1,000 room hotel for P24,000,000. Among othe lowing:1.Ten percent mobilization fee (deductible e within ten days from the signing of the contrac n all billings (to be paid with the final billing, upon cance of the project); and 3.Progress billings are t cceptance. By the end of 2019, the company hac

1,000 room hotel for P24,000,000. Among othe lowing:1.Ten percent mobilization fee (deductible e within ten days from the signing of the contrac n all billings (to be paid with the final billing, upon cance of the project); and 3.Progress billings are t cceptance. By the end of 2019, the company hac

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 6P

Related questions

Question

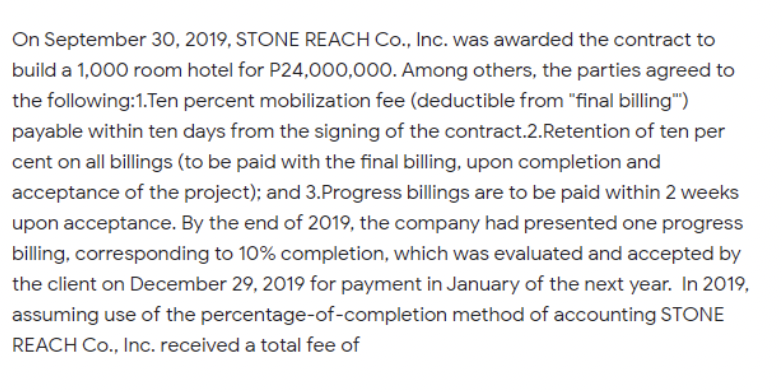

Transcribed Image Text:On September 30, 2019, STONE REACH Co., Inc. was awarded the contract to

build a 1,000 room hotel for P24,000,000. Among others, the parties agreed to

the following:1.Ten percent mobilization fee (deductible from "final billing")

payable within ten days from the signing of the contract.2.Retention of ten per

cent on all billings (to be paid with the final billing, upon completion and

acceptance of the project); and 3.Progress billings are to be paid within 2 weeks

upon acceptance. By the end of 2019, the company had presented one progress

billing, corresponding to 10% completion, which was evaluated and accepted by

the client on December 29, 2019 for payment in January of the next year. In 2019,

assuming use of the percentage-of-completion method of accounting STONE

REACH Co., Inc. received a total fee of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT