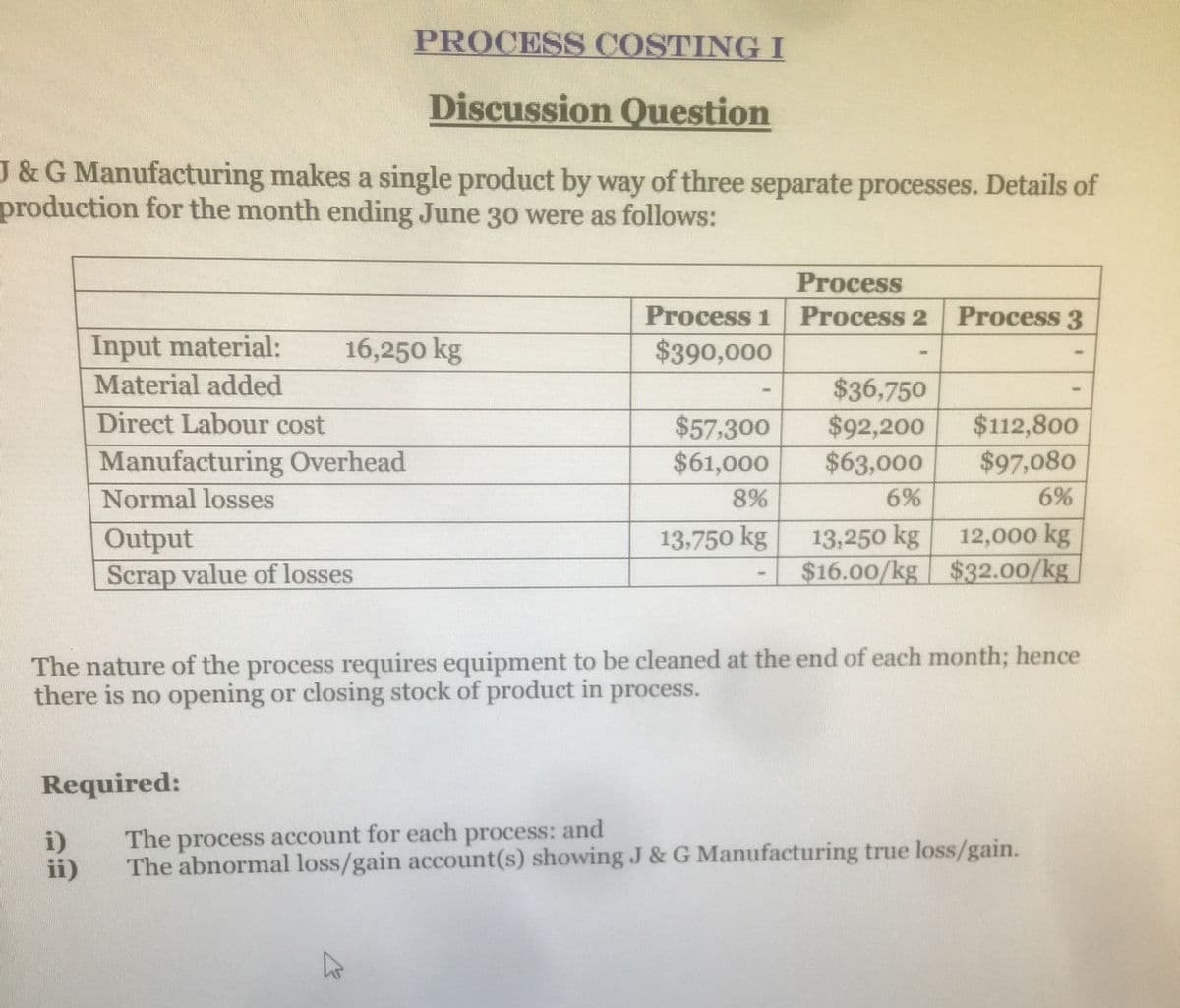

Discussion Question J&G Manufacturing makes a single product by way of three separate processes. Details of production for the month ending June 30 were as follows: Process Process 2 Process 1 Process 3 Input material: Material added 16,250 kg $390,000 $36,750 $92,200 Direct Labour cost $112,800 $57,300 $61,000 Manufacturing Overhead $63,000 $97,080 Normal losses 8% 6% 6% 12,000 kg Output Scrap value of losses 13,750 kg 13,250 kg $16.00/kg $32.00/kg The nature of the process requires equipment to be cleaned at the end of each month; hence there is no opening or closing stock of product in process. Required: i) ii) The process account for each process: and The abnormal loss/gain account(s) showing J & G Manufacturing true loss/gain.

Discussion Question J&G Manufacturing makes a single product by way of three separate processes. Details of production for the month ending June 30 were as follows: Process Process 2 Process 1 Process 3 Input material: Material added 16,250 kg $390,000 $36,750 $92,200 Direct Labour cost $112,800 $57,300 $61,000 Manufacturing Overhead $63,000 $97,080 Normal losses 8% 6% 6% 12,000 kg Output Scrap value of losses 13,750 kg 13,250 kg $16.00/kg $32.00/kg The nature of the process requires equipment to be cleaned at the end of each month; hence there is no opening or closing stock of product in process. Required: i) ii) The process account for each process: and The abnormal loss/gain account(s) showing J & G Manufacturing true loss/gain.

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter5: Process Cost Accounting—general Procedures

Section: Chapter Questions

Problem 6E: The records of Burris Inc. reflect the following data: Work in process, beginning of month2,000...

Related questions

Question

Please answer question

Transcribed Image Text:PROCESS COSTING I

Discussion Question

J&G Manufacturing makes a single product by way of three separate processes. Details of

production for the month ending June 30 were as follows:

Process

Process 1

Process 2

Process 3

Input material:

Material added

16,250 kg

$390,000

$36,750

$92,200

$63,000

$112,800

$97,080

Direct Labour cost

$57,300

$61,000

Manufacturing Overhead

Normal losses

8%

6%

6%

13,750 kg

13,250 kg

12,000 kg

Output

Scrap value of losses

$16.00/kg $32.00/kg

The nature of the process requires equipment to be cleaned at the end of each month; hence

there is no opening or closing stock of product in process.

Required:

i)

ii)

The process account for each process: and

The abnormal loss/gain account(s) showing J & G Manufacturing true loss/gain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,