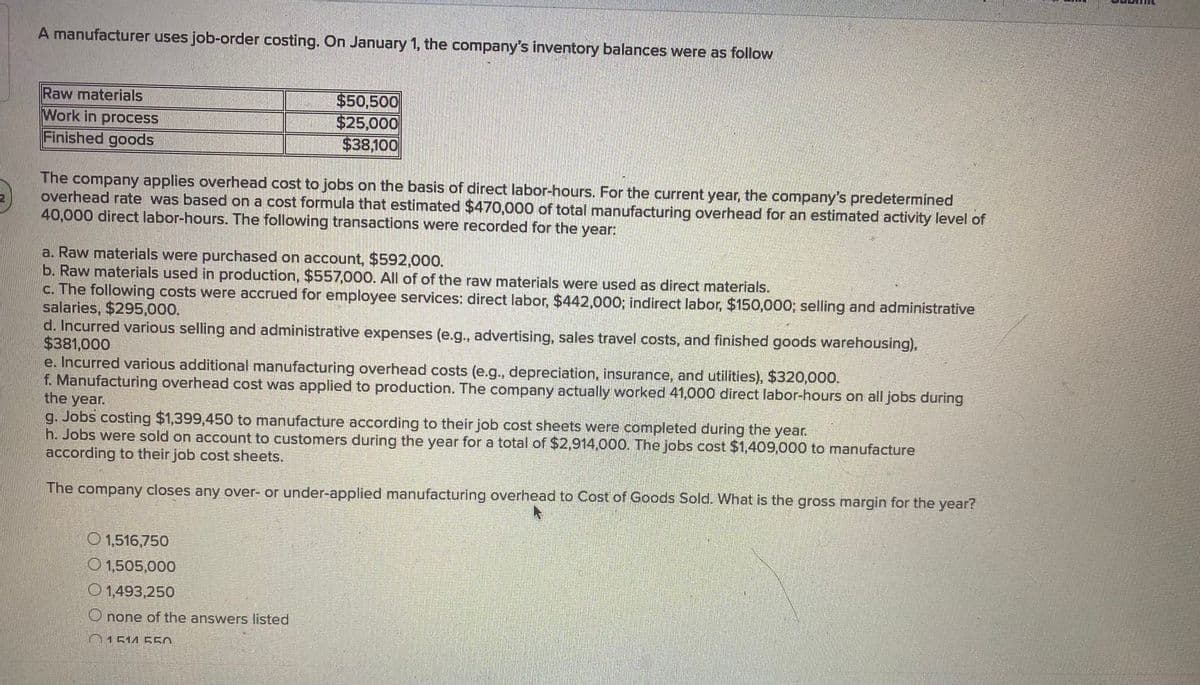

A manufacturer uses job-order costing. On January 1, the company's inventory balances were as follow Raw materials Work in process Finished goods $50,500 $25,000 $38,100 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate was based on a cost formula that estimated $470,000 of total manufacturing overhead for an estimated activity level o 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materials were purchased on account, $592,000. b. Raw materials used in production, $557,000. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $442,000; indirect labor, $150,000; selling and administrative salaries, $295,000. d. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousing), $381,000 e. Incurred various additional manufacturing overhead costs (e.g., depreciation, insurance, and utilities), $320,000. f. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all jobs during the year. g. Jobs costing $1,399,450 to manufacture according to their job cost sheets were completed during the year. h. Jobs were sold on account to customers during the year for a total of $2,914,000. The jobs cost $1,409,000 to manufacture according to their job cost sheets. The company closes any over- or under-applied manufacturing overhead to Cost of Goods Sold. What is the gross margin for the year?

A manufacturer uses job-order costing. On January 1, the company's inventory balances were as follow Raw materials Work in process Finished goods $50,500 $25,000 $38,100 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate was based on a cost formula that estimated $470,000 of total manufacturing overhead for an estimated activity level o 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materials were purchased on account, $592,000. b. Raw materials used in production, $557,000. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $442,000; indirect labor, $150,000; selling and administrative salaries, $295,000. d. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousing), $381,000 e. Incurred various additional manufacturing overhead costs (e.g., depreciation, insurance, and utilities), $320,000. f. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all jobs during the year. g. Jobs costing $1,399,450 to manufacture according to their job cost sheets were completed during the year. h. Jobs were sold on account to customers during the year for a total of $2,914,000. The jobs cost $1,409,000 to manufacture according to their job cost sheets. The company closes any over- or under-applied manufacturing overhead to Cost of Goods Sold. What is the gross margin for the year?

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter4: Accounting For Factory Overhead

Section: Chapter Questions

Problem 15E: The books of Petry Products Co. revealed that the following general journal entry had been made at...

Related questions

Question

Transcribed Image Text:A manufacturer uses job-order costing. On January 1, the company's inventory balances were as follow

Raw materials

Work in process

Finished goods

$50,500

$25,000

$38,100

The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined

overhead rate was based on a cost formula that estimated $470,000 of total manufacturing overhead for an estimated activity level of

40,000 direct labor-hours. The following transactions were recorded for the year:

a. Raw materials were purchased on account, $592,000.

b. Raw materials used in production, $557,000. All of of the raw materials were used as direct materials.

c. The following costs were accrued for employee services: direct labor, $442,000; indirect labor, $150,000; selling and administrative

salaries, $295,000.

d. Incurred various selling and administrative expenses (e.g, advertising, sales travel costs, and finished goods warehousing),

$381,000

e. Incurred various additional manufacturing overhead costs (e.g., depreciation, insurance, and utilities), $320,000.

f. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all jobs during

the year.

g. Jobs costing $1,399,450 to manufacture according to their job cost sheets were completed during the year.

h. Jobs were sold on account to customers during the year for a total of $2,914,000. The jobs cost $1,409,000 to manufacture

according to their job cost sheets.

The

company closes any over- or under-applied manufacturing overhead to Cost of Goods Sold. What is the gross margin for the year?

O 1,516,750

O 1,505,000

O 1,493,250

O none of the answers listed

01514 550

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,