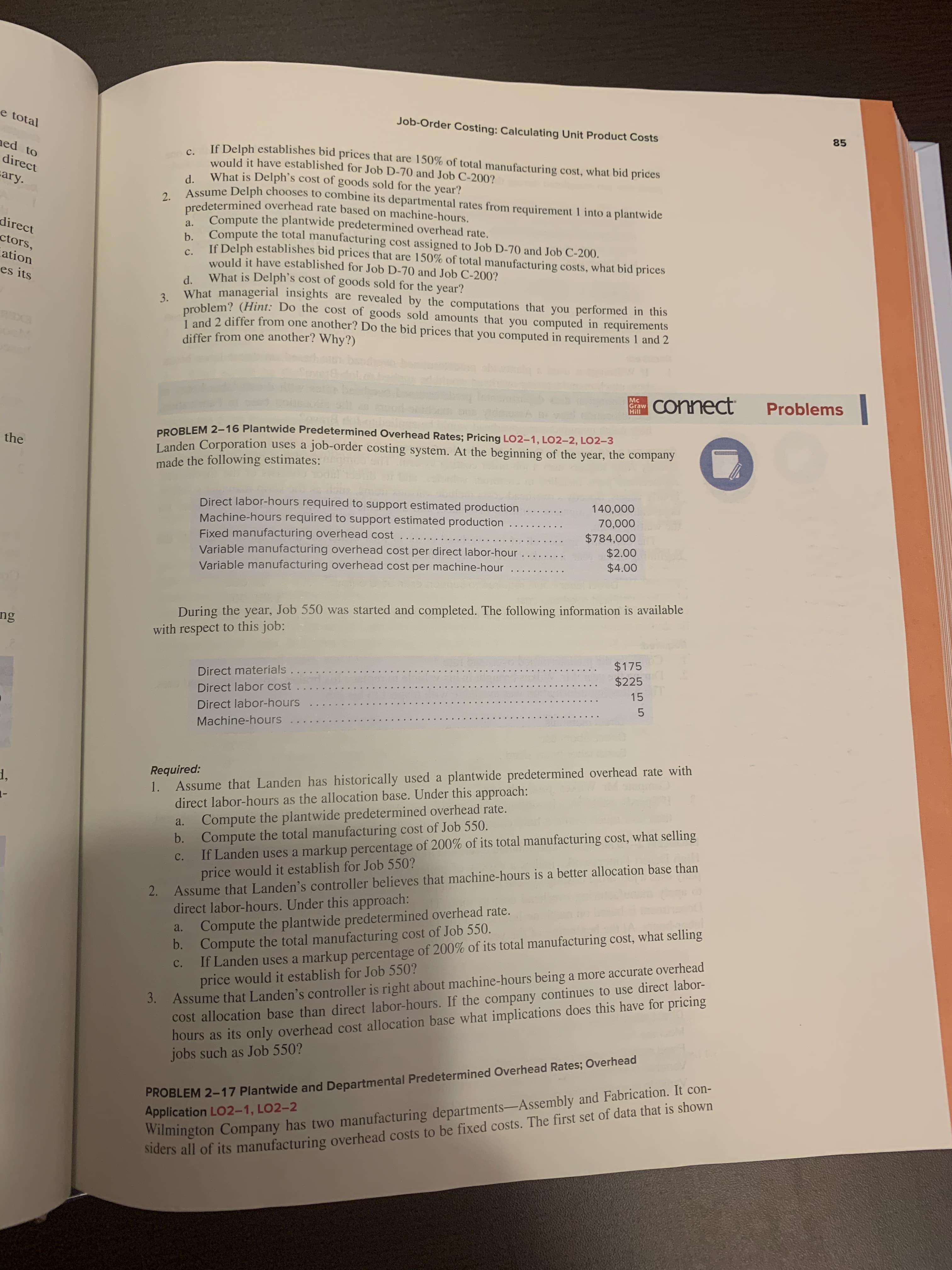

PROBLEM 2-16 Plantwide Predetermined Overhead Rates; Pricing LO2-1, LO2–2, LO2-3 Landen Corporation uses a job-order costing system. At the beginning of the year, the company made the following estimates: Direct labor-hours required to support estimated production Machine-hours required to support estimated production Fixed manufacturing overhead cost ... Variable manufacturing overhead cost per direct labor-hour Variable manufacturing overhead cost per machine-hour 140,000 70,000 $784,000 $2.00 $4.00 During the year, Job 550 was started and completed. The following information is available with respect to this job: Direct materials.... Direct labor cost.. $175 $225 Direct labor-hours 15 Machine-hours Required: 1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550? a. с. 2. Assume that Landen's controller believes that machine-hours is a better allocation base than direct labor-hours. Under this approach: Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550? Assume that Landen's controller is right about machine-hours being a more accurate overhead cost allocation base than direct labor-hours. If the company continues to use direct labor- hours as its only overhead cost allocation base what implications does this have for pricing jobs such as Job 550? a. с. ulhond Pates: Overhead 3.

PROBLEM 2-16 Plantwide Predetermined Overhead Rates; Pricing LO2-1, LO2–2, LO2-3 Landen Corporation uses a job-order costing system. At the beginning of the year, the company made the following estimates: Direct labor-hours required to support estimated production Machine-hours required to support estimated production Fixed manufacturing overhead cost ... Variable manufacturing overhead cost per direct labor-hour Variable manufacturing overhead cost per machine-hour 140,000 70,000 $784,000 $2.00 $4.00 During the year, Job 550 was started and completed. The following information is available with respect to this job: Direct materials.... Direct labor cost.. $175 $225 Direct labor-hours 15 Machine-hours Required: 1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550? a. с. 2. Assume that Landen's controller believes that machine-hours is a better allocation base than direct labor-hours. Under this approach: Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550? Assume that Landen's controller is right about machine-hours being a more accurate overhead cost allocation base than direct labor-hours. If the company continues to use direct labor- hours as its only overhead cost allocation base what implications does this have for pricing jobs such as Job 550? a. с. ulhond Pates: Overhead 3.

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter18: Activity-Based Costing

Section: Chapter Questions

Problem 18.2APR: Multiple production department factory overhead rates The management of Orange County Chrome...

Related questions

Question

Question 2. A,B,C need help understanding how to do the math. And I also have to put this all on a spreadsheet. Please help.

Transcribed Image Text:PROBLEM 2-16 Plantwide Predetermined Overhead Rates; Pricing LO2-1, LO2–2, LO2-3

Landen Corporation uses a job-order costing system. At the beginning of the year, the company

made the following estimates:

Direct labor-hours required to support estimated production

Machine-hours required to support estimated production

Fixed manufacturing overhead cost ...

Variable manufacturing overhead cost per direct labor-hour

Variable manufacturing overhead cost per machine-hour

140,000

70,000

$784,000

$2.00

$4.00

During the year, Job 550 was started and completed. The following information is available

with respect to this job:

Direct materials....

Direct labor cost..

$175

$225

Direct labor-hours

15

Machine-hours

Required:

1. Assume that Landen has historically used a plantwide predetermined overhead rate with

direct labor-hours as the allocation base. Under this approach:

Compute the plantwide predetermined overhead rate.

b. Compute the total manufacturing cost of Job 550.

If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling

price would it establish for Job 550?

a.

с.

2. Assume that Landen's controller believes that machine-hours is a better allocation base than

direct labor-hours. Under this approach:

Compute the plantwide predetermined overhead rate.

b. Compute the total manufacturing cost of Job 550.

If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling

price would it establish for Job 550?

Assume that Landen's controller is right about machine-hours being a more accurate overhead

cost allocation base than direct labor-hours. If the company continues to use direct labor-

hours as its only overhead cost allocation base what implications does this have for pricing

jobs such as Job 550?

a.

с.

ulhond Pates: Overhead

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,