Proble Aborigine Company reported the fo- statement of financial position on J= Noncurrent assets Financial asset – FVOCI Market adjustment for unrealized loss Market value ther comprehensive income Unrealized loss An analysis of the investment p ollowing on December 31, 2020. YZ ordinary share BC ordinary share EST preference share On July 1, 2021, the ABC ordinar "2,100,000. On December 31, 2021, the remaining bllowing market value: YZ ordinary share ST preference share Cequired:

Proble Aborigine Company reported the fo- statement of financial position on J= Noncurrent assets Financial asset – FVOCI Market adjustment for unrealized loss Market value ther comprehensive income Unrealized loss An analysis of the investment p ollowing on December 31, 2020. YZ ordinary share BC ordinary share EST preference share On July 1, 2021, the ABC ordinar "2,100,000. On December 31, 2021, the remaining bllowing market value: YZ ordinary share ST preference share Cequired:

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 7P: Hamilton Companys balance sheet on January 1, 2019, was as follows: Korbel Company is considering...

Related questions

Question

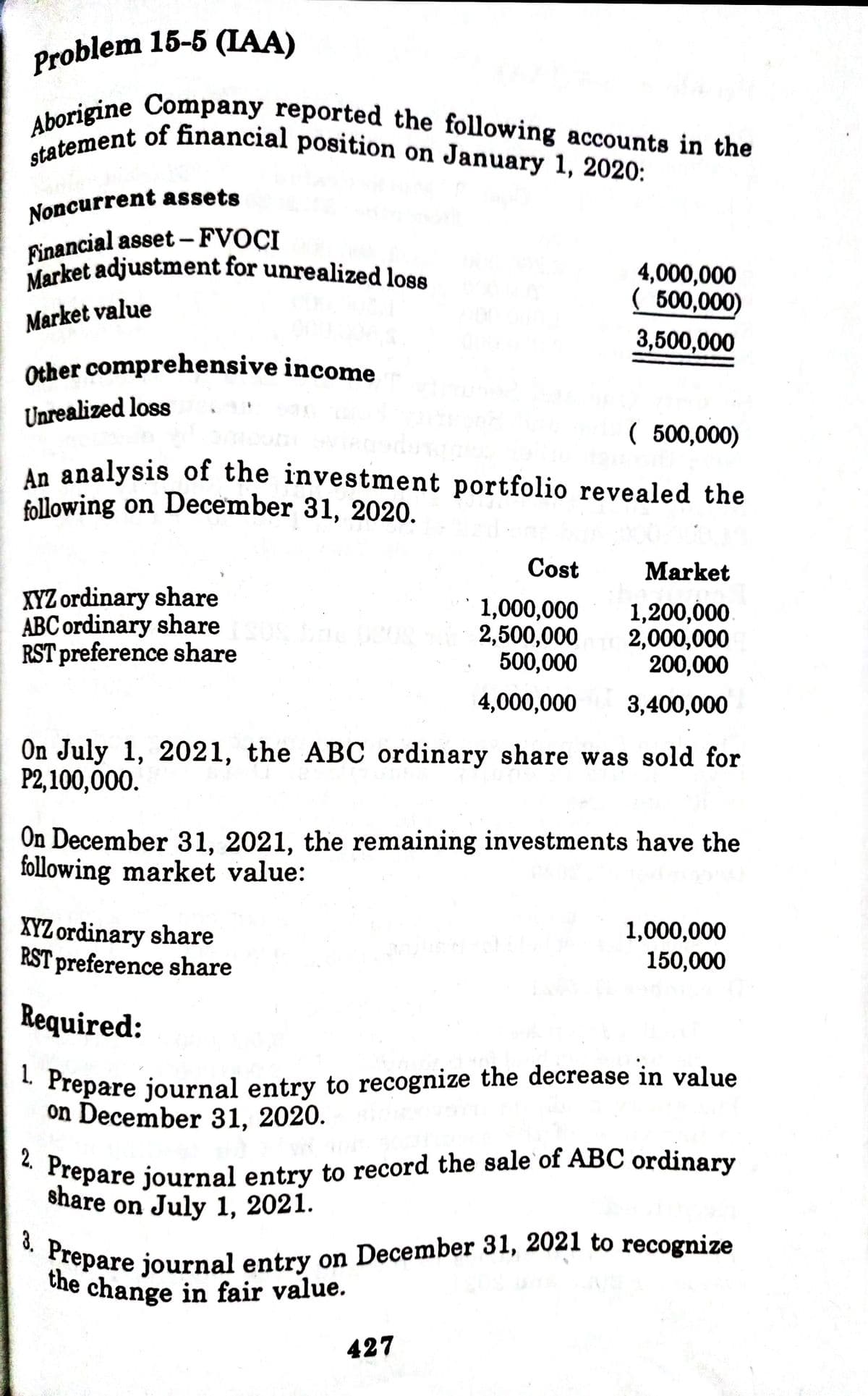

Transcribed Image Text:Problem 15-5 (IAA)

Prepare journal entry to record the sale`of ABC ordinary

statement of financial position on January 1, 2020:

Aborigine Company reported the following accounts in the

share on July 1, 2021.

Market adjustment for unrealized loss

the change in fair value.

3. Prepare journal entry on December 31, 2021 to recognize

A tement of hnancial position on January 1, 2020:

Noncurrent assets

Financial asset –FVOCI

Market adjustment for unrealized loss

4,000,000

( 500,000)

Market value

3,500,000

Other comprehensive income

Unrealized loss

( 500,000)

An analysis of the investment portfolio revealed the

following on December 31, 2020.

Cost

Market

XYZ ordinary share

ABC ordinary share

RST preference share

1,000,000

2,500,000

500,000

1,200,000

2,000,000

200,000

4,000,000

3,400,000

On July 1, 2021, the ABC ordinary share was sold for

P2,100,000.

On December 31, 2021, the remaining investments have the

following market value:

XYZ ordinary share

RST preference share

1,000,000

150,000

Required:

* Prepare journal entry to recognize the decrease in value

on December 31, 2020.

2.

427

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning