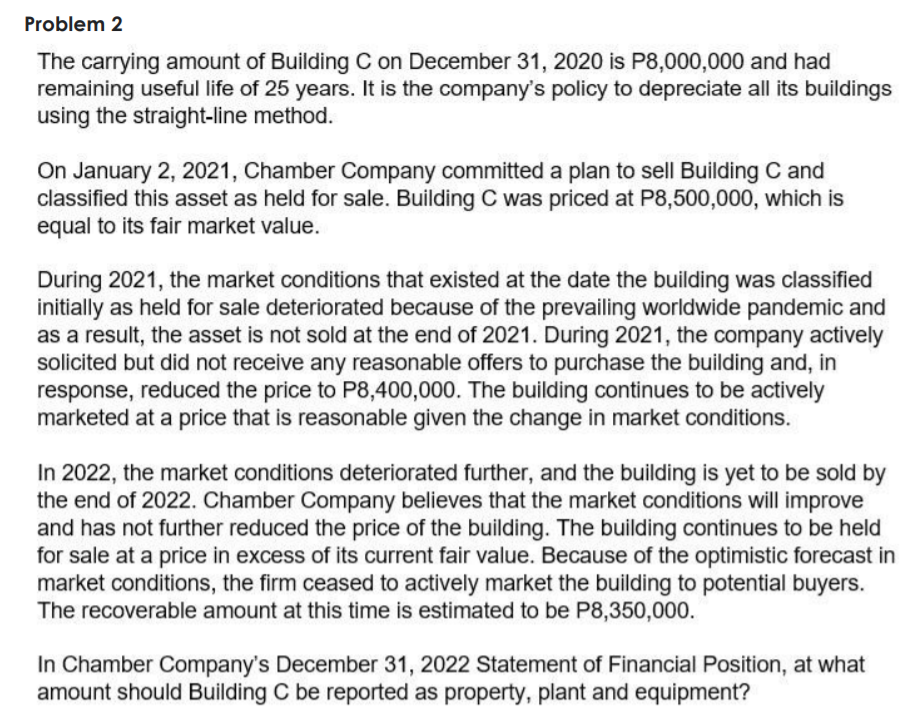

Problem 2 The carrying amount of Building C on December 31, 2020 is P8,000,000 and had remaining useful life of 25 years. It is the company's policy to depreciate all its buildings using the straight-line method. On January 2, 2021, Chamber Company committed a plan to sell Building C and classified this asset as held for sale. Building C was priced at P8,500,000, which is equal to its fair market value. During 2021, the market conditions that existed at the date the building was classified initially as held for sale deteriorated because of the prevailing worldwide pandemic and as a result, the asset is not sold at the end of 2021. During 2021, the company actively solicited but did not receive any reasonable offers to purchase the building and, in response, reduced the price to P8,400,000. The building continues to be actively marketed at a price that is reasonable given the change in market conditions. In 2022, the market conditions deteriorated further, and the building is yet to be sold by the end of 2022. Chamber Company believes that the market conditions will improve and has not further reduced the price of the building. The building continues to be held for sale at a price in excess of its current fair value. Because of the optimistic forecast in market conditions, the firm ceased to actively market the building to potential buyers. The recoverable amount at this time is estimated to be P8,350,000. In Chamber Company's December 31, 2022 Statement of Financial Position, at what amount should Building C be reported as property, plant and equipment?

Problem 2 The carrying amount of Building C on December 31, 2020 is P8,000,000 and had remaining useful life of 25 years. It is the company's policy to depreciate all its buildings using the straight-line method. On January 2, 2021, Chamber Company committed a plan to sell Building C and classified this asset as held for sale. Building C was priced at P8,500,000, which is equal to its fair market value. During 2021, the market conditions that existed at the date the building was classified initially as held for sale deteriorated because of the prevailing worldwide pandemic and as a result, the asset is not sold at the end of 2021. During 2021, the company actively solicited but did not receive any reasonable offers to purchase the building and, in response, reduced the price to P8,400,000. The building continues to be actively marketed at a price that is reasonable given the change in market conditions. In 2022, the market conditions deteriorated further, and the building is yet to be sold by the end of 2022. Chamber Company believes that the market conditions will improve and has not further reduced the price of the building. The building continues to be held for sale at a price in excess of its current fair value. Because of the optimistic forecast in market conditions, the firm ceased to actively market the building to potential buyers. The recoverable amount at this time is estimated to be P8,350,000. In Chamber Company's December 31, 2022 Statement of Financial Position, at what amount should Building C be reported as property, plant and equipment?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.5E: Change in Estimate Assume that Bloomer Company purchased a new machine on January 1, 2016, for...

Related questions

Question

Transcribed Image Text:Problem 2

The carrying amount of Building C on December 31, 2020 is P8,000,000 and had

remaining useful life of 25 years. It is the company's policy to depreciate all its buildings

using the straight-line method.

On January 2, 2021, Chamber Company committed a plan to sell Building C and

classified this asset as held for sale. Building C was priced at P8,500,000, which is

equal to its fair market value.

During 2021, the market conditions that existed at the date the building was classified

initially as held for sale deteriorated because of the prevailing worldwide pandemic and

as a result, the asset is not sold at the end of 2021. During 2021, the company actively

solicited but did not receive any reasonable offers to purchase the building and, in

response, reduced the price to P8,400,000. The building continues to be actively

marketed at a price that is reasonable given the change in market conditions.

In 2022, the market conditions deteriorated further, and the building is yet to be sold by

the end of 2022. Chamber Company believes that the market conditions will improve

and has not further reduced the price of the building. The building continues to be held

for sale at a price in excess of its current fair value. Because of the optimistic forecast in

market conditions, the firm ceased to actively market the building to potential buyers.

The recoverable amount at this time is estimated to be P8,350,000.

In Chamber Company's December 31, 2022 Statement of Financial Position, at what

amount should Building C be reported as property, plant and equipment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning