of financial position? 2. At what amount should the non-current…arrow_forwardOn January 1, 2021, a Dune Corporation truck was in an accident with an auto driven by R. Bell. Dune received notice on January 12, 2021, of a lawsuit for $700,000 in damages for personal injuries suffered by Bell. Dune Corporation’s legal counsel believes it is probable that Bell will be awarded an estimated amount in the range between $200,000 and $500,000, Dune’s accounting year ends on December 31, and the 2020 financial statements were issued on March 31, 2021. What amount of provision should Dune accrue on December 31, 2020?arrow_forwardThe following selected circumstances relate to pending lawsuits for Erismus, Incorporated Erismus’s fiscal year ends on December 31. Financial statements are issued in March 2025. Erismus prepares its financial statements according to U.S. GAAP. Required: Indicate the amount Erismus would record as an asset, a liability or if no accrual would be necessary in the following circumstances. Erismus is defending against a lawsuit. Erismus's management believes the company has a slightly worse than 50/50 chance of eventually prevailing in court, and that if it loses, the judgment will be $1,430,000. Erismus is defending against a lawsuit. Erismus's management believes it is probable that the company will lose in court. If it loses, management believes that damages could fall anywhere in the range of $2,830,000 to $5,660,000, with any damage in that range equally likely. Erismus is defending against a lawsuit. Erismus's management believes it is probable that the company will lose in court.…arrow_forward

- Tyeso Company entered into a lawsuit on December 25, 2020 and recognized on the same date a provision of P2,000,000. On February 28, 2021, when the financial statements for the year ended December 31, 2020 had not yet been authorized for issue, the case was settled and the court decided the final total damages to paid by the entity at P3,000,000. In addition, the Company has a loan payable of P2,000,000 due on June 30, 2021. On January 1, 2021, before the authorization of the issuance of financial statements, the bank agreed to refinance the loan, extending the maturity to June 30, 2023. Also, another loan amounting to P7,000,000 due on December 1, 2021 was obtained by the Company from BDO. TYESO Company has the discretion to refinance or roll over the loan for at least twelve months from December 31, 2021. 1. Compute for the current liability to be presented in the financial position a. P12 million b. P10 million c. P5 million d. P4 million Answer: 2. Compute for…arrow_forwardBeautiful Company is involved in litigation regarding a faulty product sold in a prior year during 2021. The company has consulted with its attorney and determined that it is possible that they may lose the case. The attorneys estimated that there is a 40% chance of losing. If this is the case, their attorney estimated that the amount of any payment would be P500,000.How much is the Provision to be reported at December 31, 2021?arrow_forwardIn early January 2024, Bramble Corporation applied for a trade name, incurring legal costs of $15,600. In January 2025, Bramble incurred $9,000 of legal fees in a successful defense of its trade name.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning